① Top U.S. economist Steve Hanke warned of two major problems facing the U.S. economy and markets: inflation may be slipping out of the Federal Reserve's control, and U.S. stocks may be starting to fall back to their lowest point; ② He said, "What keeps me up at night is that the Fed will not be able to achieve its inflation target by 2026. As for the stock market, my bubble detector is at an all-time high, which suggests that we are in a bubble."

As we approach the "final chapter" of 2025, Steve Hanke, a top American economist, professor of economics at Johns Hopkins University, and Nobel laureate, is having sleepless nights because of two major anticipated prospects for next year.

He warned that the US economy and markets face two major problems. One is inflation, which he believes may begin to slip out of the Federal Reserve's control; the other is the high-flying US stock market, which he believes will begin to fall back to its bottom.

“What keeps me up at night is the thought that the Fed will not be able to achieve its inflation target by 2026. As for the stock market, my bubble detector is at historic highs, which suggests that we are in a bubble,” he said.

Inflation is making a comeback

Regarding inflation, Hank explained that there are some signs that price growth in the United States is beginning to pick up again. Overall inflation in November was lower than expected, but still well above the Federal Reserve's 2% target.

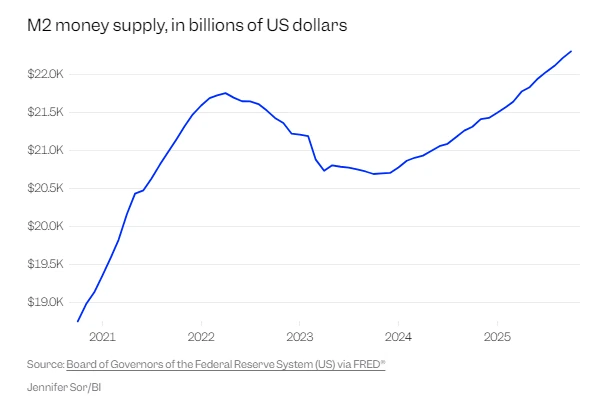

Hank has long argued that money supply is a key driver of inflation, citing the recent growth in M2 money supply. This is an indicator of cash flow in the economy, and according to the Federal Reserve, M2 money supply has increased by $3.5 trillion over the past five years.

“For me, this is the most important indicator,” he said, referring to the inflation outlook. “It looks like the money supply will increase significantly, and possibly even excessively.”

Hank also stated that some developments appear likely to exacerbate inflation next year:

The Federal Reserve cut interest rates. The Fed has cut rates three times this year, totaling 75 basis points. Hank stated that this helps ease financial conditions, but inflation is still not fully under control, meaning price increases could accelerate.

Quantitative tightening has ended. The Federal Reserve halted its quantitative easing program this month, a policy designed to tighten financial conditions by selling long-term Treasury bonds. This was another tool the Fed used to curb inflation in the post-pandemic era.

Loan rules will be relaxed. Some loan regulations, such as those issued by banks... Capital requirements will be eased early next year. This will give banks greater power to increase the money supply, thereby exacerbating inflationary pressures.

The U.S. Treasury is issuing more Treasury bonds, partly to cover the government deficit. Hank said this also increases the money supply, which could exacerbate inflation.

“My concern is that after the Federal Reserve allowed the money supply to explode in 2020-21, causing inflation for Americans, it has failed to put the ‘magician’ of inflation back in the bottle,” he added.

US stock market bubble

On the other hand, Hank believes the outlook for the US stock market isn't much better. He points out that with the increasing focus on artificial intelligence... The AI craze has reached new heights, and the tech industry is overvalued.

"As far as the warning signs of an AI bubble are concerned, you never know when the Wille E. Coyote moment will arrive," he warned, advising investors to rebalance their portfolios.

The "Wille E. Coyote moment" is a metaphorical term derived from the Looney Tunes character Wile E. Coyote, known for his repeated failures to catch the Road Runner. In economics, it describes a crisis moment when consumers, facing financial pressure, suddenly realize their income is insufficient to cover their expenses and must make significant adjustments.

This metaphor highlights the turning point that consumers may reach after experiencing interest rate hikes, rising debt, or increased living costs, potentially shifting from maintaining the status quo to taking emergency measures.

Regarding the AI bubble, he had previously warned that once today's artificial intelligence companies begin to deviate from growth expectations, they may ultimately suffer the same fate as internet companies.

(Article source: CLS)