Nasdaq The company has submitted an application seeking regulatory approval to extend the trading hours of its stock exchange to 23 hours per day during weekdays.

According to a filing submitted on Monday (December 15), Nasdaq has filed a lawsuit with the U.S. Securities and Exchange Commission . The Securities and Exchange Commission (SEC) has applied to add a new trading session—from 9 p.m. Eastern Time to 4 a.m. the following day.

Source: SEC filings

Currently, Nasdaq offers three trading sessions each weekday: the pre-market session (4:00 a.m. to 9:30 a.m.), the regular session (9:30 a.m. to 4:00 p.m.), and the after-market session (4:00 p.m. to 8:00 p.m.).

It should be noted that some brokerages offer "US stock night trading" (8 pm to 4 am the next day), which is off-exchange trading, and the liquidity is generally relatively low. Only some stocks and ETFs support night trading.

According to the documents, Nasdaq applied to cover the "nighttime trading session" from 9 p.m. to 4 a.m. the following day, and to reserve one hour before that session for system maintenance, testing, and clearing transactions such as stock mergers, splits, and dividends.

If implemented, Nasdaq's trading hours will evolve into a "23/5" model—five days a week, 23 hours a day.

In an emailed statement, Chuck Mack, senior vice president of Nasdaq North America, said: “This evolution reflects a simple reality: global investors want market access in their own way and in their own time zones without sacrificing trust and market integrity.”

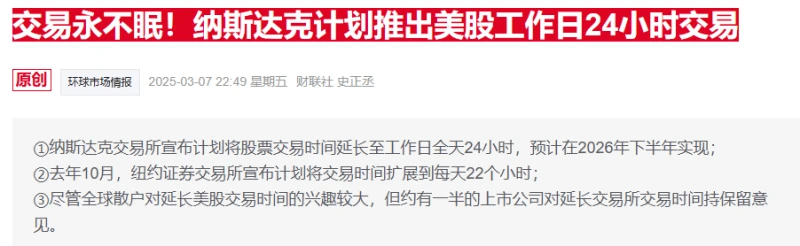

As reported by Cailian Press in March of this year, Nasdaq announced plans to expand trading hours to 24 hours a day in order to capture growing global demand for US stocks. Nasdaq anticipates this could be achieved as early as the beginning of the third quarter of 2026, subject to regulatory approval and coordination with other industry stakeholders.

Some US stock market participants from other countries welcomed the change, believing it would help prices reflect earnings reports and macroeconomic changes more quickly. However, they also warned that near-24-hour trading would reduce the time investors have to digest after-hours news and could trigger more volatile prices during periods of lower liquidity.

Last October, the New York Stock Exchange also announced plans to extend trading hours to 22 hours a day. In February of this year, the NYSE's proposal received preliminary approval from the SEC, but it still needs to wait for updates to market data sources.

Dilin Wu, a research strategist at the Australian Pepperstone Group, called Nasdaq's move "an absolute game-changer."

"This effectively brings US stocks into our local trading session, improving liquidity and allowing investors to react in real time without having to wait for overnight trading. For investors active in tech stocks or high-beta stocks, this is an important step towards a truly global market."

JPMorgan Chase Kerry Craig, a global market strategist at an asset management firm in Melbourne, said this development could attract "more retail investors in different markets around the world."

However, there is disagreement within Wall Street regarding allowing extended stock trading hours. Supporters argue that both domestic and international investors want to be able to enter and react to the market outside of regular trading hours; opponents warn that lower trading volumes could impair trading quality and make price discovery less accurate.

Currently, most trading activity in the US stock market remains concentrated during the "regular trading hours." With extended trading hours, an unresolved question arises: will institutional investors begin to actively trade during these periods of lower volume?

Vantage Markets analyst Hebe Chen said, "The real test lies in liquidity depth. If institutional funds follow suit, it will be a clear benefit for Asian investors; if not, extended trading hours may only make it noisier, not necessarily more efficient."

(Article source: CLS)