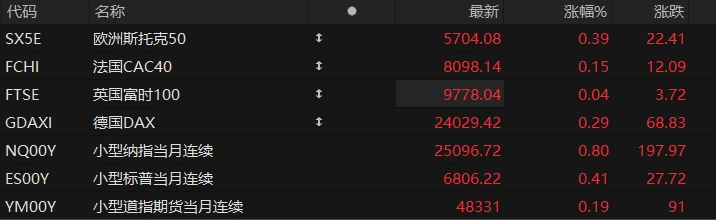

U.S. stock index futures rose across the board in pre-market trading on Thursday, while major European indices also generally gained. As of press time, the Nasdaq... S&P 500 futures rose 0.80%, S&P 500 futures rose 0.41%, and Dow Jones futures rose 0.19%.

In terms of individual stocks, most star tech stocks rebounded in pre-market trading, with Micron's earnings report showing strong demand for memory chips easing investor concerns about data centers. Concerns about a potential slowdown in construction, Tesla Nvidia Google-A Broadcom Oracle bone script Advanced Micro Devices (AMD) rose more than 1%.

Popular Chinese concept stocks generally rose in pre-market trading, with Pony.ai leading the gains. Baidu rose more than 2%. NIO It rose by more than 1%.

Storage concept stocks were active in pre-market trading, with Micron Technology leading the way. SanDisk Corp rose over 13%, Western Digital rose over 8%. Seagate Technology rose more than 5%. It rose by more than 3%.

Cryptocurrency stocks rose in pre-market trading, with Robinhood, Coinbase, and Bitmine Immersion Technologies all up more than 2%, and Strategy and IREN Ltd up more than 1%.

Wall Street is eagerly awaiting Thursday's release of the November Consumer Price Index (CPI) report, which will be the first reading of the period since the record-breaking U.S. government shutdown ended last month.

Economists expect the U.S. November CPI to rise 3.1% year-on-year, while the core CPI, excluding volatile items such as food and energy, is expected to rise 3.0% year-on-year. (Interactive Brokers) Senior economist José Torres believes that the overall inflation rate in November is likely to be between 2.9% and 3.1%.

If the report shows a reading of 2.9%, this could provide some positive momentum for the stock market heading into 2026. Torres believes such a figure would clear the way for a so-called "Santa Claus rally." He also believes it will influence the interest rate outlook for next year—the Federal Reserve is expected to cut rates once next year.

Hot News

JPMorgan Chase Data center capital expenditure is expected to grow by more than 50% in 2026.

Despite recent investor hesitation regarding the AI hype, JPMorgan believes that larger chip and internet stocks are still poised to outperform in 2026.

According to a report by JPMorgan Chase's North American analyst team, despite market concerns about artificial intelligence... Concerns about a bubble, but some leading semiconductor companies... Internet companies may still outperform the market again in 2026.

A team of analysts led by Harlan Ma estimates that business spending on data center capital expenditures could grow by another 50% in 2026, compared to approximately 65% in 2025. This growth will support equipment manufacturers across the entire semiconductor industry value chain.

It is worth mentioning that Broadcom , a well-known chip manufacturer, and memory chip... Manufacturers such as Micron Technology , semiconductor and solutions company Marvell, and Analog Devices, which produces chips for industrial and automotive electronics, are among the companies listed as the top contenders in this sector for next year.

Is OpenAI continuing to burn money on AI? Reportedly in talks for a $100 billion funding round, with a valuation aiming for $750 billion.

According to market sources, OpenAI, the artificial intelligence (AI) giant and developer of ChatGPT, has held preliminary talks with some investors regarding financing, aiming to raise at least tens of billions of dollars, with the financing amount potentially reaching as high as $100 billion and a valuation that could surge to $750 billion.

The report also stated that the discussions are still in the early stages and details such as terms, valuation, and timelines may change.

The $750 billion valuation represents a jump of approximately 50% from OpenAI's $500 billion valuation in October of this year.

This potential funding highlights the escalating demand for computing power in the AI industry as companies race to develop AI systems that match or surpass human capabilities. However, building up computing power requires massive financial investment.

Despite not yet being profitable, OpenAI is investing heavily in its computing infrastructure, aiming to become an ecosystem builder and industry rule-maker in the AI era. The company plans to invest trillions of dollars in infrastructure development to support the research and development of artificial intelligence technologies.

The Dalios support the "Trump Account" plan, and their foundation has donated funds to it.

According to the latest update released by the White House on Wednesday (December 17), prominent Wall Street hedge fund manager Barbara Dario has joined the ranks of billionaires supporting the "Trump Account" plan, which aims to provide $1,000 to each newborn over the next three years.

In a press release, the Dalio Foundation announced that Bridgewater Associates founder Ray Dalio and his wife Barbara Dalio will donate $250 to approximately 300,000 children in Connecticut, all of whom come from families with an average annual income of $150,000 or less.

Dalio stated, "Barbara and I firmly believe in the importance of equal opportunity and see this initiative as an important step in that direction."

The "Trump Account," also known as the 530A account, is a new type of savings and investment account established under the "Big and Beautiful Act" proposed by US President Trump, targeting newborns and teenagers in the United States.

According to information released by the U.S. Treasury Department, any child born between January 1, 2025, and December 31, 2028, who is a U.S. citizen, can have their parents or guardians open an account on their behalf, and the government will directly deposit $1,000 into the account. This money will be in the child's name, and the child will not receive this money until they turn 18, but the account will still be tax-free.

US Stocks Focus

Micron Technology's stock price surged in pre-market trading after earnings exceeded expectations.

Micron Technology shares surged over 13% in pre-market trading after the company reported Q1 revenue of $13.64 billion, exceeding analysts' expectations of $12.84 billion; net income of $5.24 billion; and adjusted earnings per share of $4.78, higher than the expected $3.95.

Micron said it expects second-quarter revenue to reach $18.7 billion, exceeding analysts’ expectations of $14.2 billion; earnings per share are expected to grow significantly to $8.42, exceeding the expected $4.78.

This explosive earnings guidance immediately triggered a strong reaction on Wall Street, with multiple institutions quickly raising their target prices. Morgan Stanley believes that, apart from Nvidia , the upward revisions to Micron's revenue and net profit are virtually unprecedented in the history of the US semiconductor sector. Barclays ... It was described as an "explosive quarter" that was expected but surprisingly strong, due to an improved pricing environment.

The market consensus is that the structural demand brought about by AI is reshaping the supply and demand pattern of the storage industry, and the tight supply situation will continue until at least 2026.

Will the chip stock bull market continue next year? Morgan Stanley's "Top Picks" list is out: Nvidia's position remains secure!

Morgan Stanley A recent research report states that, driven by an unprecedented surge in artificial intelligence (AI) infrastructure investment and a robust destocking process for traditional analog chips/MCUs (microcontrollers), the "long-term bull market logic" for chip stocks remains intact, and chip stocks are likely to be one of the best-performing sectors in the US stock market next year.

Along with the bullish market predictions came a list of "Top Chip Stocks for 2026": Nvidia, Broadcom , and Astera Labs ranked in the top three. Morgan Stanley analysts believe the semiconductor industry's boom cycle is far from over, and chip stocks still have enormous upside potential.

"For three consecutive years, the biggest debate in the market has focused on artificial intelligence semiconductors, with AI chip companies accounting for a significant portion of the chip industry's index weighting. To date, the unlimited global demand for AI computing power remains the most critical variable," they wrote.

Morgan Stanley points out that Nvidia and Broadcom are its two top picks in the semiconductor sector. The analyst explains, "At the time of writing, there's a growing enthusiasm for ASICs and market bets on very strong growth, but with various bottlenecks emerging, we still believe Nvidia will be the leader in cloud computing. " The solution with the highest ROI in the field, especially as the Vera-Rubin architecture begins to ramp up production in the second half of 2026.

BHP Billiton CEO: Copper supply shortages are unlikely to be resolved; high prices may persist for several years.

In 2025, limited copper supply has driven prices up and triggered a stockpiling frenzy. The CEO of one of the world's largest mining companies said that high copper prices are unlikely to fall in the short term.

London copper futures prices hit a record high of $11,952 per tonne on Friday, driven by tight supply, mining disruptions, and concerns about U.S. tariffs; New York copper prices have risen about 34% this year and are on track for their best year since 2009.

On Wednesday (December 17), BHP CEO Mike Henry emphasized in an interview that copper is a "critical" metal that not only supports the daily operation of the economy, but is also a key component of decarbonization and digitalization technologies.

Henry said, "The annual market size for copper is between $300 billion and $400 billion; while the annual market size for rare earths, which you often hear about, is only about $20 billion. So this is a very large market."

Like rare earth minerals, copper is facing pressure from surging demand and insufficient supply. Henry points out that against the backdrop of "strong demand growth," the copper bull market could continue for the next few years. Henry also stated that increased market focus on the "overall basket of commodities" could also support copper prices.

(Article source: Hafu Securities) )