"The Big Short" Burry is back again!

Recently, Michael Burry, the "Big Short" known for predicting the 2008 financial crisis, issued a serious warning about the future of the U.S. stock market.

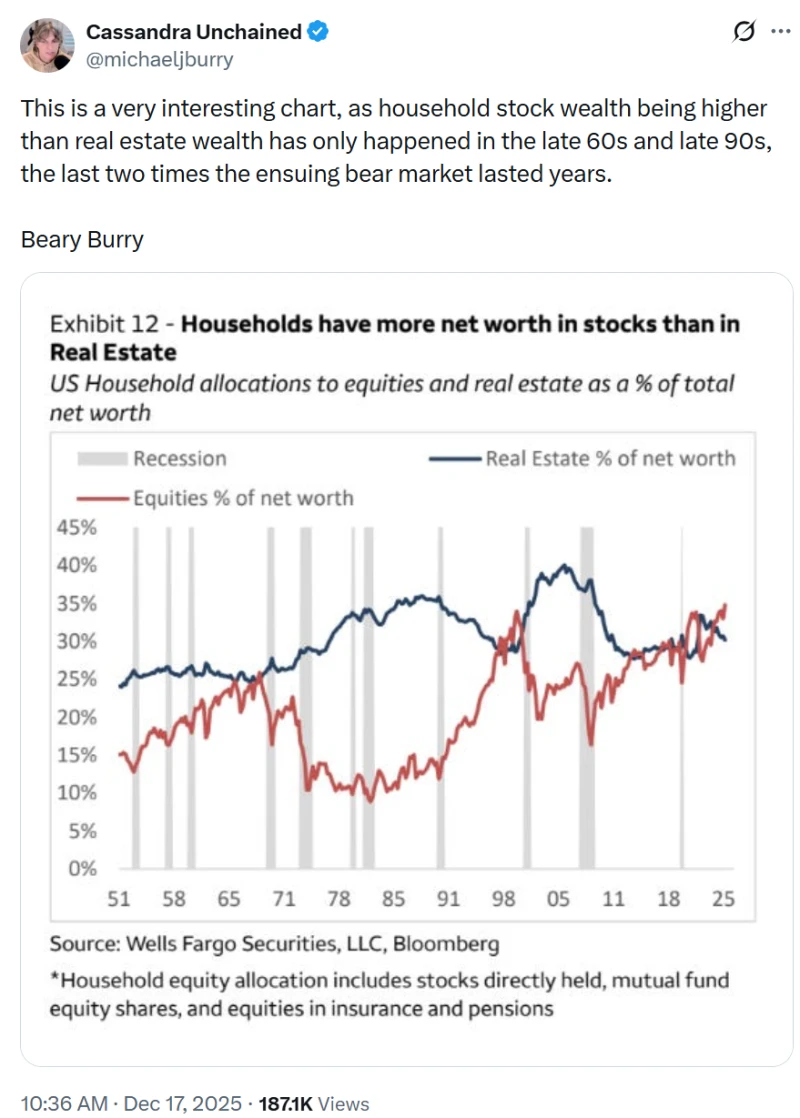

Burry shared a "very interesting" chart on the social media platform X, showing that American households' stock wealth has surged, recently surpassing their real estate wealth. Burry noted that this phenomenon was only seen in the late 1960s and late 1990s, and in those two instances, "the ensuing bear market lasted for several years."

In response, some netizens commented, "It's certain that there will be a bear market in the next 5 to 10 years, and those who predict the bear market will receive applause." "The charts loudly proclaim the danger in a calm voice."

However, Burry's warning has also drawn criticism from some netizens. Some commented that they can't afford to buy a house and have "nowhere else to invest but in the stock market." Others argued that the increasing popularity of index investing has distorted charts, and that the aforementioned chart indicators are too simplistic and fail to consider "technical breakthroughs."

Michael Burry, the real-life inspiration for the film "The Big Short," has recently been making frequent public statements, issuing warnings to the market. On December 11, Burry cited a Financial Times blog post stating that the Federal Reserve's plan to begin "Reserve Management Purchases" (RMPs) indicates that U.S. banks... The system is becoming increasingly fragile.

The Federal Reserve decided to halt its balance sheet reduction and announced its intention to purchase approximately $35 billion to $45 billion in Treasury bonds per month. In response, Burry stated, "If the U.S. banking system cannot function without the Fed's more than $3 trillion in 'life support,' it is not a sign of strength, but rather a sign of fragility."

Burry believes that the Federal Reserve now appears to expand its balance sheet after each crisis in order to protect banks . The system is experiencing funding pressures, a dynamic that helps explain the stock market's strong performance. "The practical limit of this approach might be the complete nationalization of the US bond market, meaning the Federal Reserve owns all $40 trillion of US debt. So I guess, keep the party going."

Previously, Burry had also challenged several major US tech companies, including expressing a bearish view on Tesla. Nvidia Palantir, OpenAI, and others. Burry posted that "OpenAI is the next Netscape, doomed to fail" and that "even if OpenAI raises $60 billion, it will be far from enough to fill the funding gap." Regarding Tesla , he believes its valuation is "overvalued" and criticized Musk's compensation package.

Last month, Burry disclosed his short positions in Nvidia and Palantir and engaged in a debate with the two companies. Subsequently, Burry closed his hedge fund and launched a paid column called "Cassandra Unchained" on the Substack platform ($39 per month, $379 per year), promising to provide more direct and unvarnished analysis.

(Source: China Fund News)