Recently, at Goldman Sachs At the "At The Helm" private wealth management conference, banks The experts, along with over one hundred of their affluent clients, discussed one of the hottest topics of the day: artificial intelligence. (AI) — From popular AI investment areas to whether AI is a bubble.

Artificial intelligence has become a focal point—from office workers agonizing over the automation of their jobs to tech CEOs trying to keep up with their competitors. It's a $280 billion industry that is fundamentally transforming how we work and live.

The majority of attendees were millennials (born between 1983 and 1995) and younger Generation X (born between 1965 and 1980), who grew up in the internet age and recognize how technology has changed the status quo. They were clients of Goldman Sachs ' Private Wealth Management (PWM) division, which has an average account size of over $75 million.

Overall, attendees generally favored AI-driven energy investments and healthcare innovations, and believed that the current AI boom was not a bubble.

AI Investment Hot Areas

According to Brittany Boals Moeller, regional head of Goldman Sachs ' San Francisco PWM division, there are several areas where artificial intelligence has particularly piqued the interest of its clients: the technology's impact on healthcare, personal productivity, and energy use.

Specifically, she pointed out that artificial intelligence has already been well applied in the medical field. This technology interprets brain scan results with twice the accuracy of professionals examining stroke patients, can detect more fractures than humans, and can detect early signs of more than 1,000 diseases.

Furthermore, when it comes to productivity, many see limitless opportunities. People are using artificial intelligence to automate routine tasks, plan vacations, and process piles of emails. McKinsey found that long-term use of AI in enterprise cases could generate an additional $4.4 trillion in productivity growth.

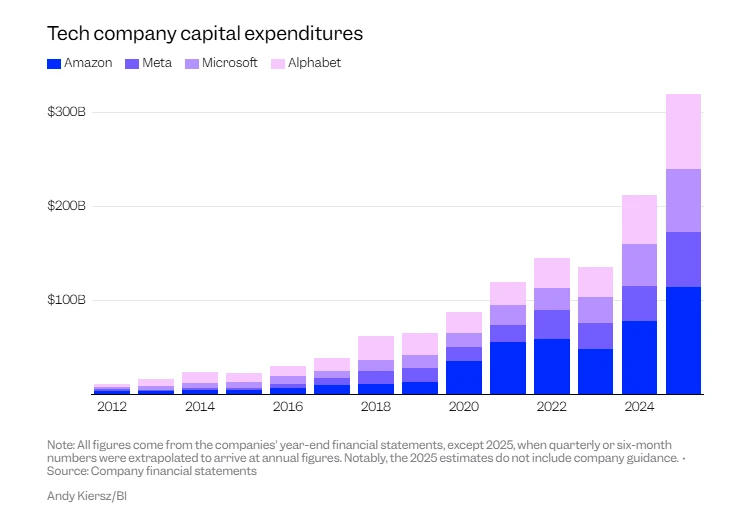

But most importantly, all these complex language models need to be driven, and the participants were well aware of the energy consumption involved.

According to predictions from Lawrence Berkeley National Laboratory, data centers will... More than half of the electricity will be used for artificial intelligence. By 2028, artificial intelligence alone could consume the equivalent of 22% of the electricity needed by American households.

Clearly, the explosive growth of artificial intelligence is accompanied by the fact that "the power grid is being pushed to its limits," which is gradually shifting industry attention from "production capacity" to " energy storage. " Musk proposed last month that large-scale deployment of industrial-grade batteries could achieve this . Energy storage systems could double the effective power generation capacity of the US power grid, providing a clear path to solving the AI energy crisis.

He explained that the US power grid has a stable output capacity of approximately 1 trillion watts, but its daily usage is only 0.5 trillion watts. By operating power plants at night to charge battery packs and releasing electricity during the day to support AI computing, it would be possible to "double the US's annual power generation." He called large-scale industrial-grade batteries the winning solution for a stable power grid.

Recently, South Korea’s three major battery manufacturers, Samsung SDI, SK On and LG Energy Solutions, also announced that they are rapidly shifting their business focus to energy storage systems and plan to double their total annual production capacity in the United States from the current 300GWh to 600GWh by the end of 2026.

Boals Moeller stated that attendees were concerned not only with the environmental impact but also with how to invest in energy related to artificial intelligence in the right way.

“For clients, energy is indeed an interesting investment opportunity in the context of artificial intelligence, while also addressing the social issue of energy as a finite resource,” he added. “This is one way of looking at the value creation of AI from an ‘indirect’ perspective. How exactly should we think about this issue responsibly, and its relationship with energy demand?”

Is prosperity a bubble?

Finally, Moeller added, "We have indeed had discussions about the market and whether we believe we are in a bubble. We do not believe we are in a bubble, and we are monitoring it closely. "

“Will there be winners and losers in artificial intelligence? Absolutely. There will definitely be areas where valuations are overvalued, and time will tell where those areas are. Therefore, it is wise for clients to remain cautious about how to invest in artificial intelligence,” he added.

(Article source: CLS)