Betting on Maduro's arrest has yielded huge profits!

Before US President Trump's surprise visit to Venezuela, a mysterious account on the prediction market Polymarket accurately bet on Maduro's downfall, turning a principal of over $30,000 into over $400,000 in a single day, achieving a return of over 1200% in less than a day.

Trump announced that elite Delta Force conducted a nighttime raid near Caracas, capturing Venezuelan President Nicolás Maduro and his wife, Celia Flores, and flying them out of Venezuela from a military base. This operation marks the abrupt end of Maduro's rule.

Earn over 1200% in one day

The arrest of Maduro sent shockwaves through prediction markets, particularly Polymarket, where traders had been betting on whether and when Maduro would step down. Bitcoin.com News reported on this particular bet on December 13, 2025, when the likelihood of Maduro's removal from power began to rise. A flagship contract related to his impending downfall was deactivated as "yes" on January 3 following his arrest.

Prior to the raid, the contract was trading at around 5-7 cents, reflecting widespread suspicion that Maduro would be removed from office in the near future. The outcome of the raid resulted in a full payment of $1 per share, generating huge profits for traders who had entered positions shortly before the operation was made public.

Observers documented several anonymous wallets that placed large, high-confidence bets on Polymarket hours before the announcement, turning modest investments into six-figure payouts. Many of the accounts were newly created and almost exclusively focused on markets related to Venezuela.

“This account, Burdensome-Mix, existed for only a week, yet it quickly became the account with the most ‘yes’ holdings in the ‘Maduro step down’ market. This is highly suspicious,” one observer wrote on X.

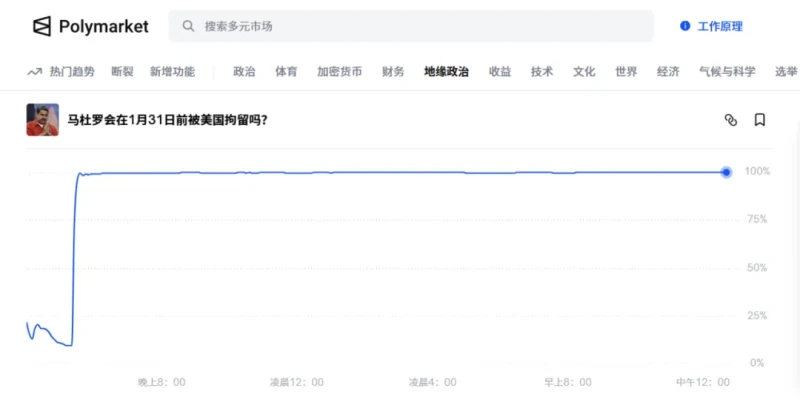

It is reported that the relevant market on the platform saw a rapid surge in trading volume from low probability to nearly 100% after US special forces captured Maduro and removed him from Venezuela on January 3, resulting in a surge in trading volume to over $120 million.

Did someone leak the information?

According to Axios, prior to Trump's official public statement, the price of Polymarket contracts predicting whether Maduro would lose power by the end of January fluctuated wildly late Friday night, suggesting that some market participants may have had advance knowledge of highly sensitive military operations. This volatility quickly sparked widespread discussion about "prediction market regulation and the leakage of political intelligence."

It is reported that the timing of the mysterious account's transactions closely coincided with the timeline of US military decisions. Sports business analyst Joe Pompgliano wrote on the social media platform X: "A newly created Polymarket account invested over $30,000 yesterday on 'Maduro's downfall.' The US will take action against Maduro tonight, and the trader made $400,000 in less than 24 hours. Insider trading is not only permitted in prediction markets, but is even encouraged."

In another post shared on X, a trader said he made $80,000 overnight using Polymarket by leveraging signals related to U.S. military activities.

The trader pointed out that the US had earlier deployed its largest aircraft carrier, which convinced him that a strike against Venezuela was imminent. The only unknown was the timing, so he created a simple robot. The pattern of monitoring Domino's Pizza orders near the Pentagon has long been associated with government late-night operations. "As soon as the pizza indicator bot detected unusual activity, my phone alerted me, and I immediately bought as many 'Will the US strike Venezuela?' contracts as possible on Polymarket," the trader wrote.

Some analysts point out that this unusual transaction may once again bring the regulatory issues surrounding prediction markets to the forefront. The U.S. Commodity Futures Trading Commission (CFTC) typically prohibits contract trading involving war, terrorism, assassination, or other activities that violate the public interest. However, Polymarket, as a global platform, is theoretically not open to U.S. users, thus existing in a regulatory gray area in the United States.

(Source: Securities Times)