With the Christmas holidays approaching, most institutional forecasts for the US stock market next year have been released. Wall Street's target for the S&P 500 index in 2026 is concentrated in the 7000-8100 range, with an average target close to 7500 points, representing a potential upside of about 9%. The driving factors are corporate earnings growth, Federal Reserve interest rate cuts, and artificial intelligence. The market is primarily driven by AI technology diffusion, but cautions are warranted regarding the risks of recession, valuation corrections, and policy volatility. Meanwhile, analysts remain optimistic about information technology, energy, and communication services . The industry. Of course, Wall Street also highlighted numerous risks, including downside risks to the US economy, the US midterm elections, and controversies surrounding valuation bubbles.

Wall Street's perspective

Oppenheimer predicts that the S&P 500 will challenge 8,100 points next year, which is also the most optimistic target on Wall Street. The core logic is that the US economy has sustained resilience, the S&P 500 companies' performance is better than expected, and corporate earnings growth is expected to reach 12% in 2026. Double-digit growth in earnings per share will support a significant rise in the index.

Deutsche Bank The bank has set a target of 8,000 points. It believes that the S&P 500 is poised for double-digit returns, driven by strong capital inflows, share buybacks, and continued positive corporate earnings momentum. Furthermore, the bank noted that S&P 500 company earnings grew by 13.4% year-over-year in the third quarter of 2025, laying the foundation for growth in 2026.

Morgan Stanley The bank set a target of 7,800 for the S&P 500. Chief equity strategist Michael Wilson reiterated his "rolling recovery theory," concluding that the worst is over. Corporate earnings expectations have rebounded to positive 15% from their April lows; slower wage growth leaves room for profit margin expansion. Consumer demand is expected to accelerate, strengthening corporate pricing power. Furthermore, the Federal Reserve may cut interest rates twice more in 2026.

Large-cap technology stocks were conspicuously absent from Morgan Stanley's recommended stock portfolio. The shift in consumer spending from services to goods, declining interest rates, and the release of pent-up demand are all favorable for investments in sectors such as consumer discretionary, small-cap stocks, healthcare, financials, and industrials. Wilson added that small-cap stocks have recently shown the most significant upward inflection point in terms of higher earnings expectations.

HSBC Bank (UK) The S&P 500 is expected to challenge 7,500 points in 2026, and there is a bet on the strong performance of the artificial intelligence industry. "Regardless of whether there is a bubble - history shows that the uptrend can last for a considerable period of time (the dot-com bubble and the real estate boom both lasted 3-5 years), so we believe there is still room for further growth and suggest expanding the coverage of artificial intelligence -related transactions."

Barclays The S&P 500 is projected to reach 7,400 points by 2026. The bank believes that in a low-growth macroeconomic environment, large-cap technology stocks are performing steadily, the AI race shows no signs of slowing down, and the Fed's interest rate cuts will drive the index higher.

A summary compiled by CBN reporters found that while the aforementioned institutions were bullish, they also highlighted several risks: First, the risk of a downturn in the US economy, with rising inflation and unemployment potentially dragging down overall economic activity and consumption; second, the impact of the US midterm elections, which historically tend to lead to weaker stock market returns; and third, the controversy surrounding valuation bubbles, with the current expected price-to-earnings ratio of the stock market approaching 22 times, far exceeding the five-year average, and the key question being whether the productivity gains brought about by artificial intelligence can be transmitted to non-technology companies.

Which sectors are worth paying attention to?

As the year draws to a close, analysts have released updated ratings for S&P 500 constituent stocks. Which sectors are the most optimistic and the most pessimistic?

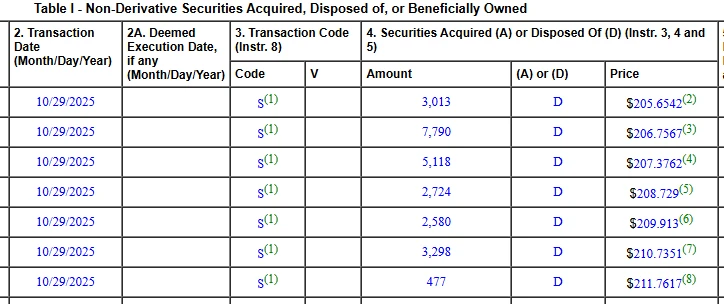

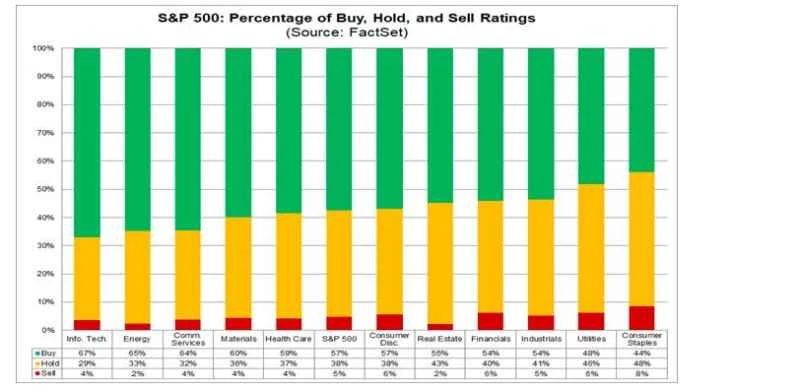

According to a report provided to CBN by financial data provider FactSet, there are a total of 12,696 ratings for S&P 500 constituent stocks. Of these, 57.5% are buy ratings, 37.7% are hold ratings, and 4.8% are sell ratings. The percentage of buy ratings is higher than its 5-year average of 55.5%; conversely, the percentage of hold ratings is lower than its 5-year average of 38.8%, and the percentage of sell ratings is also lower than its 5-year average of 5.7%.

In terms of sectors, analysts are most optimistic about information technology, energy, and communication services , with these three sectors having the highest percentage of buy ratings. Conversely, institutions are less optimistic about consumer staples and utilities. The most pessimistic sectors are those two sectors, with the lowest percentage of buy ratings. Furthermore, the consumer staples sector has the highest percentage of hold and sell ratings among all sectors.

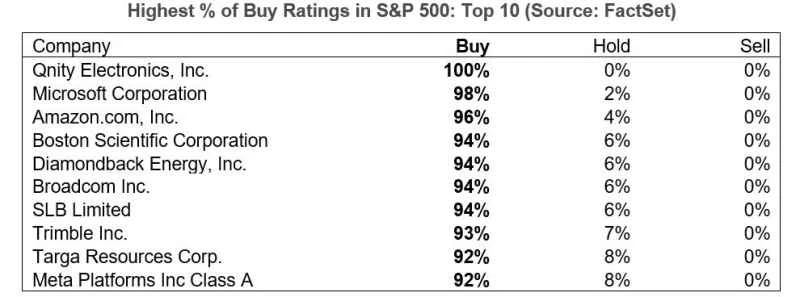

Microsoft Amazon Meta and others are among the top ten companies with the highest percentage of buy ratings in the S&P 500 index.

It's worth noting that investment in the artificial intelligence sector will become significantly more difficult in 2025. Although leading global tech companies have embarked on a large-scale capital expenditure cycle and achieved profit growth, propelling the US stock market to record highs, the era of easy, effortless profits is over. In the second half of the year, the market began to show significant divergence. Concerns about high valuations, negative macroeconomic factors, and lingering concerns about an emerging AI bubble became the dominant factors, triggering several rounds of sharp trading fluctuations.

Looking back at last year's forecasts, two of the three sectors with the largest gains were also among the top three sectors with the highest percentage of buy ratings: the telecommunications services sector and the information technology sector, while the energy sector lagged behind. Conversely, among the three sectors with the smallest gains, only one was among the top three sectors with the lowest percentage of buy ratings: the consumer staples sector.

(Article source: CBN)