① JPMorgan Chase The report anticipates a “disturbingly slow growth” in the U.S. labor market in the first half of 2026, with the unemployment rate peaking at 4.5% at the beginning of the year; ② The report states that Trump’s trade policies have created uncertainty for businesses, while his immigration controls have reduced the labor supply; ③ Despite these multiple challenges, JPMorgan predicts that the U.S. labor market will turn around in the second half of 2026.

According to a report by JPMorgan Chase , the U.S. labor market is expected to experience "disturbingly slow growth" in the first half of 2026, but is projected to improve in the second half.

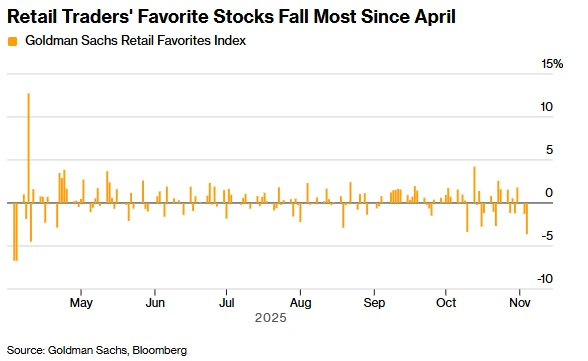

This year has been turbulent in the economy and financial markets, with the labor market cooling down. Many economists attribute the slowdown in job growth this year to the uncertainty brought to businesses by President Donald Trump's tariff and trade policies.

As for the upcoming year 2026, JPMorgan Chase's report points out that "the labor market is expected to experience a worryingly slow growth in the first half of 2026, with the unemployment rate peaking at 4.5% in early 2026."

Multiple factors affect the labor market

"Business planning has been challenging for companies, both in the long and short term, with low rates of layoffs and hiring. Companies are reluctant to make significant changes to their headcount, whether expanding or shrinking, given the uncertainty surrounding the next six months," wrote Michael Feroli, chief U.S. economist at JPMorgan Chase, in the report.

Furthermore, JPMorgan Chase added that Trump's actions regarding immigration control and deportation have been more aggressive than expected. JPMorgan Chase attributes the weak job market to a shrinking labor supply, stemming from factors including deportations of undocumented immigrants, an aging population, and a reduction in visas issued to workers and students.

This month, the U.S. Bureau of Labor Statistics delayed the release of its November jobs report, which showed that the unemployment rate climbed to 4.6% in November, the highest level in four years.

In addition, JPMorgan Chase also mentioned another major factor affecting the US labor market: artificial intelligence. The report points out that this technology has spurred innovation in equipment, software, and data centers . The large-scale investment did not create many jobs.

Although there are no signs of mass unemployment due to artificial intelligence yet, a JPMorgan report points out that job growth has slowed in some of the industries most affected by the technology.

The second half of 2026 will see a turnaround.

Despite numerous headwinds in the labor market, some economists predict a turnaround in the second half of this year, citing factors such as stabilizing tariff policies, tax cuts under the Big and Beautiful Act, and further interest rate cuts by the Federal Reserve.

JPMorgan's Feroli noted, "We believe that supporting factors are converging, which will curb the slowdown in the labor market and revive economic growth later next year."

In addition, JPMorgan Chase's report also predicts that the U.S. GDP growth rate will be 1.8% in 2026, with a one-in-three chance of an economic recession, while the inflation rate will stubbornly remain at 2.7%.

(Article source: CLS)