There's a new development in the race for Federal Reserve Chair – another "Kevin" has emerged.

According to reports, in a recent interview, US President Trump stated that Kevin Hassett and Kevin Warsh are both his preferred candidates to lead the Federal Reserve.

Trump expects the next Federal Reserve chairman to consult with him on interest rates, which would overturn the Fed's traditional independence.

Trump said he believes interest rates should be "1% or even lower" and expects to elect the next Federal Reserve chairman "in the coming weeks".

Previously, Wall Street had expressed its concerns to the Trump administration about Hassett's potential succession, which it saw as a threat to the Federal Reserve's independence.

According to sources familiar with the matter, JPMorgan Chase At a private meeting of the bank's asset management CEOs in New York on the evening of the 11th, CEO Jamie Dimon said he agreed with Warsh's views on the Federal Reserve. He also told Wall Street executives that Hassett was more likely to support Trump's call for interest rate cuts.

In a recent interview with CBN, Hu Jie, former senior economist at the Federal Reserve and professor at the Shanghai Advanced Institute of Finance at Shanghai Jiao Tong University, stated: First, the Fed's basic operating rules and culture should continue; second, there will always be some flexibility in the extent to which the Fed chairman listens to the president's opinions. "In other words," he said, "if Hassett takes office, he may be more aligned with Trump's views, but the Fed's decisions will still adhere to the fundamental principle of data-driven decision-making and cannot completely deviate from this framework, otherwise it would become a laughing stock."

Trump calls for a significant interest rate cut

Hassett is the current chairman of the White House National Economic Council, while Warsh is a former Federal Reserve governor. In an interview on the 12th, Trump stated that Warsh had risen to the top of the shortlist and was competing against Hassett.

Many had previously considered Hassett the frontrunner for the position. "I think both Kevins are great," Trump said. "I think there are several others who are great too."

Trump had previously hinted that he had made a decision. On Monday (August 8), he stated that he had "broadly decided" on his nominee. Last month, Trump also said he knew who he would choose for the position. However, Trump's latest comments indicate that the selection process is still ongoing.

It is reported that Trump met with Walsh on Wednesday (10th). Trump said that Walsh told him that borrowing costs should be lower.

When asked whether the next Federal Reserve chairman should consult with him on interest rates, Trump said, "I've been very successful, and I think my role should at least be to offer advice—they don't have to listen to my advice."

“I believe my opinion should be heard, but I will not make a decision based solely on that,” he continued.

Throughout his second term, Trump has sought to strengthen his control over the Federal Reserve and has frequently expressed dissatisfaction with the Fed's failure under Powell's leadership to more aggressively lower borrowing costs. He has also threatened to fire Powell on several occasions and has even called him a "stupid" and an "idiot."

In the interview, Trump continued to call for the Federal Reserve to cut interest rates significantly. "We should have the lowest interest rates in the world," he said.

Which Kevin does Wall Street prefer?

Wall Street wasn't particularly enthusiastic about Hassett.

According to sources familiar with the matter, while conducting the second round of interviews with candidates in November, the U.S. Treasury Department also held one-on-one conversations with executives from major Wall Street banks and institutions to solicit their opinions. Executives at bond investment firms generally worry that Hassett's appointment as Federal Reserve Chairman would lead to aggressive interest rate cuts to appease Trump, thereby threatening the Fed's independence.

However, after news broke that the Trump administration had interviewed Warsh, major Wall Street banks voiced their approval. Dimon, one of the most influential figures on Wall Street, publicly warned earlier this year that "the independence of the Federal Reserve is crucial" and that manipulating the Fed "often has adverse consequences."

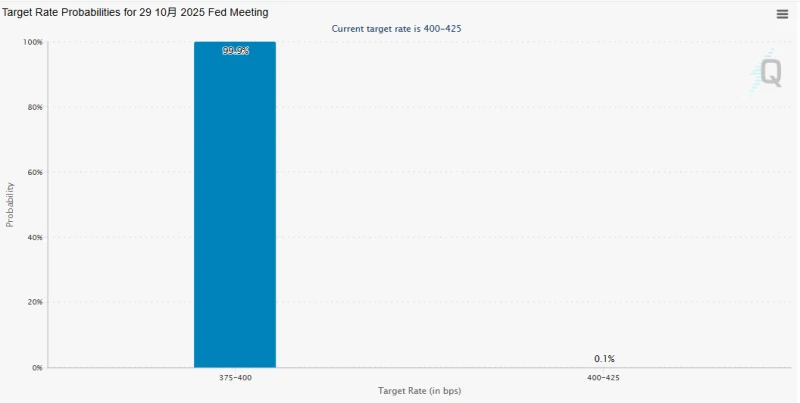

The Federal Reserve cut interest rates to their lowest level in three years on Wednesday, but the threshold for further action is now high. Powell said the Fed has "ample reasons to wait and see how the economy develops."

Three Federal Reserve officials opposed the rate cut decision, and the Federal Open Market Committee (FOMC) has yet to reach a consensus on whether to cut rates further.

Trump vowed to avoid repeating the mistake of appointing Powell, saying that loyalty and a willingness to actively cut interest rates were key criteria for getting the job.

Hassett, who worked at the Federal Reserve in the 1990s and holds a PhD in economics, has long been considered a leading contender for the next Federal Reserve chairman.

Despite concerns among many about Hassett's close relationship with Trump, Warsh was also unpopular within the Federal Reserve because he had been a frequent critic of the Fed since leaving.

This Hoover Institution economist was also considered by some in the American economics and investment communities to be too hawkish and unlikely to gain Trump's support. Records of the 2008 FOMC meeting show that, just as American investment banks... Just days before Lehman Brothers collapsed, Walsh was reiterating his concerns about inflation.

In addition, many academic economists and Federal Reserve insiders prefer that current Federal Reserve Governor Christopher Waller take the position, and Waller is also very popular on Wall Street.

The outside world is also watching to see if the Trump administration will interview more candidates for Federal Reserve chair next week.

Hu Jie told reporters that, according to the working rules, the FOMC has 12 members with voting rights, with the chairman having only one vote. "From an institutional perspective, the chairman's personal influence is limited," he said, adding that if Hassett takes office, his working methods remain to be seen.

“From a professional perspective, if Hassett becomes the new Fed president, he must first demonstrate his professionalism and independence to avoid being seen as a ‘puppet’,” Hu Jie cautioned. He noted that the overlap between Hassett and Trump’s views may stem from Hassett’s previous role as an economic advisor, suggesting a shared understanding on economic matters. “This consistency is not necessarily blind obedience, but if they continue to follow each other blindly for a long time, the market may reassess his decision-making independence,” he said.

(Article source: CBN)