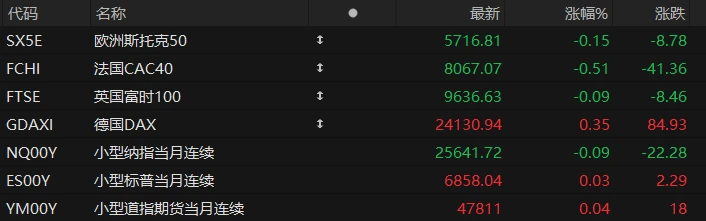

U.S. stock index futures were mixed in pre-market trading on Tuesday, while most major European indices were down. As of press time, the Nasdaq... S&P 500 futures fell 0.09%, S&P 500 futures rose 0.03%, and Dow Jones futures rose 0.04%.

In terms of individual stocks, most prominent tech stocks declined in pre-market trading, with Nvidia among them. Tesla rose more than 1%. Meta Platforms, Google-A Slight decline. Popular Chinese concept stocks generally fell in pre-market trading, with Baidu among them. XPeng Motors fell more than 3%. Alibaba fell nearly 3%. Pinduoduo JD.com It fell by more than 1%.

US President Donald Trump gave an interview to Politico at the White House on August 8th. When asked if he was considering granting more tariff exemptions to other goods that Americans consider overpriced, Trump replied, "Yes."

When asked if he would rule out further tariff reductions on other goods, Trump replied, "Some goods will (have tariffs reduced), some I will raise tariffs on. What's happening right now is all because of tariffs, like all the car companies coming back to the United States."

Furthermore, when asked about interest rates, whether an immediate rate cut was a litmus test for choosing a new chairman, Trump replied "yes," but did not explicitly state that he had communicated with potential chairmen.

Hot News

The Fed is poised to cut interest rates! JPMorgan warns: The US stock market rally may stall.

JPMorgan Chase Strategists recently warned that the recent rally in U.S. stocks may stall due to profit-taking after the Federal Reserve implements its expected rate cut this week.

The market currently predicts a 92% probability that the Federal Reserve will cut borrowing costs on Wednesday. Expectations of a rate cut have continued to rise as policymakers have signaled positive sentiment in recent weeks, driving U.S. stocks higher. “Investors may be inclined to lock in gains at the end of the year rather than increase directional exposure,” Mislav Matejka’s team wrote in a report. “Current rate cut expectations are fully priced in, and the stock market has returned to its highs.”

JPMorgan strategists remain optimistic about the medium-term outlook for U.S. stocks, believing that the Federal Reserve's dovish stance will support the market. Meanwhile, Matejka wrote that low oil prices, slowing wage growth, and easing U.S. tariff pressures will enable the Fed to... It is sufficient to ease monetary policy without exacerbating inflation.

Global stock markets have rebounded in recent weeks, nearing record highs reached in October. However, due to mixed signals from the US labor market, uncertainty remains regarding the Federal Reserve's policy direction in 2026.

JPMorgan strategists have identified several factors that could boost the stock market in 2026, including reduced trade uncertainty and artificial intelligence. Its rapid promotion in the United States, etc.

Will the Fed's decision tomorrow night see three dissenting votes again? Is Powell losing his composure?

The Federal Reserve is expected to cut interest rates for the third consecutive meeting this week, but Fed Chairman Jerome Powell may face another tough challenge in winning the support of his colleagues for this easing measure.

Every Fed rate cut this year has been met with dissenting votes—and at this week's final FOMC meeting of the year, it is widely speculated that three FOMC voting members will again cast dissenting votes.

With only one policy tool to address the conflicting goals of high inflation and a weak job market, Powell, the Federal Reserve chairman known for building consensus during difficult times, may now find himself unable to completely "hold the line" towards the end of his term…

Given Powell's strong prestige within the FOMC (his term as chairman expires next May), this may also indicate that the next Fed chair nominated by Trump will find it more difficult to manage his 18 colleagues.

Wall Street veterans are joining the bullish camp on US stocks, but they don't recommend buying too many tech stocks.

As 2025 draws to a close, many Wall Street investment bank analysts have given optimistic forecasts for the US stock market in 2026. Ed Yardeni, a Wall Street veteran and senior strategist, is no exception.

In a client report on Monday, Eastern Time, Ed Yardeni wrote that he expects the S&P 500 to reach 7,700 points by the end of next year.

However, Ed Yardeni also warned that U.S. tech stocks may currently have too much weight in the S&P 500, and therefore downgraded his rating on U.S. tech stocks, instead advising investors to increase their holdings in financial, industrial, and healthcare stocks.

“A strong 2020 remains our base case scenario. For 2026, we have increased the subjective probability of this scenario from 50% to 60%. We have reduced our concerns about a sharp market rally or crash, and therefore have decreased the probability of that scenario from 30% to 20%. We maintain our bearish outlook at 20%,” Ed Yardeni wrote in the report.

Ed Yardeni predicts that U.S. corporate earnings and the U.S. economy will "remain strong" next year. Like some of his Wall Street counterparts, Yardeni believes that increased corporate earnings will drive up stock prices.

US Stocks Focus

Trump announces: Nvidia will be allowed to sell H200 chips to China

According to reports, US President Trump announced on social media on the 8th local time that the US government will allow Nvidia to sell its H200 artificial intelligence chips to China, but will charge a certain fee for each chip.

Trump stated that the U.S. will take a 25% cut of related chip exports. The U.S. Department of Commerce is finalizing the details, and the same approach will apply to AMD. AMD, Intel And other American companies.

In response, Chinese Foreign Ministry spokesperson Guo Jiakun stated, "We have noted the relevant reports. China has consistently advocated that China and the United States achieve mutual benefit and win-win results through cooperation."

Oracle bone script Earnings reports are coming on Thursday! AI ambitions vs. debt risks – will the previous surge in stock prices repeat itself?

Oracle will release its second fiscal quarter 2026 results after the market closes on Wednesday (December 10) Eastern Time.

Nearly three months ago, Oracle 's financial report once drove the company's stock price to surge by 36% in a single day, marking the largest single-day increase since 1999.

However, three months later, amid market concerns about an artificial intelligence bubble and Oracle's debt risks, Oracle's stock price had essentially fallen back to the level before the previous earnings report was released.

In fact, the large orders Oracle disclosed in the last fiscal quarter mark a significant strategic shift towards positioning itself as an artificial intelligence infrastructure provider. However, whether this shift will bring sustainable returns, or whether the company has taken on excessive financial leverage, will be the key factors determining its future stock price trajectory.

Oracle is currently at a crossroads of tremendous opportunity and enormous risk. Where Oracle will go in the future may become clearer during this week's earnings call.

The EU has once again wielded its antitrust power, launching an investigation into Google's use of online content to train AI.

On Tuesday (December 9) local time, the European Commission announced an antitrust investigation into Google for its use of online content to develop artificial intelligence (AI).

The European Commission says Google is using content from online publishers and content uploaded to the online video-sharing platform YouTube to train its AI, and the Commission is investigating whether this violates EU competition regulations.

Earlier this year, the European Commission reportedly received a legal complaint from publishers regarding Google's AI Overview tool, accusing Google of unfairly diverting traffic away from news websites.

A Google spokesperson responded on Tuesday, saying the complaint could stifle innovation. "Europeans deserve to benefit from the latest technologies, and we will continue to work closely with the news and creative industries to help them transition to the AI era," the spokesperson said.

This survey comes as Google makes progress in the AI race, having released the Gemini 3 last month to widespread acclaim and boost its stock price.

(Article source: Hafu Securities) )