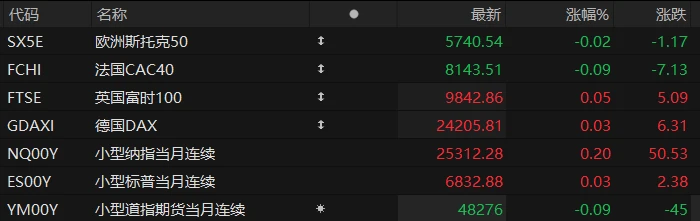

U.S. stock index futures traded in a narrow range in pre-market trading on Friday, while major European indices showed mixed results. As of press time, the Nasdaq... S&P 500 futures rose 0.20%, S&P 500 futures rose 0.03%, and Dow Jones futures fell 0.09%.

In terms of individual stocks, most prominent tech stocks rose in pre-market trading, with Oracle among them. Micron Technology rose more than 4%. Tesla rose more than 1%. Advanced Micro Devices (AMD), Nvidia It rose by nearly 1%.

Popular Chinese concept stocks rose in pre-market trading, with Pinduoduo among them. XPeng Motors shares surged over 7% following news that it announced adjustments to its corporate governance structure, implementing a co-chairman system and appointing Zhao Jiazhen as co-chairman, alongside Chen Lei as co-chairman and co-CEO. Pony.ai rose more than 5%. Li Auto Alibaba rose more than 2%. Baidu NIO It rose by more than 1%.

Cryptocurrency stocks generally rose in pre-market trading, with Bitmine Immersion Technologies up over 6%, Strategy and IREN Ltd up over 3%, and Coinbase, Robinhood, and Circle up over 2%.

Nvidia- related stocks rose in pre-market trading, with CoreWeave up nearly 5%, Applied Digital up over 3%, and NEBIUS up nearly 3%.

Space-related stocks rose in pre-market trading, with AST SpaceMobile and EchoStar Communications leading the gains. Rocket Lab and Planet Labs PBC rose more than 3%, while Rocket Lab and Planet Labs PBC rose more than 2%.

According to senior government officials, Federal Reserve Governor Waller and Trump conducted a "productive interview" for the position of Federal Reserve Chairman, discussing in depth the labor market and how to stimulate job growth. The interview took place at the presidential residence and concluded shortly before Trump's national address on the economy Wednesday evening. Treasury Secretary Bessant, White House Chief of Staff Wiles, and Deputy Chief of Staff Scavino also attended the interview.

Officials said BlackRock Rick Riddell of the group will be interviewed at Mar-a-Lago during the final week of the year. They also stated that Federal Reserve Governor Bowman is no longer a candidate for the position. Officials noted that Waller's conversations with Trump regarding jobs demonstrate that concerns and criticisms—that the president is simply looking for a candidate who will yield to his wishes on interest rates—are unfounded. They emphasized that the president addressed a wide range of economic issues in his interviews with candidates.

Hot News

Goldman Sachs The November CPI is unlikely to change the outlook for a Fed rate cut.

On Thursday, Eastern Time, the latest U.S. November CPI data initially pleased the market: both the November CPI and core CPI figures were lower than expected, leading the market to increase its bets on a Federal Reserve rate cut next year.

However, Wall Street investment bank Goldman Sachs believes that this CPI data is unlikely to substantially change the Federal Reserve's policy outlook in the short term. The bank points out that Fed policymakers will pay closer attention to the December CPI data to assess the true level of US inflation.

Goldman Sachs stated that although the November CPI report showed signs of slowing inflation in both overall and core indicators in the US, the report is "unlikely to have a significant impact on the Federal Reserve." They pointed out that the December CPI data will be released before the Fed's interest rate decision in January, at which time the Fed will obviously pay more attention to that updated inflation report. Goldman Sachs also noted that the unexpected drop in core CPI in the November report was mainly due to technical and time-related factors, rather than a general easing of overall inflationary pressures.

Therefore, Goldman Sachs believes that the Federal Reserve will remain patient on the path of interest rate cuts, and Fed officials are likely to rely on a broader range of data rather than the current single CPI figure when making policy decisions early next year.

What will the US stock market do next year? Which sectors should we focus on? This UBS report explains it all!

As the eventful year of 2025 draws to a close, a new research report released this week by UBS's trading department will give investors a preview of 2026.

UBS first outlined its market strategy for 2026—it expects US stocks to have a bumpy upward trend with more pullbacks than usual, but investors should take advantage of these pullbacks to increase their holdings in select sectors that benefit from the accelerated economic recovery and the expansion of market breadth.

Meanwhile, UBS also discussed two key factors in its report that have influenced market performance this year and will remain a focus next year: first, developments related to US President Trump, especially the midterm elections; and second, artificial intelligence . Related transactions.

In summary, UBS offers four recommendations for trading next year:

Transaction Recommendation 1: Regional Banks ETF (KRE) – The purest form of market breadth expansion trading;

Trading Recommendation 2: Maintain a positive outlook on the consumer sector;

Trading Recommendation 3: US Real Estate Sector – A Key Issue in the Midterm Elections;

Trading Recommendation 4: Mid-cap stocks are about to enter a new era.

Today marks the expiration of the largest options trading event in history, setting the stage for a "crazy day" for US stocks?

Wall Street may face significant volatility on the last trading day of the week, as traders prepare for an unprecedented options expiration event.

According to Goldman Sachs data, more than $7.1 trillion in notional value of options contracts will expire this Friday, setting a new record. This day is known as "Quadruple Witching Day," a day when stock index futures, stock index options, individual stock futures, and individual stock options all expire simultaneously. This concentrated expiration typically amplifies market trading volume and volatility.

In this record-breaking expiration event, approximately $5 trillion in risk exposure is linked to the S&P 500 index, with another $880 billion tied to individual stocks. Goldman Sachs points out that while December options expiration is typically the largest of the year, this one surpasses all previous records, with a nominal risk exposure equivalent to approximately 10.2% of the total market capitalization of the Russell 3000 index.

This event comes against the backdrop of significant gains already recorded in U.S. stocks this year. The S&P 500 has risen approximately 15% this year and traded around 6770 points on Thursday. The record number of options expiring could be a key variable in the year-end market, adding significant uncertainty.

From a technical perspective, the market is at a delicate balance. According to a report by options analysis firm SpotGamma, the S&P 500 is currently in a "negative gamma" range of 6700 to 6900 points, which means that the market itself tends to amplify volatility, i.e., accelerating upwards and accelerating downwards.

For investors seeking trading opportunities, SpotGamma suggests that if bullish, they could consider a call option spread strategy expiring on December 31st near 6900 points; if bearish, they recommend choosing put options expiring in February or March of next year to avoid excessive time value decay during the holiday period.

US Stocks Focus

Amazon A proposed investment of 10 billion yuan in OpenAI: seemingly a win-win situation, but in reality, someone is suffering a hidden loss.

This week, Amazon confirmed that it is in talks with artificial intelligence company OpenAI for an investment, with initial discussions aiming to raise at least $10 billion. At the same time, OpenAI may use Trainium, an AI chip developed by Amazon 's Amazon Web Services (AWS).

OpenAI completed its restructuring in October and now has more freedom to seek external funding and collaborate with other companies, following its previous partnership with Microsoft. The businesses are deeply intertwined, and Microsoft 's cloud business directly competes with Amazon AWS.

On the other hand, Amazon has invested at least $8 billion in OpenAI's competitor, Anthropic. But with the rise of cyclical deals within the AI industry, a collaboration between Amazon and OpenAI seems "reasonable," given that Microsoft also invested in Anthropic last month.

Cloud infrastructure investor Charles Fitzgerald pointed out that OpenAI signed a $38 billion computing power agreement with AWS last month, but OpenAI simply doesn't have the funds to fulfill its promises; it's a sham deal, or at least just a framework.

In his view, Amazon's $10 billion investment is precisely the means to fill this gap. Amazon will transfer $10 billion from its balance sheet to OpenAI's account, and OpenAI will then use cloud computing... The funds will be returned to AWS under the guise of an expenditure.

However, Fitzgerald also warned that Amazon's choice to have OpenAI boost chip visibility might be a mistake. Under this collaboration model, Amazon would be responsible for the computationally intensive tasks of building new models, which are costly to implement, have a short-lived profitability cycle, and constantly face the risk of becoming obsolete with each new chip generation.

Michigan passes controversial agreement to fund Oracle data center The power supply plan was given the "green light".

Michigan regulators unanimously approved a utility on Thursday (December 18). DTE Energy has requested power support for a large data center project planned by Oracle and OpenAI. As of press time, Oracle shares were up nearly 5% in pre-market trading on Friday.

According to documents previously filed by DTE, the company has entered into a power supply agreement with Oracle to support a multi-billion dollar, 1.4-gigawatt AI infrastructure in Salin, state.

The agreement stipulates that Oracle will bear the majority of the project's costs, including minimum monthly fees and termination fees. Sources familiar with the matter previously revealed that the developer is financing the project through a debt agreement worth approximately $14 billion.

The rapid expansion of data centers in the United States is reshaping the energy industry, and at the same time, controversy surrounding these infrastructures is growing, mainly revolving around their staggering power consumption.

In response, a DTE representative stated that the utility has a responsibility to serve all its customers (including data centers) within its jurisdiction, and "we acknowledge that there are various opinions and emotions surrounding this decision."

Oracle stated that the data center will bring economic benefits and tax revenue to schools and towns in Michigan, and that regulatory approval ensures that Michigan customers are protected from rising electricity prices.

Nike The "direct-to-consumer" strategy suffers setback: Q2 net profit plummets 32%! Slowing performance in Greater China and tariffs severely impact gross profit.

According to its financial report, Nike's net sales in the second quarter of fiscal year 2026 increased by 1% year-on-year to $12.43 billion, slightly exceeding market expectations; net profit decreased by 32% year-on-year to $792 million; diluted earnings per share were $0.53, lower than $0.78 in the same period last year, but better than the market expectation of $0.38.

According to Barron's analysis, the core reason for the profit decline was the significant contraction in gross margin. Gross margin fell by 3 percentage points in the quarter, primarily due to rising tariffs in North America, price reductions and promotions to clear out old inventory, and a decrease in direct-to-consumer (DTC) sales.

Nike 's DTC (Direct-to-Consumer) business typically boasts higher profit margins than its wholesale business, but this segment declined by 8% in the second fiscal quarter. Furthermore, Nike's marketing expenses increased by 13% year-over-year to stimulate demand, further driving up costs.

The decline in Greater China and the Asia Pacific and Latin America region offset the strong performance in North America. Nike's revenue in Greater China in Q2 fell 17% year-on-year to $1.7 billion, while its EBIT also shrank significantly by 49%.

In addition, Nike's direct sales revenue was $4.6 billion, down 8% year-over-year, with Nike brand digital revenue down 14% and Nike-owned store revenue down 3%. As of press time, Nike's stock was down more than 10% in pre-market trading on Friday.

(Article source: Hafu Securities) )