As 2025 draws to a close, the market's attitude towards artificial intelligence... Attitudes toward the (AI) craze are mainly divided into two camps: whether it's a bubble or not.

According to John Belton, a US portfolio manager who manages the $35 billion Gabelli Funds, stock market bubbles are either earnings-driven or valuation-driven, and AI currently falls into neither category.

与许多金融专业人士一样,他将当前美股市场上的人工智能前景与互联网时代进行了比较,并指出,目前顶级科技股的价格相对于利润来说确实很高,但并没有过高。出于这个原因,他认为人工智能市场可能尚未进入估值泡沫。

“It’s hard to say we’re currently in a valuation bubble. For example, at the end of 1999, the median forward P/E ratio of the ‘Big Seven’ (the seven largest tech companies) was close to 90, while today it’s around 25. Valuations seem to reflect only strong fundamentals and don’t appear significantly overvalued. Are we in an earnings bubble? Time will tell,” he added.

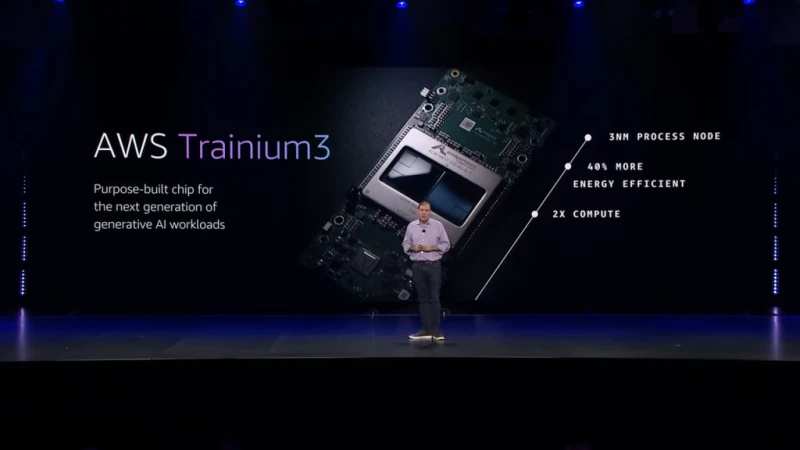

This portfolio manager also shared two reasons why he believes artificial intelligence has not yet entered a profit bubble. The biggest reason is that, although AI capital expenditures are high, most of it is used to strengthen already profitable businesses. Secondly, the list of use cases for AI is expanding.

"The second major reason we believe we haven't fallen into a profit bubble is the emergence of more large-scale application cases, such as autonomous driving and robotics ." "Life sciences, other scientific discoveries, and proxy software. We really need at least some of these use cases to be commercialized—though it's still early stages, the prospects are promising," he added.

Belton pointed out the importance of oracle bone inscriptions. (Oracle) and Broadcom Concerns have arisen regarding Broadcom, as both companies have recently seen declines due to investor skepticism about the returns on their high capital expenditures and investments in artificial intelligence. However, he added that he believes both stocks have the potential to recover from the current volatility, and Broadcom is currently one of the best chip stocks to hold.

这位投资组合经理看好人工智能交易在短期内的持续强劲势头,但他表示,投资者对OpenAI的巨额支出持谨慎态度是正确的。

“Like any infrastructure cycle, this will be a cycle (the question is not whether we reach the peak, but when we reach the peak and how high the peak will be),” he said.

(Article source: CLS)