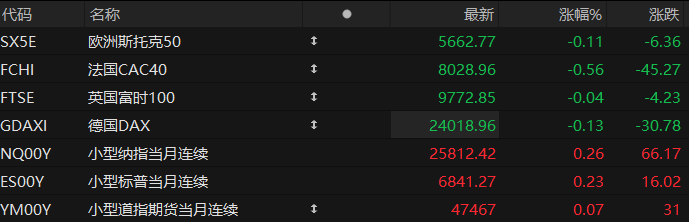

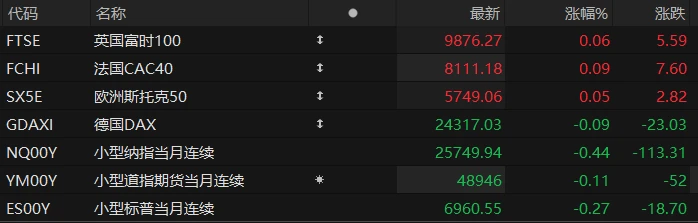

U.S. stock index futures fell across the board in pre-market trading on Monday, while most major European indices rose. As of press time, the Nasdaq... S&P 500 futures fell 0.44%, Dow Jones futures fell 0.11%, and S&P 500 futures fell 0.27%.

In terms of individual stocks, prominent tech stocks fell across the board in pre-market trading, with Oracle among them. Tesla Nvidia Micron Technology It fell by more than 1%.

Most popular Chinese concept stocks fell in pre-market trading, with Pony.ai among them. Alibaba fell more than 3%. XPeng Motors fell nearly 3%. Li Auto Baidu It fell by more than 2%.

Wall Street has entered another relatively quiet holiday week. Employment data from labor market provider ADP and the minutes of the Federal Open Market Committee (FOMC) December meeting are both due on Wednesday. These two data points will be in focus as Wall Street seeks to stride confidently into 2026.

According to reports, US President Trump will nominate a new Federal Reserve chairman in the first week of January. This is an uncertain event, and the announcement is likely to be delayed.

With stocks hitting new highs over the weekend, the market appears poised for a strong "Santa Claus rally"—typically referring to the last five trading days of December and the first two trading days of January. "The momentum heading into the year suggests a favorable 'Santa Claus rally'—which is generally a bullish signal for January and the year ahead," said the chief technical strategist at LPL Financial.

Hot News

Silver experiences an epic surge! Its market capitalization surpasses that of Apple. Becoming the world's third largest asset

As silver prices continue to climb, this precious metal... Its market capitalization has surpassed Apple , making it the world's third-largest asset, second only to gold and Nvidia .

On Monday, the silver market experienced a dramatic rollercoaster ride, with prices surging and then plummeting: spot silver opened with a violent surge, rising over 5% at one point to reach $83 per ounce; it then subsequently plunged, briefly falling below $75, with an intraday range of $9.

It has only been about 10 days since silver became the world's fourth-largest asset. Market experts believe that silver's global market capitalization ranking may rise further. Some industry insiders say that if the current upward trend continues, silver may surpass Nvidia to become the world's second-largest asset.

Amidst the rollercoaster ride of silver prices, analysts' opinions on the price have become polarized. Optimists, represented by renowned Wall Street economist Peter Schiff, believe silver prices could break $100 next year. Pessimists, however, warn that precious metal prices are on the "edge of a cliff," with the risk of a correction accumulating. UBS recently warned that short-term risks in precious metal trading have increased significantly, with the risk of short-term investors taking profits after new highs rising, and that thin year-end liquidity could exacerbate price volatility, making short-term price movements more difficult to interpret.

JPMorgan Chase Multiple factors will affect the US job market, which may experience slow growth in the first half of 2026.

According to a report by JPMorgan Chase , the U.S. labor market is expected to experience "disturbingly slow growth" in the first half of 2026, but is projected to improve in the second half. Regarding the upcoming year 2026, the JPMorgan Chase report states, "The labor market is expected to experience disturbingly slow growth in the first half of 2026, with the unemployment rate peaking at 4.5% in early 2026."

"Business planning has been challenging for companies, both in the long and short term, with low rates of layoffs and hiring. Companies are reluctant to make significant changes to their headcount, whether expanding or shrinking, given the uncertainty surrounding the next six months," wrote Michael Feroli, chief U.S. economist at JPMorgan Chase, in the report.

Furthermore, JPMorgan Chase added that Trump's actions regarding immigration control and deportation have been more aggressive than expected. JPMorgan Chase attributes the weak job market to a shrinking labor supply, stemming from factors including deportations of undocumented immigrants, an aging population, and a reduction in visas issued to workers and students.

Three major bears unanimously predict: In 2026, the dollar will fall and gold will rise!

Three prominent short-selling traders—Danny Moses, Vincent Daniel, and Porter Collins—have once again reached a high degree of consensus on their macroeconomic forecasts for 2026. All three are known for shorting the housing market during the subprime mortgage crisis.

Reportedly, when asked by the media about their most confident investment predictions for 2026, all three emphasized a slow-moving macroeconomic shift that they believe is putting pressure on the US dollar.

Although the US stock market bull run proved its strength again in 2025, mainly benefiting from artificial intelligence... Trading, but Moses expressed some skepticism about the field. And as the three traders prepared for the coming year, they remained quite cautious about the prospects.

Moses told the media that if he had to express his prediction for the 2026 macroeconomic outlook through a single trade, it would be to bet on gold, the cornerstone of his investment strategy over the years. He believes that even after a year of breakthrough gains in gold, the precious metal still has room to rise further as the dollar's status as the world's reserve currency weakens. He noted that he sees no factors that could hinder gold's upward momentum.

Daniel added that his investment firm believes emerging markets have enormous growth potential, particularly China and Brazil. He also noted that while many business-friendly governments have emerged in Latin America in recent years, Brazil offers high interest rates and real returns, and its stock prices are very attractive.

US Stocks Focus

Nvidia internal documents reveal: Due to Amazon Cloud computing is too expensive, and many customers are hoping for more affordable alternatives.

According to an internal Nvidia document, Bank of America Capital One, a subsidiary of Nvidia, expressed its interest in cloud computing at a technology conference. Cost concerns, especially for Amazon 's cloud computing services (AWS).

Capital One has seen its growing demand for GPUs and inference models and therefore believes its costs on AWS will soon spiral out of control. The company has told Nvidia it hopes to find an alternative to AWS as the financial institution seeks to control costs.

According to the document, Nvidia and Capital One discussed AI factories and new types of clouds, the former referring to internal data centers built by enterprises themselves. The latter is an emerging cloud service provider focused on artificial intelligence workloads. Both methods can serve as alternatives to renting computing resources from third parties.

AWS is one of the leading cloud service providers in the North American market, supporting a wider range of computing needs than newer cloud providers, and is also a key partner of Capital One. Capital One is leveraging artificial intelligence technologies to perform tasks such as fraud detection, customer support, and algorithmic trading.

In response to the internal document, Capital One stated that it will continue to maintain its partnership with AWS. AWS, in turn, pointed out that its pricing philosophy is to continuously strive to reduce its own costs and pass on the savings to AWS customers at lower prices.

ExxonMobil Raising long-term growth forecasts, targeting earnings over the next few decades

ExxonMobil is the gold standard in the global energy industry—and the company’s updated five-year corporate plan, released last week, further underscores its core strengths. ExxonMobil now expects its earnings per share to grow at a compound annual growth rate of over 13% by 2030, up from its previous target of around 10%.

This forecast is based on the assumption that the average real price of Brent crude oil is $65 per barrel. This target could be challenged if oil prices remain low—currently, Brent crude is priced at around $61 per barrel. However, oil prices stand out as an outlier amid rising prices for commodities such as gold, silver, and copper. In the long term, the oil and gas supply landscape remains favorable, and global demand continues to rise despite the ongoing development of renewable energy.

CEO Darren Woods is positioning the company to "remain profitable for decades to come." The stock is currently trading at around $120, representing a P/E ratio of 16 times projected 2026 earnings and a dividend yield of 3.4%. ExxonMobil has increased its dividend for 43 consecutive years, and its payout level appears secure even if crude oil prices fall to $40 per barrel.

Morgan Stanley Analyst Devin McDermott is bullish on the stock with a target price of $137, citing the company's industry-leading cash flow and earnings growth capabilities, as well as its diversified business model that includes refining and chemicals.

Defying the trend and bearish on US stocks! A legendary investor's asset management firm predicts the S&P 500 may see negative returns in 2026.

As 2025 draws to a close, Wall Street generally expects the US stock market to continue its bull run in 2026. However, a very small number of institutions hold a cautious view on the future trend of the US stock market, including GMO, the asset management company of legendary investor Jeremy Grantham.

Ben Inker, co-head of asset allocation at GMO, predicts that the S&P 500's future returns may be disappointing, potentially even turning negative in 2026, due to the high concentration of funds in expensive artificial intelligence (AI) stocks.

However, Inker does not believe that the US stock market will experience the kind of massive crash that the institution has warned of in the past. On the contrary, he believes that the AI sector may begin to underperform the market, and investors may turn to other sectors of the market, which would drag down the overall index—a market dynamic that has been exhibiting periodically over the past few months.

While there are investment opportunities in non-AI sectors within the S&P 500, Inker's two most favored investment targets are Japanese small-cap stocks and European value stocks.

Major Wall Street investment banks have projected a target price of 7,100-8,100 for the S&P 500 by the end of 2026, with an average target price of approximately 7,500, representing a potential upside of nearly 10%.

(Article source: Hafu Securities) )