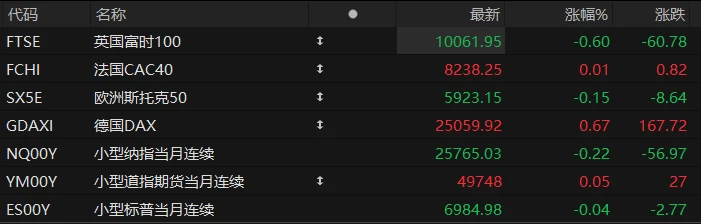

U.S. stock index futures traded in a narrow range in pre-market trading on Wednesday, while major European indices showed mixed results. As of press time, Nasdaq... S&P 500 futures fell 0.22%, Dow Jones futures rose 0.05%, and S&P 500 futures fell 0.04%.

In terms of individual stocks, most prominent tech stocks fell in pre-market trading, with ASML among them. Nearly 2% drop in Micron, AMD, Google, and Microsoft. A slight decline was observed. Popular Chinese concept stocks showed mixed performance in pre-market trading, with UMC surging nearly 9%; JD.com... Alibaba It fell by more than 1%.

Strategy rose nearly 4% in pre-market trading after MSCI stated it would not implement a plan to remove digital asset treasury companies; biotech company Ventyx Biosciences surged over 69%, reportedly by Eli Lilly. The acquisition of the company is imminent; Game Station The stock rose more than 6% in pre-market trading and announced that it would award CEO Ryan Cohen a long-term performance bonus.

U.S. ADP employment rose by 41,000 in December, below the forecast of 50,000 and the previous month's figure of a decrease of 32,000. ADP private sector employment data is expected to remain generally stable in the second half of 2025, although employment growth has remained positive in the three weeks ending December 6.

The U.S. Bureau of Labor Statistics will release the Job Openings and Labor Turnover Survey (JOLTS) for November of last year at 11 p.m. Beijing time on Wednesday, announcing the number of job openings for that month as well as data on resignations and layoffs among Americans. The market generally expects job openings in November to fall slightly to 7.6 million.

Hot News

JPMorgan Chase Survey: US mid-sized businesses are becoming "cautiously optimistic" about the 2026 economic outlook.

Optimism about the U.S. economy among mid-sized businesses has cooled. According to a new survey released Wednesday by JPMorgan Chase , only 39% of executives at mid-sized U.S. companies are optimistic about the national economic outlook for 2026, a significant drop from 65% a year ago—when confidence in the U.S. economy reached a five-year high.

JPMorgan Chase Commercial Bank Business director Melissa Smith described the outlook as “cautious optimism.” “I think people are feeling good about the economic fundamentals,” she said in an interview. But she added, “The reason I say 'cautious' is because clearly geopolitical uncertainty remains high, and I think that’s affecting people’s judgment.”

However, respondents showed relatively higher confidence when examining their own companies' situations. Of the more than 1,400 business leaders surveyed, 51% were optimistic about their industry's performance in 2026, down from 60% last year; 71% were confident about their own company's prospects in 2026, roughly the same as last year's 74%. Approximately 73% of respondents expected revenue growth in 2026, 64% anticipated profit increases, and 48% planned to expand their workforce. In comparison, the figures for last year were 74%, 65%, and 51%, respectively.

The sentiment of U.S. mid-sized businesses is often seen as an important economic "bellwether." JPMorgan Chase defines the "mid-market" as businesses with annual revenue between $20 million and $500 million. The bank says these businesses account for about one-third of revenue and employment in the U.S. private sector.

Some investment banks are pouring cold water on the idea that copper prices will peak after breaking through $14,000 in January.

Citigroup Analysts have raised their near-term copper price target to $14,000 per tonne, citing strong market momentum that exceeded their December expectations. Citigroup analyst Max Layton noted that market momentum, positioning volatility, demand expectations, and supply constraints could all further push copper prices higher in the short term.

However, the bank is not confident about further increases in copper prices, maintaining its forecast for the average copper price for the whole of 2026 at $13,000 per ton. Citigroup analysts stated that January 2026 could be the peak for copper prices this year, and without new market catalysts, prices could fall back to a more sustainable level of around $13,000 per ton.

On Wednesday (January 7), copper prices hovered near record highs after a record rally. The benchmark three-month copper contract on the London Metal Exchange (LME) fell 0.49% to $13,173.50 per tonne. This followed a record high of $13,387.50 per tonne on Tuesday.

From a macro perspective, interest rates and geopolitics are once again influencing market trends. Industrial commodity prices remain driven by the dollar's performance and economic growth expectations, both heavily influenced by the Federal Reserve's interest rate path. Discussions of interest rate cuts could support demand in the construction and electrification sectors by lowering financing costs, but they could also exacerbate speculative capital flows. Coupled with geopolitical factors and supply risk premiums, prices could adjust rapidly unless inventory and production data confirm claims of "tight supply."

Nickel prices have retreated slightly from their highs, with analysts warning that the speculative frenzy is unlikely to be sustainable.

Nickel prices on the London Metal Exchange surged more than 10% on Tuesday, marking their biggest one-day gain in more than three years. However, this rapid rise appears to be merely a speculative frenzy, with analysts believing it is disconnected from weak fundamentals, suggesting the rally may be short-lived.

On Tuesday, three-month nickel futures prices surged as much as 10.5%, approaching $18,800 per tonne, before retreating to $18,500. On the news front, India earlier announced plans to reduce nickel ore production this year. Additionally, reports indicate that Chinese demand for nickel pig iron has become more active due to increased inventories ahead of the Chinese New Year. Mysteel Global analyst Fan Jianyuan stated that the decline in nickel prices reflects profit-taking after the previous rally, which was primarily driven by capital inflows. From a fundamental perspective, the nickel market remains in a state of oversupply.

Meanwhile, the LMEX index, which tracks London's six major metals, also surged to its highest level since 2022 this week. In addition to the impact on nickel prices, investors also flocked to copper and aluminum trading due to concerns about potential US tariffs, pushing copper prices to a record high on Tuesday, although both copper and aluminum prices retreated on Wednesday.

Analysis indicates that the surge in nickel prices since mid-December has been primarily driven by two factors: first, a large influx of speculative capital into the Chinese metals market, with spillover effects on international exchanges; and second, market concerns about increased supply risks in Indonesia, a major nickel-producing country. However, the nickel market remains in a state of severe structural oversupply. As of the end of November 2025, nickel warehouse inventories on the London Metal Exchange had surged to over 254,364 metric tons, a significant increase from the beginning of the year. ING Ewa Manthey, the group's commodities strategist, pointed out that the global market is expected to remain in a state of oversupply until 2026, with an oversupply of approximately 261,000 tons.

US Stocks Focus

Jensen Huang's speech ignites confidence on Wall Street! Two major investment banks give their thumbs up: Nvidia It will be the strongest AI concept stock in 2026!

At the 2026 International Consumer Electronics Show , Nvidia CEO Jensen Huang... Following his first keynote address of the new year at CES 2026, two major Wall Street institutions— Bank of America and Bank of America— [the following text appears to be unrelated and possibly a separate sentence fragment:] Securities Both Evercore ISI and investment bank have stated that Nvidia remains the strongest AI concept stock in 2026.

Bank of America Securities chief analyst Vivek Arya reiterated his buy rating and set a price target of $275, calling Nvidia his "top choice for artificial intelligence". share".

Aya stated that Nvidia management has clearly indicated that the demand for AI computing remains very strong. He pointed out that AI efficiency is steadily improving, with annual system output increasing while costs continue to decline. In his view, this supports the broader and longer-term application of AI.

Regarding chips, although there were no new product releases, Jensen Huang brought some exciting news: the company's latest AI super chip platform, Vera Rubin, has begun full-scale production.

Another Wall Street analyst, Mark Lipacis of Evercore ISI, also listened to Jensen Huang's speech and once again gave Nvidia an "outperform" rating, setting a Wall Street target price of $352 per share, calling Nvidia "the top pick for 2026".

Liparchis stated that Nvidia is well-positioned to capitalize on the AI boom because computing is moving towards "parallel processing," a model where many tasks are performed simultaneously rather than one after another. He believes this is a long-term shift that aligns with Nvidia's strengths.

Musk reveals: He strongly advocated for OpenAI but chose Microsoft over Amazon. Bezos's collaboration seems a bit too "clever."

In the email, Musk stated bluntly that he thought Amazon CEO Jeff Bezos was "a bit too clever for his own good," while having a better impression of Microsoft CEO Satya Nadella. However, he also expressed dissatisfaction with Microsoft's marketing department. Altman, in his reply, stated that Amazon "played us" with the terms of the partnership, especially regarding marketing promises, and pointed out that their products were not technically very good to begin with.

This early suggestion echoed subsequent developments. In 2019, Microsoft invested $1 billion in OpenAI, later increasing the total investment to $13 billion, marking a milestone partnership. Under the agreement, Microsoft will receive a share of OpenAI's revenue until 2030, or until the company develops human-level artificial intelligence.

Meanwhile, Amazon has turned to investing in OpenAI's competitor, Anthropic. However, Amazon is still in talks with OpenAI about a $10 billion collaboration involving OpenAI using Amazon's AI chips.

In addition, Nadella revealed in his testimony that after Altman was fired by the board in 2023, tech giants such as Google and Meta acted quickly to try to recruit members of the OpenAI core team.

The AI boom is ushering in a new chapter: a "memory supercycle" is coming, and these three companies deserve special attention!

The artificial intelligence (AI) craze has entered a new phase: people's focus is shifting from chips that process data to the hardware needed to store data.

In a recent interview, Gil Luria, Head of Technology Research at DA Davidson, stated, "Currently, we are still in the early stages of the memory development cycle. Our progress in artificial intelligence models is making memory the next frontier area. We need to focus on chips, devices, servers, and data centers ." "It will be equipped with more memory." Analysts have identified three companies worth watching closely in the next phase of the revolution.

First, Micron Technology The company has transformed from a cyclically lagging enterprise into a cornerstone of the artificial intelligence server stack. Its main driving force ... It is high-bandwidth memory HBM (Hardware-based DRAM) is a "DRAM variant" specifically designed for artificial intelligence training. Micron Technology recently predicted that the potential market size for HBM will reach $100 billion by 2028, with a compound annual growth rate of 40%.

Despite Micron Technology's popularity in the US, many on Wall Street believe that South Korea's SK Hynix is the true center of the memory boom. SK Hynix is a major supplier to Nvidia's HBM and is projected to maintain a market share of around 60% by the end of 2025.

The analyst's final recommendation was SanDisk, the leading US flash memory manufacturer. (SanDisk). Western Digital Last year, it officially spun off its flash memory business to SanDisk , and since then, its stock price has soared by more than 800%.

(Article source: Hafu Securities )