As 2025 draws to a close, the US job market is exhibiting a new normal of "no firing, no hiring." Multiple surveys indicate that job security is becoming a major concern for American professionals next year. It's worth noting that as US household debt continues to reach record highs, the Federal Reserve's monetary policy choices are becoming increasingly delicate.

Increased risk to job stability

A recent survey report released by Mercer indicates that job security has become the second biggest concern for working professionals in the United States this year, second only to "paying monthly living expenses".

In the annual surveys over the past three years, "paying for monthly living expenses" has consistently ranked first on the list of concerns for working professionals, while concerns about unemployment have rapidly climbed from seventh place in 2023 to second place in 2025, ranking alongside "achieving retirement goals" and "maintaining work-life balance".

The survey results are seen as reflecting a growing disconnect between individual perceptions of the working class and macroeconomic data. Data released on Tuesday showed that U.S. GDP grew 4.3% year-on-year in the third quarter (this data is based on figures prior to the government shutdown). Sean Connelly, head of overall pay preference research in the U.S. and Canada at Mercer, stated, “Macroeconomic data may be positive, but people’s personal experiences don’t reflect that. The shock of seeing the bill at the grocery store every time adds to people’s financial pressure.”

Despite overall growth in U.S. consumer spending in the third quarter, Moody's... Research by chief economist Mark Zandi shows that the top 10% of earners in the U.S. now contribute half of all consumer spending. In a report released in October, he stated that 22 U.S. states are in recession, and another 13 states have experienced economic stagnation.

Connelly added that persistently high inflation and volatile markets have exacerbated economic uncertainty, prompting working professionals to wonder: "Looking at the current economic situation and examining my own company, I can't help but wonder—can our company weather the storm and achieve growth?" He predicted: "In 2026, the pressure from various macroeconomic issues will undoubtedly continue to affect people's lives."

There was a time when American professionals were far more concerned about their physical and mental health than about their economic well-being. Mercer's 2021 survey ranked job stability only tenth and monthly expenses ninth. But that's a thing of the past. From soaring inflation and a stagnant job market to artificial intelligence... Since the rise of economic anxiety has impacted traditional work patterns, it has gradually become a top concern for working professionals.

Data from the U.S. Department of Labor shows that the U.S. unemployment rate climbed to 4.6% in November, a four-year high, with new jobs highly concentrated in the healthcare sector. A survey released by the Conference Board on the 23rd showed that consumers' assessment of the labor market was "more negative" in December. The survey also found that the percentage of respondents who now consider their household finances "bad" has exceeded that of those who consider them "good."

Meanwhile, the University of Michigan's December consumer confidence survey showed that 63% of respondents expect the unemployment rate to continue rising next year. The report indicated that, influenced by persistent concerns about financial strain, consumers' overall view of the economy is becoming more pessimistic, with the final consumer confidence index for this year declining by nearly 30% compared to the same period in 2024.

US household debt hits record high

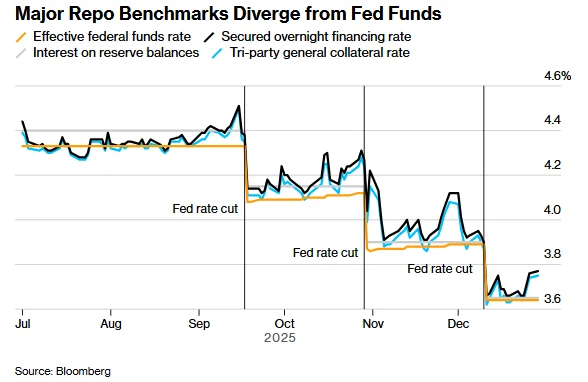

In the third quarter of 2025, U.S. household debt surged to a record high of $18.6 trillion. The Federal Reserve signaled at its December policy meeting that it had set a higher threshold for interest rate cuts in 2026, which is seen as potentially depriving indebted Americans of much-needed breathing room. It is widely expected that the Fed will only cut rates one or two times next year to slightly reduce borrowing costs.

Matt Shultz, chief consumer finance analyst at lending platform LendingTree, said, "Regardless of how the economic situation changes this year, people should remember that they have far more control over their debt than they think. They can consider getting a credit card to transfer their balance, applying for a debt consolidation loan, consulting a credit advisor, or directly calling their credit card issuer to request a lower interest rate."

Federal Reserve Bank of New York The released report on household debt and credit shows that mortgages accounted for the largest share of the trillions of dollars in household debt recorded last quarter, reaching $13.07 trillion. Non-housing debt rose 1% quarter-on-quarter, with credit card debt reaching $1.23 trillion and auto loans reaching $1.66 trillion.

According to TransUnio's 2026 Consumer Credit Outlook report, new car prices will still far exceed the cash payment capabilities of most Americans, and the auto loan default rate is expected to rise for the fifth consecutive year in 2026, although the rate of increase will continue to narrow. The report also predicts that credit card default rates will remain relatively stable, while mortgage default rates will rise slightly due to a slight increase in the unemployment rate.

It is worth noting that the credit market is also showing characteristics of the "K-shaped divergence" of the US economy, with high-income groups accumulating a lot of wealth through a booming stock market and rising home equity, which to some extent masks the financial pressure faced by low-income families.

Warren Cohenfeld, senior vice president of financial institutions at Moody's , said that low- and middle-income households have been particularly sensitive to inflation in recent years, prompting lenders to tighten credit approval standards. In the new year, the state of the job market will largely determine the ease of loan approval. Cohenfeld stated that if the job market maintains its current trajectory—weak but without a "significant increase" in layoffs—lenders are likely to maintain existing credit standards. "However, if the macroeconomic outlook deteriorates further, lenders will inevitably tighten credit further," he said.

(Article source: CBN)