In its latest report released on Monday, Morgan Stanley Reiterated its support for Seagate Technology, a global giant in hard disk drives. The company has given Seagate Technology an "overweight" rating and expects hard drive products to remain in short supply until 2027.

In a report, Morgan Stanley's team, led by Erik Woodring, head of U.S. technology hardware equity research, wrote that during a meeting with Seagate CFO Gianluca Romano, the latter indicated that the company expects its hard disk drive (HDD) product sales margin to exceed 50% within the next 12 months .

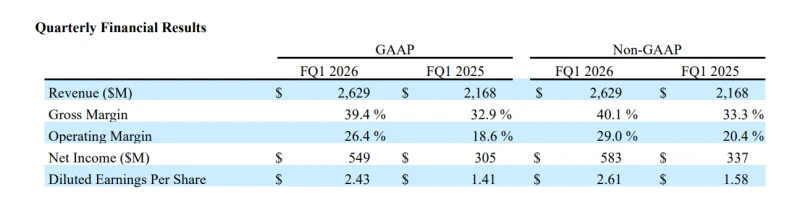

As background, in the first quarter report of fiscal year 2026 ending October 3, thanks to AI data centers... Driven by strong demand for cloud platforms, Seagate reported a record high non-GAAP gross margin of 40.1% , up nearly 7 percentage points year-over-year.

Woodring further stated, "Romano has made it clear that current demand for hard drives is growing significantly faster than the company's projected annual growth of approximately 25% in HDD data capacity (Morgan Stanley projects a growth rate of around 40%) . This could mean that even if the industry begins validating new, larger-capacity drives in the first half of 2026, demand will still fall short of supply by 2027. "

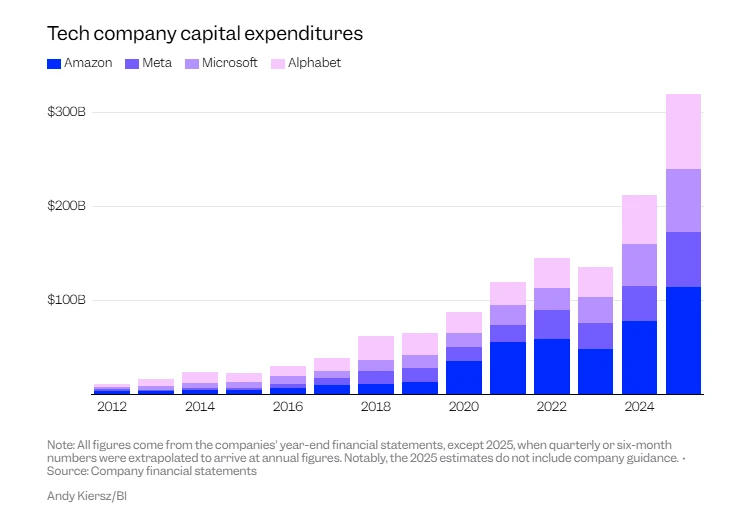

According to the latest supply chain report, the hard disk drive (HDD) market, after two years of relative calm, has begun to fluctuate. Contract prices rose approximately 4% quarter-on-quarter in the fourth quarter of this year, marking the largest increase in the past eight quarters . The main reasons for this price volatility include the development of China's domestic IT innovation (ITAI) technology. The industry's shift in procurement strategies, and the wave of AI data center construction in the United States.

Compared to the soaring prices of flash memory chips in the past few months, hard disk drives (HDDs) have an advantage in terms of reliability for long-term data storage. Meanwhile, the explosive growth of data driven by AI applications is also prompting cloud service providers to purchase large-capacity, relatively economical HDDs.

Analysts also noted the impressive “quality” of HDD demand during the talks. Morgan Stanley is quite confident that these orders represent “real demand” as closely as possible (rather than the result of inventory buildup or over-ordering), which largely reduces the risk of this industry cycle being disrupted.

The report points out that, taking into account the above factors, Seagate's revenue growth, profit margin, and earnings per share (EPS) trends are converging toward the current "bull case" scenario, and may even exceed it.

Morgan Stanley sets its "bull market scenario" for Seagate Technology with EPS of approximately $17 in fiscal year 2027. This compares to a baseline scenario of $15.40 and a market consensus of $14.67. Under this scenario, Morgan Stanley assigns Seagate Technology a "bull market target price" of $341.

(Article source: CLS)