With nearly 10 trading days left in the US stock market before the end of the year, "interest rate cut trading" has become the top focus for traders.

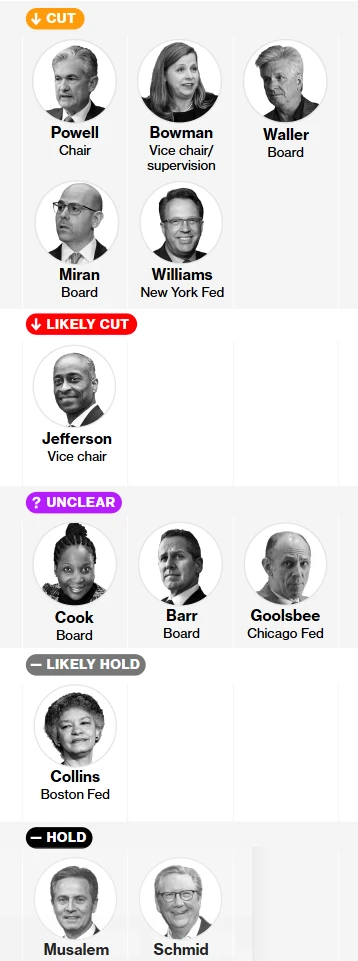

Currently, the market has priced in nearly 90% of the probability of a rate cut in December (this Thursday) (compared to a low of around 30% three weeks ago). Whether the Federal Reserve will restart balance sheet expansion in some form to increase market liquidity after ending quantitative tightening is also attracting considerable attention.

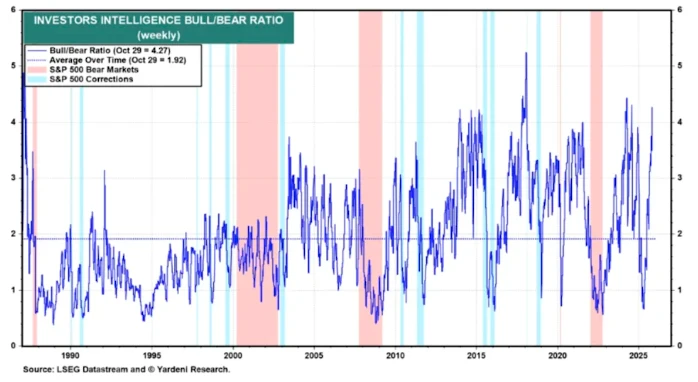

Amidst the atmosphere of interest rate cuts, US stocks seem to be recovering from the " artificial intelligence" trend. Goldman Sachs is recovering from the "AI bubble" theory and preparing for the year-end "Christmas rally." According to First Financial Daily, Goldman Sachs... In his latest trading notes, hedge fund manager Tony Pasquariello noted that just three weeks ago, various investor sentiment indicators were depressed, the S&P 500 fell below its 50-day moving average, and clients sold off heavily. Now, implied volatility has dropped significantly, long positions have been replenished, and the S&P 500 is just a hair's breadth away from breaking through its high.

Hawkish interest rate cuts + balance sheet expansion?

The market widely expects the Federal Reserve to cut interest rates by 25 basis points (BP) for the third consecutive time, bringing the federal funds rate range down to 3.5%–3.75%.

Goldman Sachs believes there are strong reasons for a rate cut: job growth is not keeping pace with labor supply growth, the unemployment rate has risen to 4.4% for three consecutive months, and several indicators of labor market tightness are weakening overall.

Data shows that those who have received a university education The deterioration in the labor market is particularly pronounced among American workers. The unemployment rate for college graduates aged 20-24 has climbed to 8.5%, 3.5 percentage points higher than the low point in 2022. College graduates make up more than 40% of the U.S. workforce and account for approximately 55-60% of U.S. labor income. Further deterioration in employment opportunities for this crucial group may reflect the disproportionately negative impact of AI and other efficiency-enhancing measures on consumer spending, ultimately leading to further interest rate cuts.

While inflation may remain a roadblock to further rate cuts, concerns about the labor market are gaining the upper hand in the short term. Reports indicate that investors widely expect a "hawkish rate cut," but this concept can be interpreted in several ways—the Fed is unlikely to lock itself in on forward guidance and will not strongly hint at a pause at its January meeting, as further rate cuts may still be appropriate if the labor market continues to weaken.

In fact, market expectations fluctuated particularly sharply due to the delayed release of the latest labor force data. (Invesco) Zhao Yaoting, Global Market Strategist for the Asia Pacific region, told Yicai that not long ago, the market's expectation of a December rate cut was only 20%, but in the last few days, the probability has risen to nearly 100%. "Although there has been almost no new progress in US economic data during this period, the market expectations have fluctuated so dramatically, which indicates that volatility will continue to rise in the future. We currently estimate that there will be three more rate cuts in 2026, plus this one in December, for a total of 100 basis points."

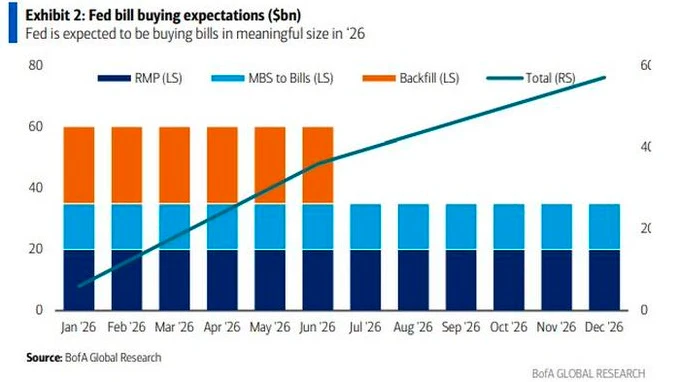

Besides interest rates, the market will also be watching whether the Federal Reserve will restart its balance sheet expansion in some form to increase market liquidity. Matt Simpson, a senior analyst at Gain Capital, told First Financial Daily that the Fed's balance sheet has now shrunk to $6.5 trillion, and banks... The system's reserves have fallen to $2.9 trillion. Regardless of whether the tool is called quantitative easing (QE, the Federal Reserve's purchase of long-term Treasury bonds) or reserve management purchases (RMPs, the purchase of short-term Treasury bonds), once officially announced, it will be a Christmas gift to investors and the Trump administration, and is expected to benefit risk assets (stocks, cryptocurrencies, Australian dollars, etc.).

The balance sheet reduction ended on December 1st. To address increasing pressure in the repurchase market, the Federal Reserve announced in October that it would release maturing Treasury securities and mortgage-backed securities. The bank reinvested in short-term notes. However, this measure has not been entirely effective. Overnight rates have frequently fallen below the Fed's target level, and banks have been using the central bank's liquidity support tool—the standing repo facility. Fed Governor Waller recently stated that this is crucial for maintaining order in the repo market and ensuring the smooth transmission of the Fed's monetary policy. (Bank of America ) The Federal Reserve is expected to announce such a "reserve management purchase program" of approximately $45 billion per month on Wednesday.

Traders prepare for a "Christmas rally"

Despite the unexpected sell-off in US stocks in November, traders seem to be preparing for a "Christmas rally" with the current rebound in AI-themed stocks, as December is traditionally a month with strong seasonal performance for US stocks.

Zhao Yaoting stated that AI-related stocks themselves are not in a bubble, as companies have strong profits and relatively reasonable valuations; the real signs of a bubble are in data centers. Investment – Capital expenditures are beginning to rely on debt financing, and the amount of investment has far exceeded the scale of corporate revenue, which is an area that needs attention. Furthermore, a significant increase in total factor productivity has not yet materialized. The development path of AI is similar to that of the internet in its early stages; that is, it may still take several years from technological breakthroughs to a real increase in productivity. Therefore, the market should not be overly pessimistic about short-term results.

When discussing the year-end market seasonality, Simpson mentioned that during periods of good market conditions... Nasdaq The S&P 100 is often the highest performing index among Wall Street's peers, with an average December gain of 1.7%, higher than its annual average gain of 1.3%.

Calculations suggest that if the Nasdaq records a positive return in December, its average gain will jump to 6%, easily surpassing the S&P 500 and Dow Jones Industrial Average. This indicates that the technology sector has the greatest upside potential in a bull market in December, but the probability of achieving this result is not the highest, at only 57.7%.

In comparison, the S&P 500 boasts a win rate of 75.6%, meaning its 3% monthly positive return is statistically more stable—even though its 1.5% average positive return is lower than the Nasdaq. The Russell 2000 performs even better, with a win rate of 78%, a 12-month average return of 2.3%, and a monthly positive return of 4.3%. This demonstrates that the Russell 2000 has historically outperformed major Wall Street benchmarks in terms of stability and average return over December.

Wall Street investment banks are bullish on the market in 2026.

According to CBN's observations, major Wall Street banks remain optimistic about the market outlook for the end of the year and next year, citing "don't go against the interest rate cut cycle" and "profit growth remains considerable" as their main arguments.

Morgan Stanley was the most optimistic. The report sets a 12-month target price of 7800 points for the S&P 500 (corresponding to a forward P/E ratio of 22), with earnings as the core support. It projects S&P 500 earnings per share (EPS) of $272 (+12%), $317 (+17%), and $356 (+12%) for 2025-2027, respectively, exceeding market consensus expectations. The driving force is... This includes positive operating leverage, AI-driven efficiency improvements, and relaxed tax and regulatory policies.

In an email to CBN, Morgan Stanley's chief U.S. equity strategist, Michael Wilson, mentioned that the current market is not comparable to the 1999 tech bubble. The current market is in an early cycle (interest rate cuts), with better corporate profits, healthier cash flow (large-cap stocks have a free cash flow yield three times that of 2000), and more supportive policies. Even when valuations adjust, earnings growth may still support the market rather than cause a collapse.

Currently, Bank of America is among the more conservative Wall Street banks. In its latest outlook, the institution stated a target of 7100 points for the S&P 500 by the end of 2026, with a bull-bear range of 5500-8500 points, reflecting a cautious stance. This is because while earnings growth is robust, there is concern about peaking liquidity. Capital expenditure (AI, manufacturing equipment) is replacing consumption as the main driver , but liquidity saturation will decline (reduced corporate buybacks, increased capital expenditure), which could limit market gains.

"Differentiation" is a consensus among major institutions. For example, Barclays... The 2026 market outlook stated that the earnings divergence will continue—AI leaders will remain resilient in earnings, but small and mid-cap stocks have greater room for earnings recovery; valuations should be wary of crowded AI sectors, such as the high capital expenditure pressure of some hyperscalers, which also leads to a decline in investment returns. Therefore, institutions also believe that opportunities in niche areas (such as AI applications) can be focused on.

(Article source: CBN)