According to Philadelphia Fed President Anna Paulson, Fed officials are currently assessing the economic performance following last year's massive easing policies, and further interest rate cuts may require some time to "settle in."

On Saturday (3rd) local time, Paulson stated in his prepared speech for the American Economic Association's annual meeting: "I believe inflation will moderate, the labor market will stabilize, and the economic growth rate this year will be around 2%. If all these goals are achieved, then some minor adjustments to the federal funds rate later this year may be appropriate. "

Overall, she believes there may be moderate further rate cuts later in 2026, but she thinks this outcome depends on a positive economic outlook. Paulson will have a vote on the Federal Open Market Committee (FOMC) policy meetings this year.

Specifically, Paulson explained that the risks in the labor market remain high, with labor demand slowing faster than the labor supply reduction caused by the Trump administration's immigration crackdown. However, she also pointed out that unemployment insurance... The number of applicants appears to have stabilized.

“While the labor market is clearly going through a period of volatility, it has not collapsed,” she added.

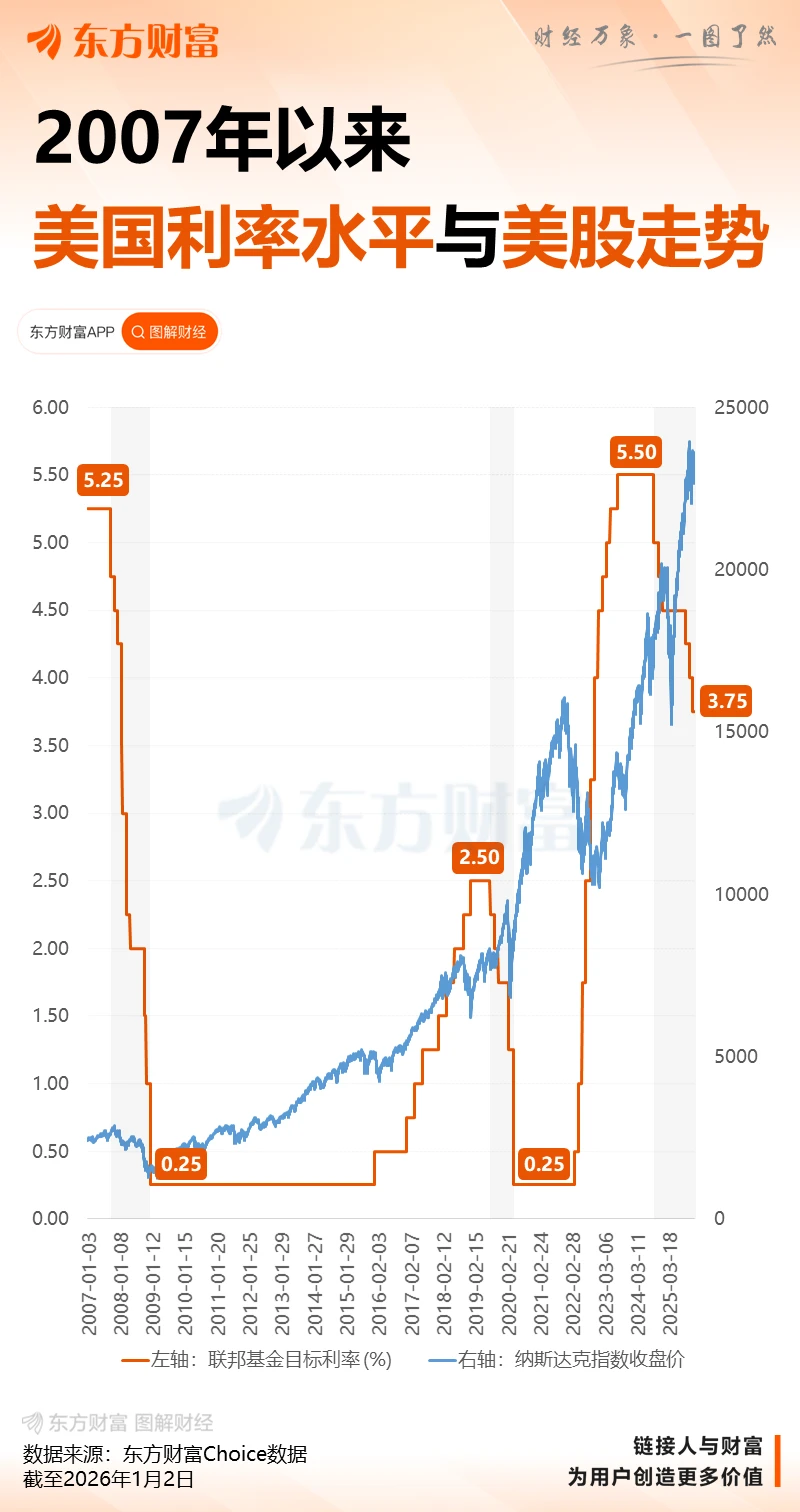

Despite the Federal Reserve cutting interest rates a total of three times in 2025, Paulson estimates that current policy remains “slightly tight,” which will help maintain downward pressure on inflation.

"The combination of past and present tight monetary policies will help bring inflation to the Fed's 2% target," she said.

Paulson also acknowledged that the impact of tariffs on commodity prices may "sustain" Qualcomm in the first half of 2026. She noted that inflation is expected to fall, but commodity inflation is projected to drop to around 2% in the second half of the year.

After cutting interest rates by a total of 75 basis points last year, Federal Reserve officials remain divided on how much to cut rates this year. A growing number of officials favor keeping rates unchanged, at least until more data on inflation and employment is available. In their projections for 2026, policymakers' median expectation is a 0.25 percentage point rate cut, while investors expect at least a 2 percentage point cut.

The future is full of challenges

Policymakers are facing a grim economic outlook. The unemployment rate rose to 4.6% in November, a four-year high, despite some improvement in underlying inflation. Economic growth data was also surprisingly strong, showing that the U.S. economy grew at an annualized rate of 4.3% in the third quarter.

But Paulson said the recent federal government shutdown and its impact on data collection "complicates the interpretation of the economic situation." She noted that her outlook did not take into account the latest unemployment data, but rather reflected "cautious optimism about inflation and a desire for a clearer understanding of what factors are driving economic growth and declining employment."

Paulson reiterated her previous point that artificial intelligence This could potentially drive a significant increase in productivity. In this scenario, the Federal Reserve wouldn't need to worry about economic growth pushing up inflation . However, she added that officials cannot determine in real time whether economic growth truly stems from increased productivity.

Earlier on Saturday, Paulson also co-authored an article highlighting the importance of central bank credibility in curbing soaring inflation. The article stated, "The inflation experience of the past five years does not appear to have had a lasting impact on long-term inflation expectations."

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)