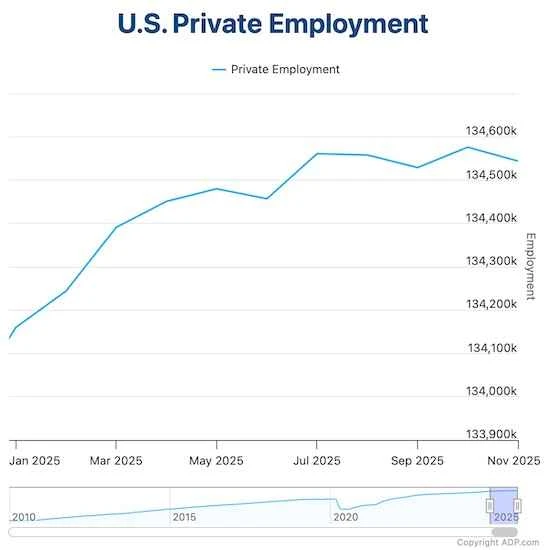

Data released Wednesday showed that U.S. private sector employment fell by the largest margin in nearly two and a half years in November, primarily due to job losses in small businesses. This is the third time in four months that the private sector has experienced job losses, indicating a general slowdown in hiring activity. If this trend does not reverse in time, it could push unemployment up and negatively impact the economy. For the Federal Reserve meeting five days later, the suspense surrounding an interest rate cut may have ended.

Cooling job market

US Automatic Data Processing ADP reported that businesses lost 32,000 jobs last month, the largest drop since March 2023. The last time the hiring market was this weak was during the pandemic.

By sector, small businesses lost 120,000 jobs that month, which economists attribute to increased costs due to import tariffs. Medium-sized businesses added 51,000 jobs, while large businesses added 39,000.

The U.S. Bureau of Labor Statistics will release its highly anticipated November jobs report on December 16. Originally scheduled for release on December 5, the report was delayed due to the previous government shutdown. It will include October's non-farm payroll data. However, the October unemployment rate will remain unknown because the household survey data used to calculate the unemployment rate was not collected due to the longest government shutdown in history. The U.S. unemployment rate climbed to 4.4% in September, a four-year high.

The latest ADP report confirms that the broad-based hiring freeze continues as the year-end approaches. ADP Chief Economist Nera Richardson stated, "Recent hiring has been volatile as employers grapple with cautious consumer spending and an uncertain macroeconomic environment."

The Federal Reserve may refer to this ADP report to inform its decision next week. While usually considered a secondary labor market indicator, the government shutdown has increased the report's importance. Prior to the shutdown, hiring activity had already slowed significantly due to businesses coping with the impact of tariffs, tightened immigration policies, and overall economic uncertainty.

It's worth noting that two other data releases this week also highlighted problems in the job market. Data released Monday by the Institute for Supply Management (ISM) showed that the overall manufacturing sentiment in the U.S. further declined, falling below the 50-point mark for the ninth consecutive month. Manufacturing employment has contracted for ten consecutive months. Susan Spence, chair of the ISM Manufacturing Business Survey Committee, stated, "67% of survey participants indicated that headcount management remains the norm for companies, rather than hiring new employees." The subsequently released ISM November U.S. services index rose to 52.6, marking the sixth consecutive month of growth. However, due to persistent "tariff uncertainty," businesses remained cautious in hiring and investment, and the employment index remained below the 50-point mark.

A survey by CBN reporters found that Wall Street generally believes the labor market has cooled down. Although interest rate cuts may have some mitigating effect, the hiring market is unlikely to see a significant improvement before trade frictions ease and the US economy accelerates—which could take a considerable amount of time.

Federal Reserve Policy Outlook

As scheduled, the Federal Reserve will release its final interest rate decision of the year next Wednesday local time, and will also update its closely watched quarterly economic projections and interest rate dot plot.

The weak labor market is one of the Federal Reserve's core concerns. However, some institutions believe that, based on multiple employment surveys from the National Federation of Independent Business, the Conference Board, and various Federal Reserve branches, the US labor market is indeed weak, but it is far from the deterioration shown by the ADP data.

The current "lifeline" is the low level of layoffs. At least until the penultimate week of November, the number of people filing for state unemployment benefits for the first time in the United States consistently conformed to the market trend of "no hiring, no layoffs".

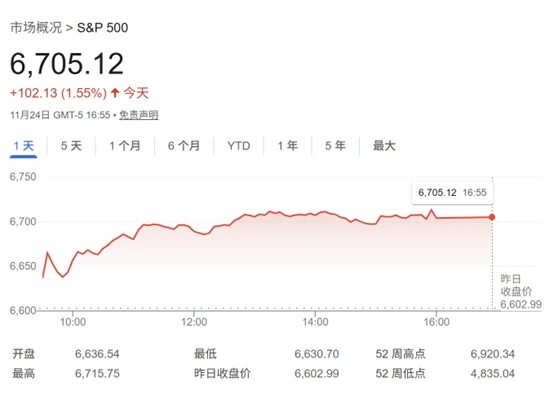

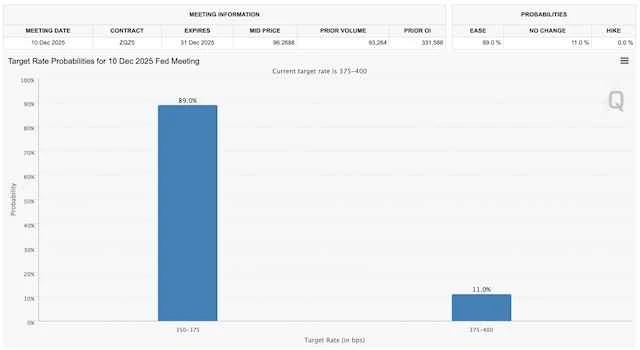

Federal funds rate futures pricing indicates that the probability of a Fed rate cut next week is nearly fully priced in following the ADP data release. The market expects a near 90% probability of a rate cut. While some senior Fed officials are more concerned about inflation and advocate maintaining current interest rates, this view is currently in the minority. The Federal Open Market Committee (FOMC) may cut rates again next week to prevent further increases in unemployment.

Bank of Montreal In a report sent to CBN reporters, Sal Guatieri, senior economist in capital markets, said: "For members of the Federal Reserve Board of Governors who favor an easing policy, this ADP report is enough for them to strongly refute those regional branch presidents who favor a tightening stance, thereby pushing the Federal Reserve to implement another interest rate cut."

However, price levels are likely to remain a focal point of future policy debates. Although the cost transmission from import tariffs has been relatively mild, inflation may remain above the Federal Reserve's 2% target for some time. A report released Wednesday by the U.S. Bureau of Labor Statistics showed that import prices were flat in September, but consumer goods prices excluding automobiles rose 0.4% month-over-month for the second consecutive month. Notably, import prices rose 0.3% year-over-year in September, the first time since March.

Christopher Rupkey, chief economist at FWDBONDS, said: "The data shows that the U.S. government's expectation that trading partners would voluntarily lower prices to reduce the cost pressure on American businesses and consumers from tariffs has not been fulfilled. Once goods arrive at U.S. ports, the tariff costs will ultimately be passed on to American consumers' shopping bills."

(Article source: CBN)