I. Overview of US Stock Index Options

Trading volume in the US stock index options market has increased slightly, and the put/call ratio has also risen.

The volume distribution of S&P 500 index options expiring today shows a divergence between call and put order distributions, with put orders peaking at 6640 points and call orders peaking at 6800 points.

Nasdaq contracts expiring today 100 Index Options Trading Volume Distribution: Call single peak at 25,500, Put single peak at 25,000 points.

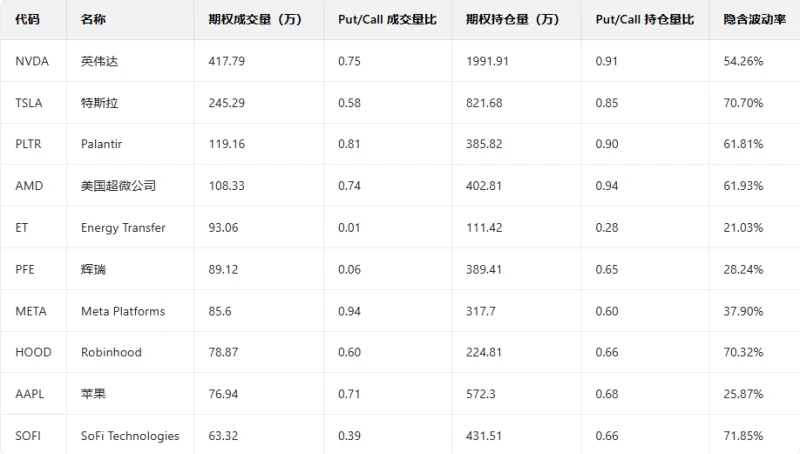

II. US Stock Options Trading Volume Ranking

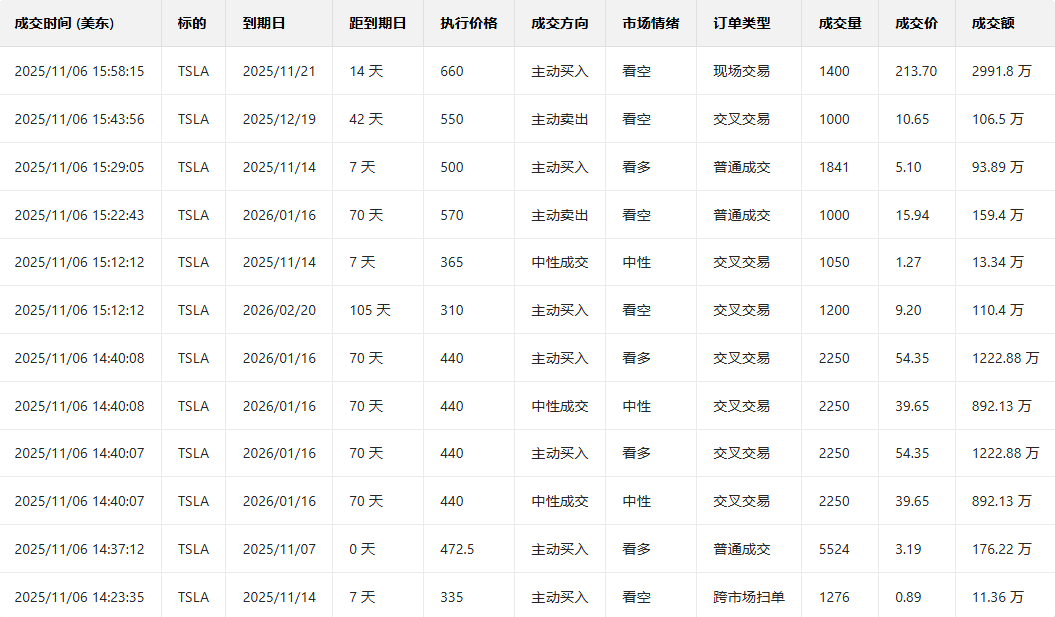

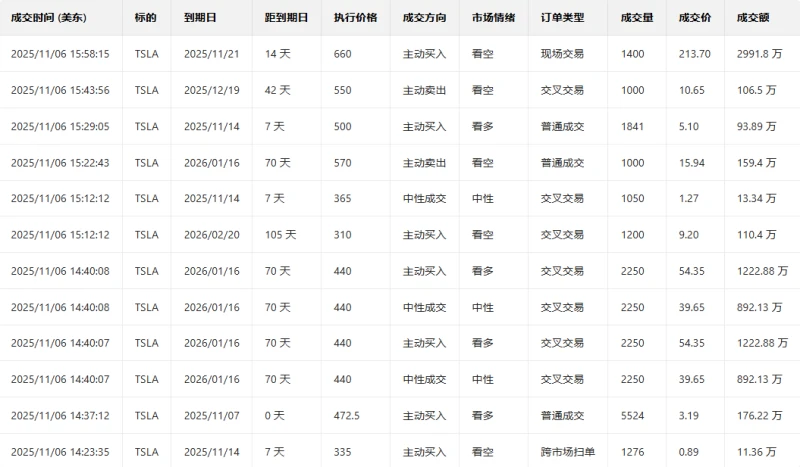

1. Tesla The stock fell 3.50% in the previous trading day. The put/call ratio rose slightly the day before, and trading volume also increased slightly.

Before the market closed, major option traders were predominantly bearish.

In terms of news, Tesla held its annual shareholder meeting at its Austin, Texas Gigafactory. Following a combination of in-person and advance voting, shareholders approved Elon Musk's new CEO compensation incentive plan—a performance-based incentive plan with a potential value of nearly $1 trillion—with over 75% of the votes in favor . This resolution means that if Musk achieves the various market capitalization and operational milestones set out in the plan over the next ten years, he will gradually receive approximately 423.7 million restricted stock units (RSUs) of the company, with a theoretical value of up to approximately $1 trillion; if the targets are not met, the corresponding rewards will forfeit.

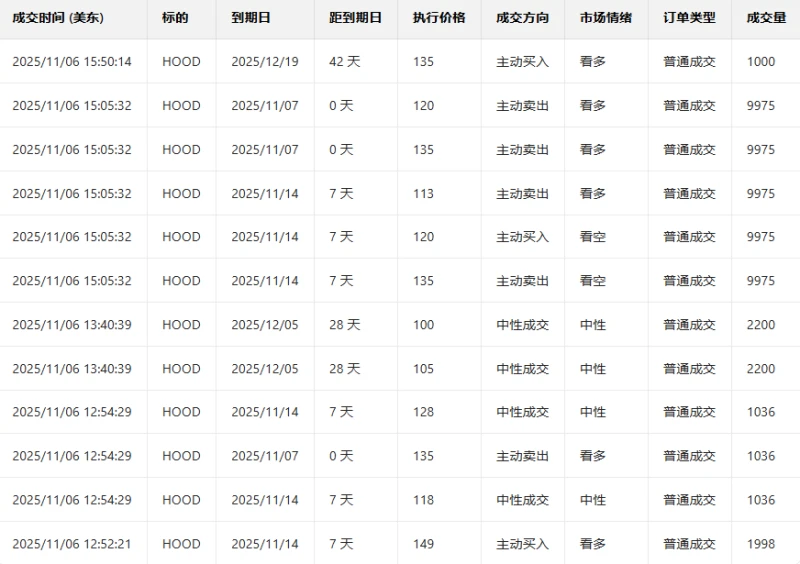

2. Robinhood fell 10.81% in the previous trading day. The put/call ratio declined slightly the day before, while trading volume increased significantly.

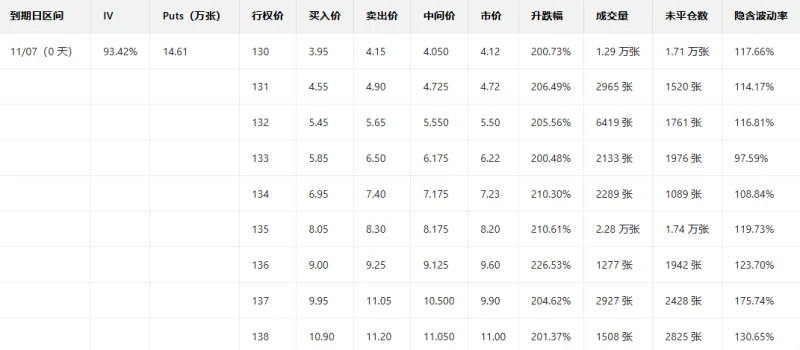

Looking at the put orders expiring this Friday, many have seen their prices more than double.

Before the market closed, major options traders were predominantly bullish.

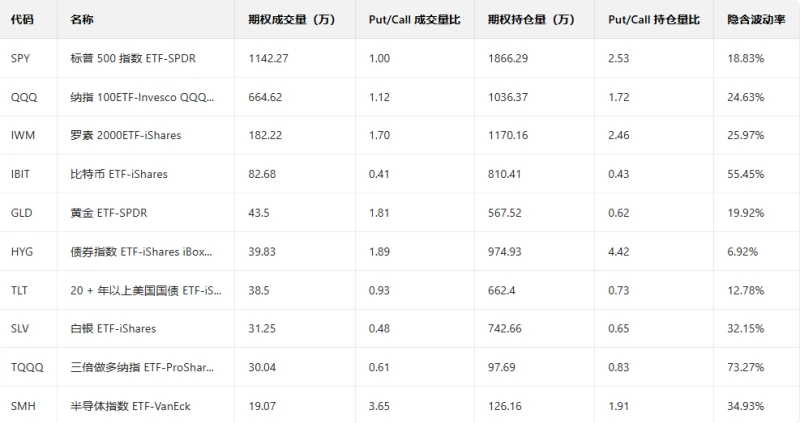

III. Top Ten US Stock ETF Options Trading Volume Ranking

Top 10 US Stock ETFs by Implied Volatility (Based on: Market Cap > $10 billion)

(Article source: Hafu Securities) )