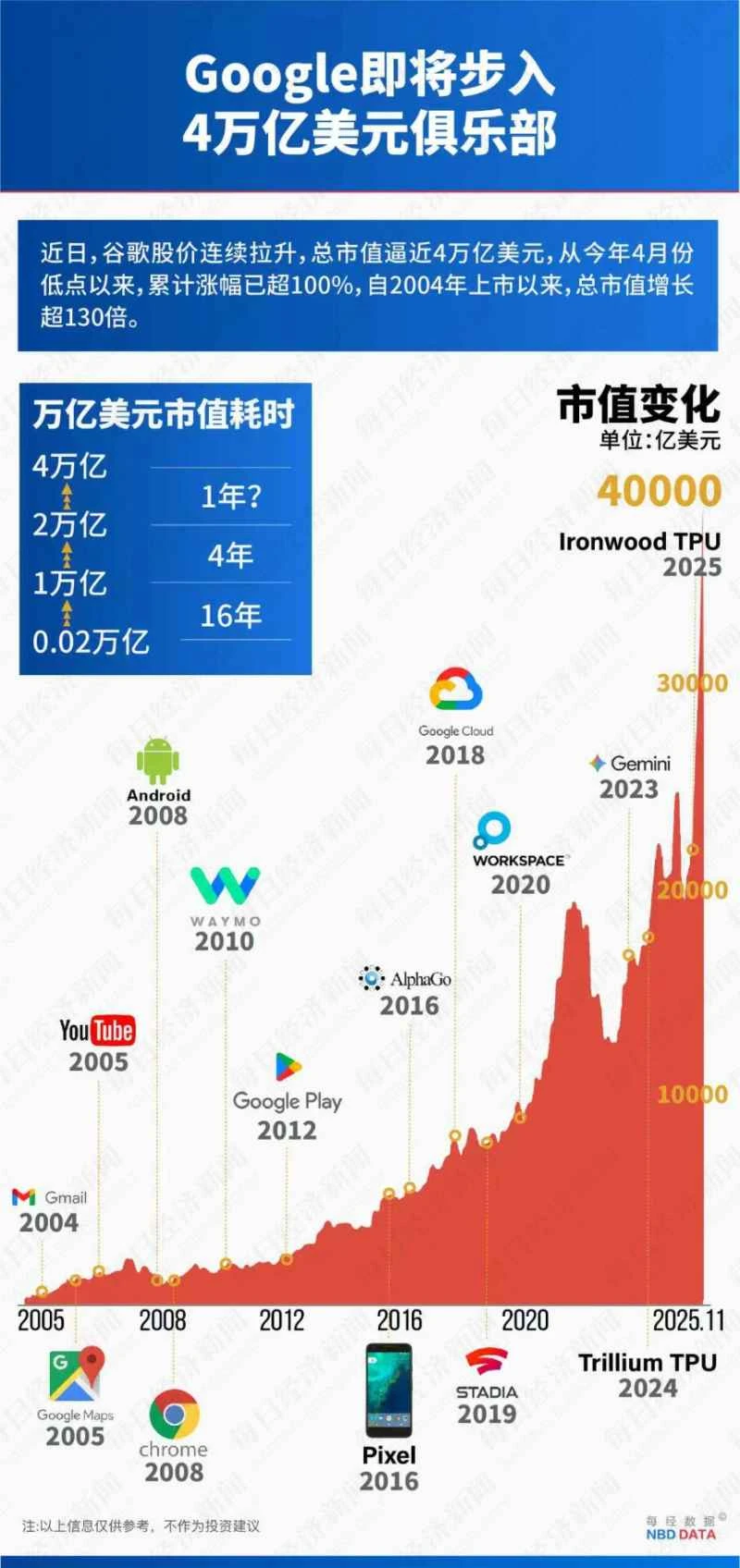

In November 2025, Nvidia's market capitalization exceeded $500 billion. A major shift has occurred between Google and Alphabet: Alphabet, Google's parent company, saw its market capitalization increase by approximately $530 billion, aiming for $4 trillion; while AI chips... The market value of the "dominant player" evaporated by $620 billion.

Behind this increase and decrease lies an industry rumor that could reshape the industry landscape: Meta is in secret talks with Google, planning to spend billions of dollars to purchase Google's TPU (Tensor Processing Unit) chips in 2027. As a core customer of Nvidia , Meta's computing power needs have been highly dependent on its GPU chips, and this "defection" will directly impact Nvidia 's nearly 85% market share.

This isn't simply about customer churn; it's a battle of technological strategies. Google's TPU chip, a product honed over a decade, has carved out a niche with its energy efficiency 2-3 times that of GPUs, and its seventh-generation Ironwood chip boasts performance up to 4 times that of its predecessor. Is Nvidia's CUDA ecosystem an unbreakable moat? What changes will the trillion-dollar AI chip market see?

TPU Surge: Google's market value rises by approximately $530 billion, while Nvidia loses $620 billion.

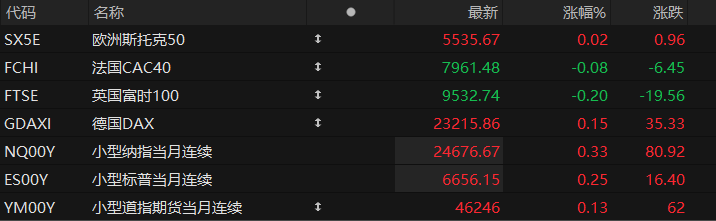

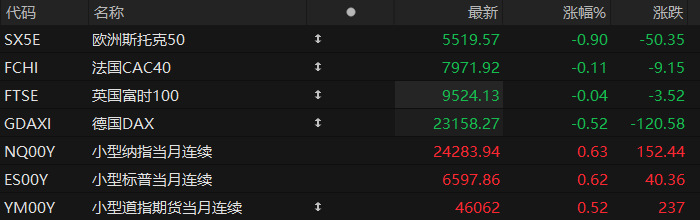

In November 2025, the stock prices of Google and Nvidia, the two giants in the global AI chip industry, diverged significantly. Alphabet, Google's parent company, saw its stock price rise by 13.87% this month, expanding its year-to-date gain to 69%; while Nvidia's stock price fell by nearly 12.59% during the same period, narrowing its year-to-date gain to 27.96%. This month, Google's market capitalization increased by approximately $530 billion, approaching $4 trillion; while Nvidia's market capitalization evaporated by $620 billion.

At the heart of this difference lies the market's sensitive response to changes in the competitive landscape of AI chips.

The catalyst for the stock price divergence stemmed from market rumors on November 24: Meta was in deep discussions with Google, planning to spend billions of dollars in 2027 to purchase Google TPU chips for deployment in its own data centers. Meta may lease Google Cloud TPU computing power starting in 2026. As a core customer of Nvidia, Meta's defection to Google would directly impact Nvidia's market dominance.

The news quickly triggered a chain reaction across the industry chain: Google's TPU partner with manufacturer Broadcom (Responsible for chip design and supply chain management, TSMC) Nvidia's stock price surged over 16% this week, with other companies in Google's supply chain also showing strength; however, Nvidia faced significant pressure – even though its latest earnings report far exceeded Wall Street expectations, its stock price still fell against the trend the day after the earnings report, accumulating a drop of over 2% this week. Coupled with talk of an "AI bubble" and controversies surrounding "circular financing" for star companies like OpenAI, Nvidia's stock price suffered further setbacks.

Ben Reitzes, an analyst at research firm Melius Research, points out that Google is the "most vertically integrated hyperscale vendor," with its own TPU chips and customized network equipment, which could reduce its reliance on external suppliers such as Nvidia, AMD, and Arista Networks in the long run.

According to Ben Reitz, Google has made a strong comeback in the field of AI. Its latest upgraded Gemini AI model and self-developed TPU have led some investors to believe that Google will win the AI war ahead of schedule.

The technological divide between TPUs and GPUs: Specialized performers versus all-rounders

The differences in the technological approaches between AI-specific chips (TPU, Tensor Processing Unit) and general-purpose processors (GPU, Graphics Processing Unit) determine their respective market positioning and competitiveness.

The evolution of Google's TPU is a history of technological iteration spanning seven generations and nearly a decade. Each generation of TPU has continuously improved in terms of computing acceleration, energy efficiency, and scalability, consolidating its leading position as a dedicated chip for AI workloads, especially in large-scale model training and inference scenarios within the Google Cloud ecosystem.

The seventh-generation product is also the first TPU product sold externally; previously, Google only offered computing power rental services. Morgan Stanley In its latest report, Brian Nowa's team pointed out that by 2027, Google may ship 500,000 to 1 million TPUs, officially entering the global computing power market.

As an application-specific integrated circuit (ASIC), the TPU uses a "pulsating array" as its core structure and is designed to accelerate tensor operations in neural networks. Under AI workloads, its energy efficiency is 2 to 3 times higher than that of GPUs of the same period. It is especially suitable for complex deep learning tasks that require long-term training, such as large language models (LLM). Google's Gemini and AlphaFold rely on it for support.

GPUs are known for their "general-purpose flexibility," with their thousands of parallel micro-cores originally designed for graphics processing. NVIDIA's CUDA platform, launched in 2006, achieved a breakthrough in general-purpose computing, leveraging its programmability and mature ecosystems such as PyTorch and TensorFlow to penetrate various fields including AI research, graphics rendering, and scientific simulation. For developers who need to customize operations or switch between frameworks, the flexibility of GPUs remains essential.

In short, GPUs are "general-purpose all-rounders," dominating the market with their ecosystem advantages; TPUs, on the other hand, are "AI specialists," carving out a niche in specific fields with their extreme efficiency.

Wall Street debates: Is Nvidia's "moat" solid?

Google's TPU's strong breakthrough has sparked fierce debate on Wall Street about Nvidia's market position, forming two major camps: the "win-win" camp and the "threat" camp.

The "win-win" camp generally believes that the market overreacted to Google's TPU, falling into the "zero-sum game fallacy."

Daniel Newman, an analyst at research firm Futurum Group, believes that AI infrastructure is a massive market that will reach trillions of dollars in the future, large enough to accommodate giants like Google, Nvidia, and AMD to coexist and thrive. (Bank of America) Analyst Vivek Arya predicts that the total market size for AI data centers will grow from $242 billion this year to $1.2 trillion by the end of this decade. At that time, although Nvidia's market share may drop from its current approximately 85% to 75%, it will still be the dominant player in the market.

In a report sent to the Daily Economic News, Wedbush analyst Dan Ives likened Nvidia to "the undisputed Rocky Balboa of the AI revolution." He believes that the beginning and end of the AI revolution are both at Nvidia, and this situation will not change in the next few years.

He emphasized that trillions of dollars in AI spending will benefit numerous tech giants in the future, but this should not be misinterpreted as a threat to Nvidia's leading position. From another perspective, the progress of Google's TPU, like AMD's recent success, is a sign of a healthy AI chip market, and more giants will join this "AI arms race" in the future.

However, the "threat proponents" argue that Google is the only company with full-stack vertical integration capabilities, from underlying chips, custom networks, and compilers to upper-layer AI models and applications. This capability allows it to build a closed but efficient ecosystem, thus posing a substantial threat to Nvidia.

Ben Reitz warned that if Google wins the AI war, it will impact hardware suppliers like Nvidia and AMD, as well as Microsoft. Amazon Cloud service providers, etc.

The controversy centers on Nvidia's core competitive advantage—the CUDA software platform. (Mizuho Securities ) Analyst Vijay Rakesh points out that CUDA's vast developer community and toolkit built up over a decade constitute an extremely high barrier to entry. While Google has launched programming languages like JAX and attempted to lower the barrier to entry through software such as the TPU command center, challenging CUDA's "standard" status remains a long and arduous task.

BOCOM International analyst Wang Dawei also believes that AI models are still evolving. While ASICs have advantages in energy consumption and efficiency, the initial investment and the technical barriers to integration with algorithms are high, and the number of companies with the capability/sales scale to develop their own ASIC chips is limited. The short-term increase in ASIC market share will not affect Nvidia's leading position in the industry.

However, cracks have already appeared in the market: Google's previous announcement of supplying up to 1 million TPU chips to AI startup Anthropic was seen as a long-term challenge to Nvidia's dominance. This potential collaboration with Meta could further push TPUs towards becoming a significant alternative to Nvidia chips for hyperscale customers.

Gary Black of asset management firm Future Fund believes that while Nvidia chips are still the gold standard for computing power, rumors of a partnership between Google and Meta signal the rise of alternatives.

In response, NVIDIA is taking proactive measures: CEO Jensen Huang is closely monitoring the progress of TPUs, investing in and securing potential customers such as OpenAI and Anthropic, and emphasizing that its platform is "a generation ahead of the industry" and "supports AI computing across all scenarios" in order to counter the limitations of TPUs' specialization.

Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Please verify before use. Any actions taken based on this information are at your own risk.

(Source: Daily Economic News)