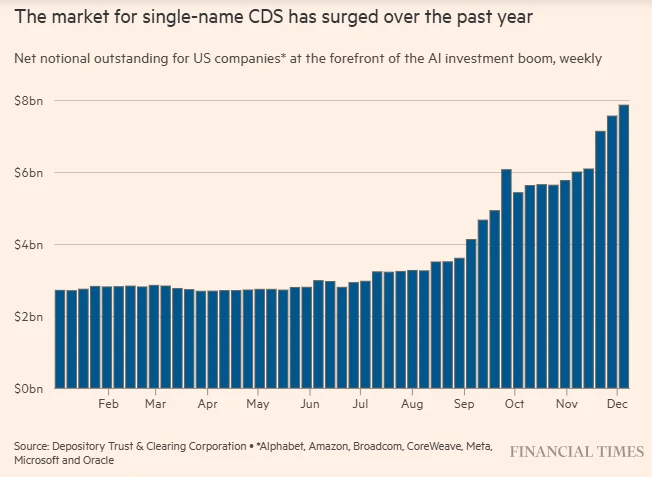

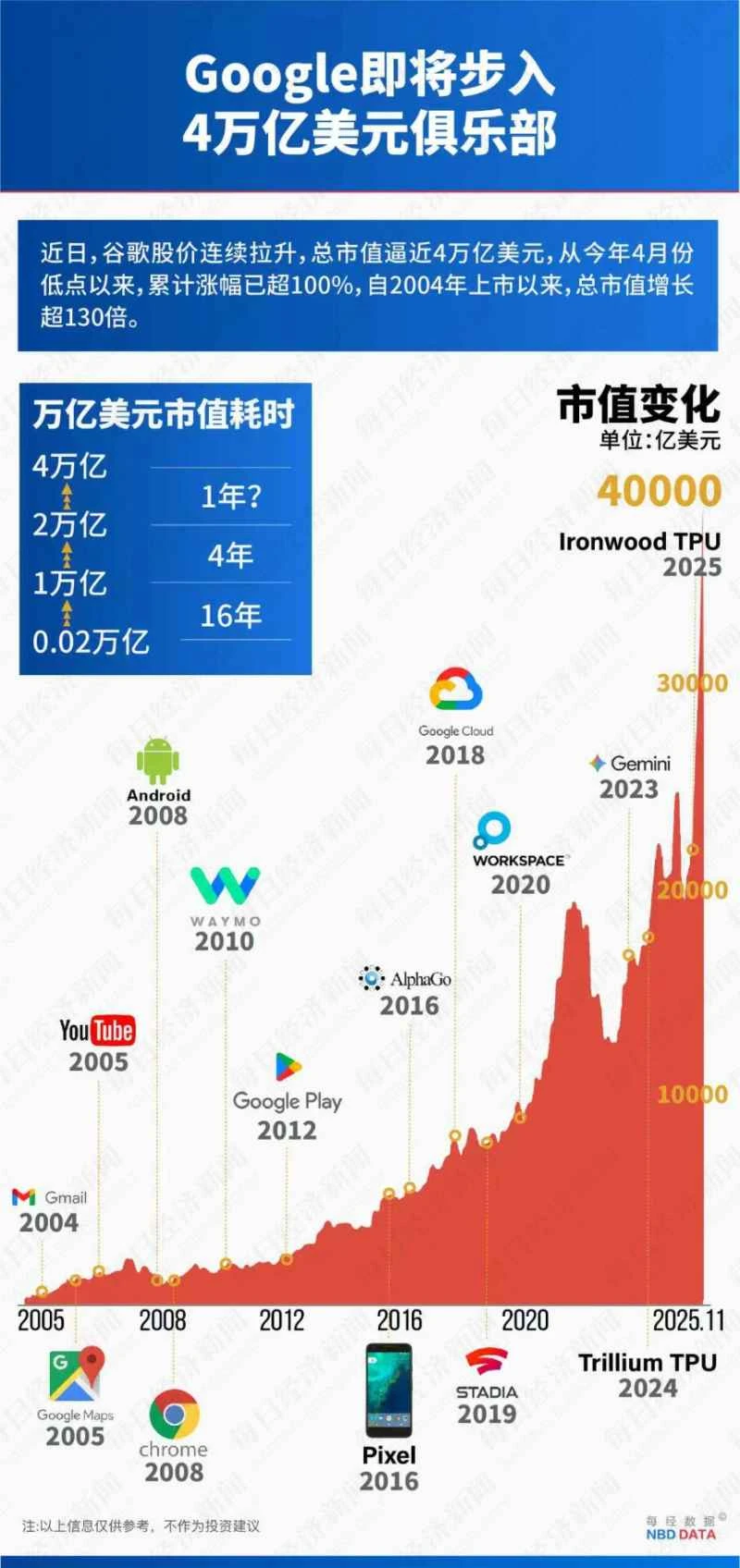

US stocks have entered 2026 with double-digit gains for the third consecutive year. This trend last occurred between 2019 and 2021, but the closing performance was less than satisfactory. Currently, investors are actively searching for direction in the market, especially with the rise of artificial intelligence... Continued investment in the sector and strong corporate earnings are expected to boost the US stock market, but macroeconomic uncertainties and the change of Federal Reserve chairman cast a shadow over the short-term direction of monetary policy.

Internal divisions within the Federal Reserve remain unresolved.

As the year-end holiday season approaches, the data landscape is generally light, with the US indicators showing a slightly positive overall performance.

Specifically, S&P Global The final reading of the U.S. Manufacturing Purchasing Managers' Index (PMI) for December was 51.8, slightly higher than the market expectation of 51.7. The existing home sales index rose 3.3% month-over-month, significantly exceeding the market expectation of 1.1%. The Chicago PMI for November was 43.5, compared to a market expectation of 41.0.

Regarding the job market, the U.S. Department of Labor reported that initial jobless claims fell by 16,000 to 199,000 in the week ending December 27, marking the third consecutive week of decline. While jobless claims data often fluctuates significantly during the holiday season, the recent low numbers are a sign of a relatively stable labor market.

Bob Schwartz, a senior economist at Oxford Economics, told CBN reporters that while seasonal fluctuations continue, the number of initial jobless claims remains within a range consistent with a relatively stable labor market. While the current level is in line with the slowdown in hiring, it does not signal a further deterioration in the hiring environment.

The latest Federal Reserve meeting minutes are the biggest focus this week. At its most recent monetary policy meeting, the Federal Open Market Committee (FOMC) voted 9-3 to cut the federal funds rate by 25 basis points. The minutes show that internal divisions among committee members persist. While most members expect the U.S. economy to expand at a moderate pace, some officials pointed to downside risks in the labor market and upward pressure on inflation. Therefore, some members believed that after the December rate cut, it would be appropriate to maintain the target range for the interest rate for some time.

Market expectations for a Federal Reserve rate cut have cooled somewhat. Federal funds rate futures pricing shows that market expectations for a 25 basis point rate cut at the next three FOMC meetings have all declined—the probability of a rate cut at the January meeting fell from 20% to 15%; at the March meeting from 58% to 54%; and at the April meeting from 84% to 77%. Historically, the Fed only adjusts its policy when the probability of a rate cut reaches approximately 65% or higher, meaning the market currently widely believes that the next rate cut will likely occur at the April FOMC meeting.

Schwartz told CBN that the outlook for the manufacturing sector will be more positive as trade policy uncertainties subside. Currently, the improvement in manufacturing output remains structural, and the growth momentum will spread to more sectors. Meanwhile, driven by investments in artificial intelligence , electrical equipment output is likely to achieve stronger growth. The drag from the automotive manufacturing sector is also expected to gradually weaken.

Schwartz believes the probability of the Federal Reserve cutting interest rates again in January is extremely low. Current job growth is slowing, and as labor's bargaining power weakens, pressure on wage increases is gradually easing. The drivers of inflation, especially service sector inflation linked to labor costs, are waning. The most significant feature of the labor market is not the growth in non-farm payrolls, but the rise in the unemployment rate—a phenomenon driven by a large influx of people back into the job market. This trend precisely indicates that the driving force behind more Americans returning to the job market is increasing economic pressure, rather than confidence in the economic outlook.

How to start the new year?

Unlike previous years, the Christmas rally in US stocks may be absent this year. With relatively low trading volume, all three major indices failed to maintain the positive trend of hitting record highs the previous week.

Declining sectors outnumbered advancing sectors. Dow Jones Market Statistics showed that the consumer discretionary sector suffered the largest decline this week, falling 3.2%; the technology and financial sectors followed closely, falling 1.5% and 1.3% respectively. Consumer staples and communication services also saw declines. The real estate, healthcare, and materials sectors also saw slight declines. Tesla The stock fell 7.8% this week. The electric vehicle manufacturer reported a larger-than-expected drop in fourth-quarter deliveries. (Wedbush Securities) In a client report, the company analyzed that the sales decline was due to pressure on market demand following the expiration of the US electric vehicle tax credit, coupled with multiple unfavorable factors in the European market. Only three sectors recorded gains this week: the energy sector led the gains, climbing 3.3%, followed by utilities. The sector and the industrial sector rose by 0.9% and 0.5%, respectively.

Last April, the Trump administration's tariff policies triggered severe turmoil in global markets, leading to a mass exodus of investors from US stocks, uncertainty surrounding interest rate prospects, and a blow to economic growth expectations. Wall Street, however, rebounded strongly from those lows, staging a remarkable turnaround. Nevertheless, as stock investors accelerate asset diversification, the S&P 500's annual gain has lagged behind some global stock indices.

The Federal Reserve's monetary policy direction will set the tone for global markets in 2026. Recent economic data, coupled with market expectations of a more dovish new Fed chairman, has prompted investors to already price in the possibility of further interest rate cuts. "The next Fed chairman is likely to be much more dovish than Powell. Therefore, I expect a significant rate cut in the second half of this year," said Dennis Dick, chief market strategist at Stock Trader Network. "This will benefit stocks across all sectors, not just tech stocks."

Charles Schwab The market outlook noted that U.S. stocks essentially gave back all of last week's gains this week. The pullback may be related to year-end tax-loss selling, or it could be influenced by a slight rise in long-term U.S. Treasury yields. While the S&P 500 has achieved a respectable 16% gain for the year 2025, its performance at the close has been less than satisfactory.

The agency believes that long-term US Treasury yields are gradually rising, which investors should closely monitor next week. Currently, the 10-year Treasury yield is slightly below 4.20%, while the 30-year yield has climbed to 4.872%, reaching a three-month high. Rising long-term yields are not necessarily bad for the stock market, but they may exacerbate market volatility, especially affecting interest rate-sensitive sectors. If yields continue to rise in the coming weeks, driven by optimistic market expectations for long-term economic growth, then investors may be more tolerant of this trend.

Next week, the market will see a series of key data releases: the ADP employment report, the Job Openings and Labor Mobility Survey (JOLTs), and the non-farm payrolls report. These data will help paint a picture of the US labor market and could also add volatility to trading. New Year trading is often difficult to predict due to a confluence of factors—including the "January effect" (new funds entering the market), capital gains selling at the beginning of the year to defer tax burdens, and the possibility of funds rotating into weaker sectors. If US Treasury yields continue to rise, it remains to be seen how long the bulls' resilience can last. However, the late-day rebound is a positive sign and is conducive to a moderate recovery in the coming week.

(Article source: CBN)