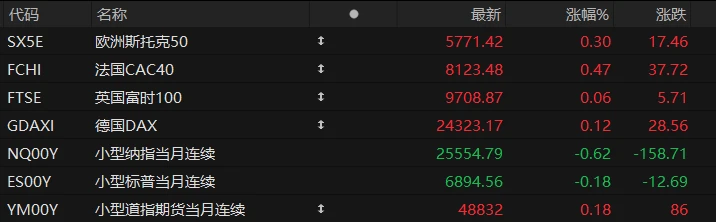

U.S. stock index futures traded in a narrow range in pre-market trading on Friday, while major European indices generally rose. As of press time, the Nasdaq... S&P 500 futures fell 0.62%, S&P 500 futures fell 0.18%, and Dow Jones futures rose 0.18%.

In terms of individual stocks, most prominent tech stocks declined in pre-market trading, with Broadcom among them. Micron Technology fell more than 6%. Advanced Micro Devices (AMD) shares fell more than 1%.

Most popular Chinese concept stocks rose in pre-market trading, with NetEase among them. Baidu rose more than 3%. Li Auto It rose by more than 1%.

Gold rose in pre-market trading, driven by Cordellen Mining. Pan American silver rose more than 4%. Newman Mining, Barrick Mining, and Harmony Gold all rose more than 3%. It rose by more than 2%.

Markets are betting on a more accommodative Federal Reserve policy, driving silver prices to new highs and spot gold back above $4,300.

Goldman Sachs It was pointed out that the biggest highlight of the Fed's meeting this week was Powell's admission that official job growth data may be "seriously overestimated" and that the actual situation may even have turned negative.

Current official figures may be inflated by 60,000 jobs per month, while the actual job market may have already fallen into a negative growth quagmire of "20,000 jobs lost per month." This grim situation has prompted the Federal Reserve to tip its scales toward "protecting employment." Institutions expect the rising unemployment rate to force interest rate cuts, and the market is betting on more aggressive easing.

Hot News

A Wall Street strategist predicts the US stock market will rise over 10% next year, fueled by the Federal Reserve's support for a bull market.

As the year draws to a close, Wall Street heavyweights are releasing a flurry of predictions for next year's market trends. Tom Lee, co-founder and head of research at Fundstrat Global Advisors, known as the "Wall Street psychologist," is no exception. He predicts that US stocks will rise by more than 10% next year, fueled by the Federal Reserve's support.

He believes the bull market remains "active" and quite strong, with the S&P 500 expected to reach 7,700 points by the end of 2026, which would represent a further increase of about 12% from current levels.

As one of Wall Street's most accurate forecasters and staunchest bulls, Lee advised investors to buy stocks during the pandemic downturn and accurately predicted the 2023 bull market. The final price that year was only about 30 points off his target. Reportedly, among the strategists tracked by Bloomberg, Lee's predictions were the closest, earning him the nickname "Wall Street Oracle." For 2025, Lee initially gave a target price of 6600 points, which he later revised upwards to 7000 points. And now, that target seems remarkably close.

In a recent video, he stated, "We believe that the outlook for 2026 is that market skepticism will build a high wall, but with the impetus of a 'new' Fed, we will see a gain of about 10%. The new Fed will not want to stifle the bull market."

This refers to the fact that current Federal Reserve Chairman Jerome Powell's term expires next May, meaning Trump may only have weeks left to nominate his own "Federal Reserve leader." Previously, Trump stated he had decided who would succeed Powell and would announce the nomination early next year.

Several major Wall Street banks warn that the Federal Reserve's interest rate cuts will cause the dollar to resume its downward trend next year.

Including Morgan Stanley Goldman Sachs and Deutsche Bank Wall Street banks, including It is predicted that the US dollar will resume its downward trend next year as the Federal Reserve continues its rate-cutting cycle.

In the first half of this year, impacted by the trade war initiated by US President Trump, the US dollar index once fell by more than 10%, marking its largest drop for the same period since 1973. However, the dollar's trend has stabilized in the second half of the year.

However, strategists predict that the dollar will weaken again in 2026 as the Federal Reserve continues to ease monetary policy while other central banks maintain or gradually raise interest rates. This interest rate differential will prompt investors to sell US Treasuries and shift funds to countries with higher yields.

Therefore, analysts from more than six major investment banks generally believe that the US dollar will weaken against major currencies such as the Japanese yen, the euro, and the British pound. According to a consensus forecast, the US dollar index will fall by approximately 3% by the end of 2026.

“The market has ample room to digest a deeper rate-cutting cycle,” said David Adams, head of G-10 FX strategy at Morgan Stanley . “This means the dollar still has considerable room to weaken further.” The bank expects the dollar to fall 5% in the first half of next year.

However, the dollar's decline next year is expected to be more moderate and less widespread than this year, when it fell against all major currencies.

The official World Cup ticket prices shocked fans; FIFA accused of draining fans' enthusiasm.

The 2026 FIFA World Cup will be held in 16 cities across the United States, Canada, and Mexico. Following the group stage draw, member associations (PMAs, or local football associations) announced ticket prices allocated by FIFA, with excessively high prices sparking considerable controversy.

The PMA's quota is equivalent to 8% of the stadium's capacity for each match. It is usually allocated by local football associations to the fans who attend the most matches according to a "loyalty program". This means that these tickets will be sold at a fixed price, rather than allocated through a "dynamic pricing system".

According to the pricing table on FIFA's official website, the starting price for an "economy ticket" for the World Cup final is $4,185 (approximately RMB 29,500), a "standard ticket" is $5,575 (approximately RMB 39,300), and a "premium ticket" is $8,680 (approximately RMB 61,200).

The Croatian Football Federation stated that if a Croatian fan were to watch the final (if the team reaches the final) from their first match, it would cost at least $6,900 (approximately 48,700 yuan) – five times the cost of watching the 2022 Qatar World Cup.

In response, the European Football Supporters Association (FSE) issued a statement saying that PMA ticket prices had reached "astronomical" levels and called on FIFA to immediately stop selling such tickets.

US Stocks Focus

Broadcom Fails to Meet Market's "Extremely High Expectations": Strong Q4 Results Still Show Decline, AI Chips Backlog of orders failed to keep up with high valuations

Broadcom shares fell in after-hours trading following the release of its fourth-quarter results, after the chipmaker announced its artificial intelligence... Backlogged orders were slightly less effective.

In its fourth fiscal quarter ending November 2, Broadcom reported sales of $18 billion, a 28% year-over-year increase, compared to analysts' expectations of $17.5 billion. Excluding certain items, earnings per share rose to $1.95, compared to analysts' expectations of $1.87.

Among them, semiconductors Revenue from the business was $11.07 billion, up 34.5% year-over-year; revenue from the infrastructure business grew by 19% to $6.94 billion.

Looking ahead, the company said its first fiscal quarter ending February 1 saw sales of approximately $19.1 billion, compared to analysts' average expectation of $18.5 billion. As of press time, the stock was down more than 6% in pre-market trading, and most other large-cap tech stocks were also weak.

Is the AI race being hampered by power shortages? Nvidia to announce plans next week. A closed-door summit will be held.

As the AI industry experiences explosive growth, a serious challenge is intensifying: the power supply, a core infrastructure of the AI industry, is struggling to meet demand. Nvidia , a leader in AI chips , is addressing this challenge that could hinder the industry's development.

According to market sources, Nvidia will host a closed-door summit next week aimed at addressing the increasingly severe power shortage dilemma in the AI era. The summit will bring together executives from startups in the power and electrical engineering sectors to explore potential solutions.

This move highlights the crucial role of energy in the AI race and demonstrates Nvidia's strategic plan to build an industry ecosystem to secure future growth. It's worth noting that some companies that have already received equity investment from Nvidia were among the participants at the summit.

This indicates that Nvidia's strategy has moved beyond simple technical discussions and delved into the capital level, aiming to build an energy solutions ecosystem that can support its core business.

SK and Ford's joint venture battery project in the US The company's dissolution suggests a shift in the landscape of the US electric vehicle industry.

The dissolution of its U.S. battery manufacturing joint venture with American automaker Ford and South Korean battery company SK Innovation could signal some significant changes in the U.S. electric vehicle supply chain.

A statement indicates that SK Innovation's battery division, SK On, will take over the BlueOval SK plant in Tennessee, while Ford will take over the joint venture's plant in Kentucky. The spin-off is expected to be completed by the end of the first quarter of 2026, but is still subject to regulatory approval.

In 2021, Ford and SK Innovation announced the construction of three battery Gigafactories in the United States, an investment of up to $11.4 billion. At the time, this was the largest manufacturing investment in Ford's 118-year history, with the idea of creating a vertically integrated battery supply chain for Ford's next generation of electric trucks and SUVs.

However, the dissolution of the joint venture marks a shift in Ford's battery supply chain plans, as the company struggles for years to curb losses in its electric vehicle business.

The main reason for this dissolution is that the adoption rate of electric vehicles is slower than expected, coupled with changes in US policy that have made the transition from gasoline-powered vehicles to electric vehicles more difficult. Starting in October of this year, the US government stopped providing subsidies for electric vehicle purchases and also relaxed emission standards for gasoline-powered vehicles.

(Article source: Hafu Securities) )