Silver prices have hit record highs this month, prompting Elon Musk, the world's richest man, to warn that downstream manufacturers could suffer the consequences.

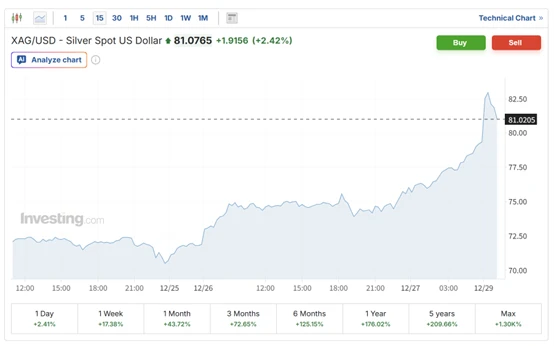

In December, silver prices surged, which is typical for precious metals. This is part of the overall bullish market. During Monday's Asian trading session, spot silver surged over 5%, rising above $83 per ounce and continuing to set new historical highs. As of now, spot silver is trading at $81, up over 2% on the day, marking its sixth consecutive trading day of gains.

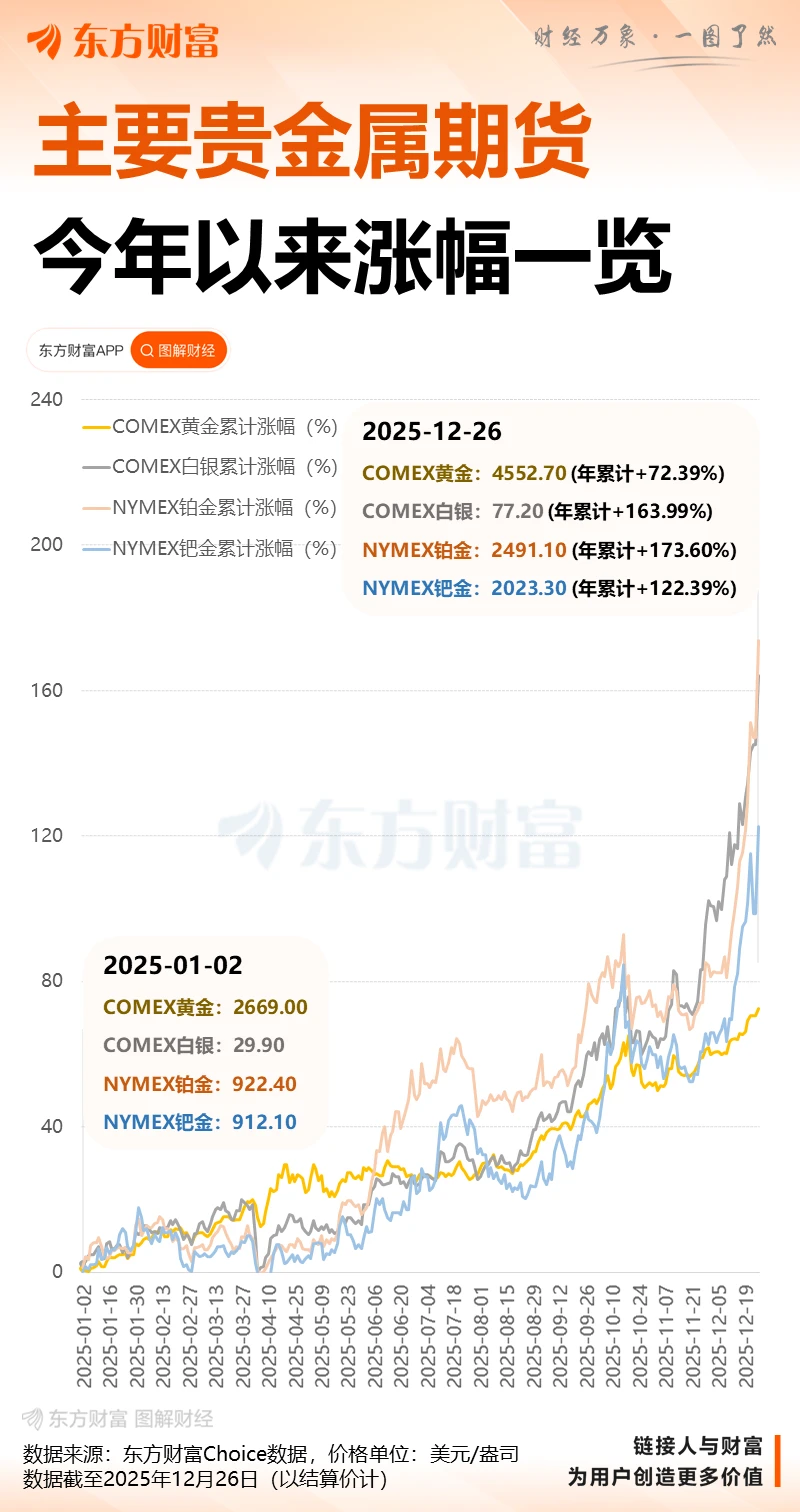

In comparison, silver was priced at only $56 per ounce in early December, and at just $29 per ounce at the beginning of 2025. Year-to-date, silver prices have risen by approximately 180%.

Escalating geopolitical risks boosted demand for safe-haven assets, and market expectations for further interest rate cuts by the Federal Reserve in 2026 also benefited silver prices.

Furthermore, growing concerns about a silver supply shortage have also contributed to the price increase. Analysts point out that the global silver market has been in a structural deficit for five consecutive years, with physical inventories rapidly depleting and significant declines in inventory levels on major exchanges. The market is facing a real-time supply squeeze, rather than simply a rise driven by safe-haven demand.

The supply-demand gap in the silver market is widening. Data from 2025 shows global silver demand will reach 1.24 billion ounces, while supply will be only 1.01 billion ounces, meaning the market faces a supply shortage of 100 million to 250 million ounces. This supply-demand imbalance is described as a "structural deficit," and there are no signs of a rapid recovery.

On December 27, Musk expressed his concern about the rising price of silver on social media, stating bluntly that it was "not a good thing" for industrial development.

“This is not good. Silver is an essential material in many industrial processes,” Musk wrote on X. His comment was in response to a post describing a surge in silver prices due to a “severe global supply shortage.”

Silver has applications in areas such as electrification and solar energy. Battery Boards, electric vehicles, and data centers Demand in these sectors continues to grow, constantly depleting silver inventories.

In addition to its industrial uses, silver also has monetary attributes and is a store of value.

IG market analyst Tony Sycamore said that the silver market is experiencing a “generational bubble” as more money flows into the precious metals market.

He stated, "The rise in precious metal prices is due to market expectations of multiple interest rate cuts by the Federal Reserve in 2026, as well as large-scale purchases by central banks and private investors. However, the core factor driving the recent rise in silver prices is the severe structural supply-demand imbalance in the silver market, which has triggered a buying frenzy for physical silver."

Reports indicate that much of the world's readily available silver is stored in New York, awaiting the outcome of the U.S. Commerce Department's investigation into whether imports of critical minerals pose a national security risk. This review could pave the way for tariffs or other trade restrictions on silver.

Optimists vs. Pessimists

With silver prices experiencing an epic surge, analysts' opinions on the price have become polarized. Optimists believe silver prices could break through $100 next year. Pessimists, however, warn that precious metal prices are on the "edge of a cliff," and the risk of a correction is accumulating.

Capital Economics analysts wrote in a recent report, "Precious metal prices have risen to levels that we believe are difficult to explain by fundamentals." They expect silver prices to fall back to around $42 by the end of next year.

UBS warned that the current rapid rise in precious metal prices is largely due to insufficient market liquidity—meaning a rapid decline is very likely.

Renowned Wall Street economist Peter Schiff recently stated that the biggest risk in 2026 is the collapse of investor confidence in the credibility of US fiscal and monetary policies. He believes that silver prices reaching $100 per ounce next year is "a very realistic goal," and that prices could rise even higher if monetary instability intensifies.

Jim Ricci, a renowned economist and bestselling author of books such as "Currency Wars," recently stated that he wouldn't be surprised if silver prices reached $200 in 2026. He pointed out that the recent surge in silver prices is related to physical silver delivery in the market.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)