Key market news during the New Year's Day holiday included: Trump's statement that Maduro and his wife had been captured and removed from Venezuela; Trump's statement that the US would "manage" Venezuela until a "safe" transition was implemented; the State Council's executive meeting deployed policies and measures for replicating and promoting cross-border trade facilitation; the State Council issued the "Comprehensive Solid Waste Management Action Plan"; Hong Kong stocks opened strong, with the Hang Seng Index rising nearly 3% and the Hang Seng Tech Index surging 4%; and the Nasdaq... China Golden Dragon Index rose over 4%, Baidu Surges over 15%; China Securities Regulatory Commission issues Securities... The following measures were announced: Implementation Measures for Supervision and Management of the Futures Market; the China Securities Regulatory Commission (CSRC) revised and issued the "Regulations on the Management of Sales Expenses of Publicly Offered Securities Investment Funds"; the Ministry of Housing and Urban-Rural Development issued an opinion on improving housing quality and continued to carry out the renovation of old urban residential areas; the Ministry of Commerce adopted safeguard measures for imported beef in the form of "country-specific quotas and additional tariffs on quotas"; two departments issued the "Guiding Opinions on Promoting High-Quality Development of the Power Grid"; Blue Arrow Aerospace's IPO on the Science and Technology Innovation Board was accepted, with a planned financing of 7.5 billion yuan; the National Integrated Circuit Fund's shareholding in SMIC's H shares increased from 4.79% to 9.25%.

Macroeconomics

State Council Executive Meeting: Deploys policies and measures for replicating and promoting the special action to facilitate cross-border trade.

Premier Li Qiang chaired an executive meeting of the State Council on December 31, hearing reports on the progress of the national water network construction, deploying policies and measures for replicating and promoting the special action to facilitate cross-border trade, and reviewing and approving the draft "Water Supply Regulations" and the draft revision of the "Regulations for the Implementation of the Drug Administration Law of the People's Republic of China." The meeting pointed out that facilitating cross-border trade is an important aspect of creating a first-class business environment. It is necessary to promote efficient and smooth cross-border logistics, strengthen connections between channels and modes of transport, and deepen multimodal transport coordination between coastal, inland, and border areas. It is also necessary to promote green trade and cross-border e-commerce. We will support the development of new business models and formats, optimize the supervision of special commodities, and support comprehensive bonded zones in carrying out bonded testing services. We will improve the level of intelligent supervision and services, deepen the construction of smart customs and smart ports, and promote cross-border interconnection of the international trade "single window." We will strengthen joint prevention and control at ports, strictly control the quality of import and export commodities, and ensure fast and effective clearance.

The State Council issued the "Action Plan for Comprehensive Management of Solid Waste".

The State Council recently issued the "Action Plan for Comprehensive Management of Solid Waste." The Action Plan emphasizes systematic advancement and focused efforts, accelerating the addressing of weaknesses and shortcomings, closely monitoring key areas, regions, and issues, conducting in-depth special rectification campaigns, strictly implementing closed-loop management, and constructing a comprehensive solid waste management system encompassing source reduction, process control, end-of-pipe utilization, and harmless treatment throughout the entire chain. Priority is given to the management of solid waste closely related to people's lives and production safety, and efforts are being made to accelerate the improvement of long-term mechanisms for comprehensive management to resolutely curb the growth of solid waste.

A spokesperson for the Ministry of Commerce answered reporters' questions regarding the EU's carbon border adjustment mechanism.

China has noted the recent flurry of legislative proposals and implementation rules related to the CBAM (Convention on International Trade in Endangered Species of Wild Fauna and Flora) by the European Union, including setting default values for carbon emission intensity and plans to expand product coverage. In particular, the EU disregards the significant achievements China has made in green and low-carbon development, setting a significantly high default value for the carbon emission intensity of Chinese products, which will be increased annually over the next three years. This is inconsistent with China's current level and future development trends, constituting unfair and discriminatory treatment. The EU's actions not only violate the World Trade Organization's principles of "most-favored-nation treatment" and "national treatment," but also contradict the principle of "common but differentiated responsibilities" established by the United Nations Framework Convention on Climate Change.

The offshore yuan broke through 6.97 against the US dollar, reaching a new high since May 2023.

On January 2, the offshore RMB broke through 6.97 against the US dollar, reaching a high of 6.9678, a new high since May 2023. By December 2025, the offshore RMB is projected to have appreciated by approximately 950 points, or 1.35%, in the cumulative fourth quarter, by approximately 1500 points, or 2.14%, and by approximately 3600 points, or over 4.93%, for the year 2025.

Global Markets

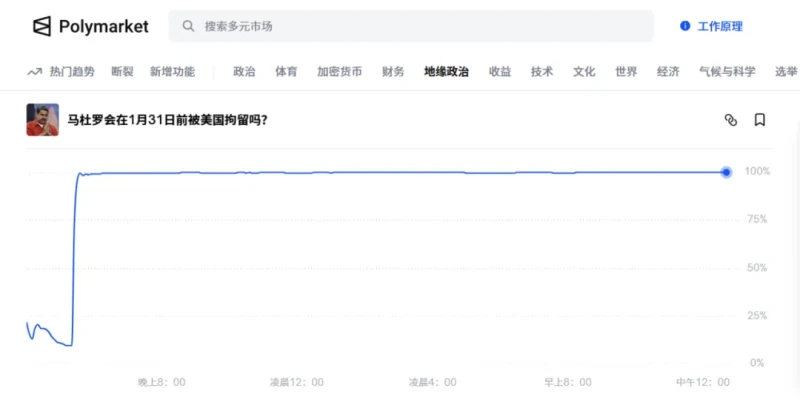

Trump claimed that the United States arrested Maduro and his wife and took them out of Venezuela.

On January 3, local time, US President Trump stated that the US had successfully carried out strikes against Venezuela, capturing Venezuelan President Maduro and his wife and removing them from Venezuela. He said the operation was conducted jointly with US law enforcement. Earlier that day, explosions were heard in Caracas, the Venezuelan capital, followed by air raid sirens. Witnesses reported multiple explosions near military facilities in southern Caracas, and that the area reportedly experienced power outages.

Trump: The decision on when to return Venezuela to Venezuela will be made by the United States.

On January 3, local time, US President Trump held a press conference regarding the US military action against Venezuela. Trump stated that the US will "manage" Venezuela until a "safe" transition is implemented. He also indicated that Maduro and his wife will face US judicial proceedings. Trump did not set a time limit for the US occupation. He claimed that when Venezuela will be returned to Venezuela will be decided by the US.

Foreign Ministry: We urge the US to immediately release President Maduro and his wife and resolve the issue through dialogue and negotiation.

Q: It is reported that on January 3, the United States sent troops to forcibly detain Venezuelan President Maduro and his wife and remove them from the country. Many governments have expressed their opposition. What is China's comment on this? A: China expresses serious concern over the US's forced detention and removal of President Maduro and his wife. The US actions clearly violate international law and the basic norms governing international relations, as well as the purposes and principles of the UN Charter. China calls on the US to ensure the personal safety of President Maduro and his wife, immediately release President Maduro and his wife, cease its efforts to subvert the Venezuelan regime, and resolve the issue through dialogue and negotiation.

Global Markets: US stock indices closed mixed; Nasdaq China Golden Dragon Index rose over 4%; Baidu rose over 15%.

The three major U.S. stock indexes closed mixed on January 2nd. At the close, the Dow Jones Industrial Average rose 319.1 points to 48,382.39, a gain of 0.66%. Large-cap tech stocks showed mixed performance, with Tesla... Netflix , Microsoft Google fell more than 2%, while Amazon rose slightly. Apple fell nearly 2%, Meta fell more than 1%, and Apple... Slight decline. Chip stocks generally rose, with SanDisk leading the gains . Micron Technology surges nearly 16% Western Digital shares rose over 10% (to a new high) Asma rose nearly 9%. Intel rose more than 8% (to a new high) GlobalFoundries rose over 6%, GlobalFoundries rose over 5%, ARM rose nearly 5%, and ASE Technology Holding rose over 6%. Nvidia shares rose over 4% (to a new high) Qualcomm Broadcom Following the upward trend, popular Chinese concept stocks generally rose, with the Nasdaq China Golden Dragon Index closing up 4.38%, Baidu surging over 15%, and Bilibili also rising . NetEase Alibaba rose more than 7%. JD.com rose more than 6% It rose nearly 3%.

Hong Kong stocks opened strong! The Hang Seng Index rose nearly 3%, and the Hang Seng Tech Index surged 4%.

On January 2nd, Hong Kong stocks surged across the board. By the close, the Hang Seng Index rose 2.76%, and the Hang Seng Tech Index gained 4%. (China Securities) A recent research report points out that looking ahead to 2026, the global liquidity easing environment will further deepen, with three factors jointly driving a weak dollar cycle. Meanwhile, domestic financial market policy dividends will continue to increase, and individual investors' motivation to enter the market is strengthening, potentially expanding the scope of incremental funds in the A-share market. Overall, the core logic supporting the bull market is expected to continue or even strengthen. Based on a comprehensive analysis of commercial scenarios, the long-term market size for embodied intelligence is expected to exceed one trillion yuan, with humanoid robots... The focus of the sector has shifted from thematic investment to expectations of mass production. Furthermore, we remain optimistic about energy storage. Better-than-expected demand has driven both volume and profit growth in the midstream sector, resulting in a synergistic benefit.

Tech stocks rallied at the start of the year, with Chinese concept stocks transforming into soaring dragons.

On the first trading day of 2026, although the closing fluctuations of the three major US stock indexes appeared relatively calm, many technology stocks saw a surge of capital inflows on the first trading day of the new year. Meanwhile, boosted by the strong start to the year in Hong Kong stocks, Chinese concept stocks in the US market experienced a collective surge. As a market focus, the Nasdaq China Golden Dragon Index jumped 4.38% in a single day, marking its largest single-day gain since May 12th of last year. Speculation in various themes was quite active: AI energy and energy storage concept stock Bloom Energy rose 13.58%; nuclear power startup NuScale Power rose 15.17%, Oklo rose 8.42%, uranium energy concept stock Energy Fuels rose 14.86%, and lidar... Concept stocks Innoviz rose 13.01%; rare earth concept stocks USA Rare Earth rose 18.91%; cryptocurrency concept stocks Riot Platforms rose 11.76%, and Canaan Technology rose 18.91%. Up 11.59%; Solaredge and Jinko Solar , both photovoltaic concept stocks. All rose by more than 8%.

This Thursday! Gold and silver are about to face their first major blow of the new year: billions of dollars in sell orders are already on the way.

After a record year-long rally, silver and gold are poised to face their first major hurdle of the new year this Thursday (January 8th): selling pressure from the reweighting of the Bloomberg Commodity Index. (JPMorgan Chase) Warnings have been issued that the upcoming annual weighting rebalancing of the Bloomberg Commodity Index could dampen precious metal prices . Recent fluctuations.

95-year-old Warren Buffett officially retires as CEO of Berkshire Hathaway

According to CCTV News, on December 31, 2025 local time, CCTV reporters learned that renowned investor Warren Buffett has officially retired from his position as CEO of the well-known investment firm Berkshire Hathaway. Warren Buffett, 95 years old, has served as CEO of Berkshire Hathaway for many years. In November 2025, he announced that he would resign from his position at the end of the year, but would continue to serve as chairman of the board and retain a "significant number" of shares.

Tesla's full-year delivery figures show it has lost its title as the world's best-selling electric vehicle by a significant margin.

On Friday evening Beijing time, Tesla , the world's most valuable automaker, released its operating data for the fourth quarter of 2025. Unsurprisingly, Tesla lost its title as the world's best-selling electric vehicle by a significant margin. According to Tesla... According to data posted on its official website, BYD delivered 418,227 new vehicles and produced 434,358 vehicles in the last three months of last year; for the whole year, it delivered 1,636,129 vehicles and produced 1,654,667 vehicles. These final figures not only fell short of most analysts' expectations but also below the company's own "market consensus expectation" released earlier this week. In comparison, BYD , China's leading electric vehicle manufacturer... Earlier on Friday, it was disclosed that 2.2567 million electric vehicles were sold in 2025, a 27.86% increase from 1.7649 million in 2024.

Global Highlights Next Week: Venezuela Situation, US Non-Farm Payroll Report, CES ("Tech Spring Festival")

With Chinese and South Korean tech stocks surging on Friday, giving global capital markets a strong start to 2026, next week will mark the first full trading week of the new year. Key US employment data and a strong tech sector performance at the start of the year could ignite traders' trading enthusiasm. For the S&P 500, which has been struggling to break through 7000 points since the end of October, next week's US December non-farm payroll report will set the tone for the first wave of market activity in the new year. Two weeks ago, the US Bureau of Labor Statistics released supplementary non-farm payroll data showing an increase of 64,000 jobs in November, but a decrease of 105,000 in October, the largest drop since the end of 2020.

Financial capital

Securities and futures regulatory measures released: Firewalls established, boundaries clarified, and rapid channels for handling emergency risks addressed.

The procedural norms for securities and futures market supervision measures, which have been in operation for over 17 years, have completed a crucial leap from "trial" to "formal." Recently, the China Securities Regulatory Commission (CSRC) officially released the "Implementation Measures for Supervision and Management of Securities and Futures Markets," which will take effect on June 30, 2026, simultaneously repealing the trial measures issued in 2008. The promulgation of these "Implementation Measures" not only represents a comprehensive upgrade and solidification of the original trial regulations but also a systematic clarification of long-standing procedural ambiguities in regulatory practice, with the core purpose of "establishing rules" for regulatory enforcement itself. The "Implementation Measures," comprising twenty-five articles, clarifies the types of regulatory measures, implementation principles, and the complete set of procedural requirements in the form of regulations.

The public fund fee rate reform has been completed, saving fund investors 51 billion yuan annually.

On December 31, the China Securities Regulatory Commission (CSRC) released the "Regulations on the Management of Sales Expenses for Publicly Offered Securities Investment Funds," marking the final step in the three-phase fee reduction work for the public fund industry and signifying the smooth and comprehensive implementation of the reform. The implementation of the new regulations on public fund sales expenses marks a milestone in the much-anticipated fee reduction work for the public fund industry, which began in 2023. After the completion of all three phases of fee reduction, it is estimated that investors will save 51 billion yuan in investment costs annually, and the overall fee level of public funds will decrease by approximately 20%. The "Regulations" consist of six chapters and 29 articles, covering six main aspects. These new regulations focus on addressing prominent issues such as relatively high subscription and purchase fees, complex redemption fee collection mechanisms, and a lack of effective regulation of sales service fees.

The duties of company secretaries will be further standardized: the entry threshold for appointment will be raised and the vacancy period shall not exceed 3 months.

To further regulate the performance of duties by board secretaries of listed companies, the first set of regulations specifically targeting them has been released. On the evening of December 31, the China Securities Regulatory Commission (CSRC) announced that, in order to further regulate the performance of duties by board secretaries of listed companies, promote their positive role, and improve corporate governance, it has drafted the "Rules for the Supervision of Board Secretaries of Listed Companies (Draft for Public Comment)" and is soliciting public opinions. The deadline for feedback is January 30, 2026. Overall, the "Rules" consist of 38 articles, mainly covering four aspects: first, clarifying the scope of responsibilities; second, improving safeguards for the performance of duties; third, improving appointment management; and fourth, strengthening accountability.

Commercial real estate REITs are taking off! The China Securities Regulatory Commission (CSRC) will proceed with the pilot program in phases.

On December 31, the China Securities Regulatory Commission (CSRC) issued the "Notice on Promoting the High-Quality Development of the Real Estate Investment Trust (REITs) Market," aiming to improve basic systems, optimize regulatory arrangements, enhance market functions, and strengthen the effectiveness of the multi-tiered capital market in serving the real economy. Simultaneously, supporting business rules from the Shanghai and Shenzhen Stock Exchanges, China Securities Depository and Clearing Corporation Limited (CSDC), the Securities Association of China, and the Asset Management Association of China were also released. According to the framework of the commercial real estate REITs system, the CSRC has initially clarified a "1+3+N" framework, namely, one "Announcement of the China Securities Regulatory Commission on Launching a Pilot Program for Commercial Real Estate Investment Trusts," one notice, two working procedures, and N representing 17 supporting rules from the Shanghai and Shenzhen Stock Exchanges, CSDC, the Securities Association of China, and the Asset Management Association of China.

Industrial Economy

The Ministry of Housing and Urban-Rural Development issued an opinion on improving housing quality: continuing the renovation of old urban residential areas.

The main objectives are: by 2030, significant progress will be made in the housing quality improvement project, housing standards, design, materials, construction and operation and maintenance will be greatly improved, affordable housing will be built into "good houses" first, commercial housing will better meet rigid and improvement needs, significant progress will be made in the transformation of old houses into "good houses", and a policy system, standard system, technical system and industrial system that effectively support the improvement of housing quality will be formed.

The Ministry of Commerce has initiated a three-year safeguard measure for imported beef to provide relief to the domestic beef industry.

On December 31, the Ministry of Commerce issued an announcement ruling that the increase in imported beef had caused serious damage to China's domestic industry and would implement safeguard measures on imported beef. According to the announcement, the safeguard measures will be implemented in the form of "country-specific quotas and additional tariffs on imports exceeding the quota." An official from the Trade Remedy and Investigation Bureau of the Ministry of Commerce explained that the safeguard measures on imported beef will take effect on January 1, 2026. From the date of implementation of the safeguard measures, if the import quantity does not reach the annual quota, imported beef will be subject to the current tariff rate. Once the import quantity reaches the annual quota, starting from the third day after that date, additional tariffs will be levied on top of the currently applicable tariff rate. Unused quotas from the previous year will not be carried over to the next year.

Two departments issued the "Guiding Opinions on Promoting High-Quality Development of the Power Grid".

By 2030, a new type of power grid platform, with the main power grid and distribution network as its important foundation and smart microgrids as a beneficial supplement, will be initially established. The main grid, distribution network, and microgrids will form an organic whole with clear interfaces, complete functions, intelligent operation, and efficient interaction. The grid's ability to optimize resource allocation will be effectively enhanced, the scale of "West-to-East Power Transmission" will exceed 420 million kilowatts, and the newly added inter-provincial power exchange capacity will be approximately 40 million kilowatts, supporting new energy sources. With a power generation share of around 30%, the capacity to accommodate distributed renewable energy reaches 900 million kilowatts, supporting over 40 million charging infrastructure units, the fundamental role of the public power grid is fully realized, smart microgrids are developing in a diversified manner, the power system maintains stable operation, and services for people's electricity needs are more effectively provided.

Company Focus

The National Integrated Circuit Industry Investment Fund (Big Fund) increased its stake in SMIC's H shares from 4.79% to 9.25%.

On January 2, information from the Hong Kong Stock Exchange showed that the National Integrated Circuit Industry Investment Fund Co., Ltd. (hereinafter referred to as the National Integrated Circuit Fund) increased its shareholding in SMIC's H shares from 4.79% to 9.25% on December 29. Previously, SMIC announced that the National Integrated Circuit Fund's shareholding would exceed 5%.

LandSpace's IPO application on the Science and Technology Innovation Board has been accepted, with a planned fundraising of 7.5 billion yuan.

According to the Shanghai Stock Exchange website, the IPO application status of LandSpace Technology Co., Ltd. on the Science and Technology Innovation Board has changed to "accepted," with the company planning to raise 7.5 billion yuan. According to the company's prospectus (draft), LandSpace is primarily engaged in the research, development, production, and provision of commercial aerospace products and services for liquid oxygen-methane engines and launch vehicles. Rocket Launch Services is committed to building a complete industrial chain encompassing "research and development, manufacturing, testing, and launch" centered on medium-to-large reusable liquid oxygen-methane launch vehicles, creating a comprehensive technology complex in the aerospace field, and becoming a world-class commercial aerospace enterprise.

This year's delivery target is 550,000 vehicles! Lei Jun's live stream trended on social media as he responded to accusations of "small-print marketing" and being dubbed the "Green Belt God of War."

Lei Jun, founder, chairman, and CEO of Xiaomi, conducted his first live stream of 2026 on the evening of January 3rd. The live stream, primarily featuring engineers disassembling the new Xiaomi YU7, addressed online rumors, directly confronted market concerns about automotive technology and safety, and lasted over four hours, sparking widespread discussion online. The hashtag "#LeiJunLiveStream" trended on Weibo . The live stream also included responses to online rumors, addressing concerns about automotive technology and safety. It ranked fourth on the trending topics list.

Sold out in seconds! The 1499 yuan Feitian i-Moutai was released for sale with multiple restocks every 5 minutes, and all orders were sold out instantly.

The 1499 yuan Feitian Moutai on the iMoutai APP sold out instantly, and multiple restocks were also sold out. At 9:00 AM on January 1, 2026, the 53-degree/500ml bottle of 2026 Feitian Moutai (hereinafter referred to as "New Feitian") officially went on sale on the iMoutai APP, priced at 1499 yuan per bottle. Each user can purchase a maximum of 12 bottles per day.

The Shanghai Stock Exchange issued a regulatory letter to Tianpu Co., Ltd. for suspected information disclosure violations.

On December 31, the Shanghai Stock Exchange issued a regulatory letter regarding Ningbo Tianpu Rubber Technology Co., Ltd.'s suspected violations of information disclosure regulations. The letter involved the listed company, its directors, senior management, controlling shareholders, and actual controllers.

Breaking news! BLT is under investigation by the China Securities Regulatory Commission! Several previously high-flying commercial aerospace concept stocks have run into trouble.

On the evening of December 31st, BLT The announcement stated that on December 31, 2025, the company received a "Notice of Case Filing" from the China Securities Regulatory Commission (CSRC). The CSRC decided to initiate an investigation into the company due to suspected violations of information disclosure regulations. Currently, the company's various production and operation activities are proceeding normally, and the aforementioned matter will not have a significant impact on the company's operations and management.

Baidu: Plans to spin off Kunlun Chip business and IPO in Hong Kong

Baidu announced on the Hong Kong Stock Exchange that on January 1, Kunlun Core, through its joint sponsors, confidentially submitted a listing application form to the Hong Kong Stock Exchange, seeking approval for the listing and trading of Kunlun Core shares on the Main Board of the Hong Kong Stock Exchange. The current proposal is for the spin-off to be conducted through a global offering of Kunlun Core shares.

Biren Technology debuted on the Hong Kong Stock Exchange on the first day of the new year, with its market capitalization exceeding HK$100 billion at its peak.

On January 2, 2026, the first trading day of the year saw a strong start for Hong Kong stocks, with Shanghai Biren Technology Co., Ltd. (hereinafter referred to as Biren Technology ) officially listing on the Hong Kong Stock Exchange, becoming the "first domestic GPU stock in Hong Kong". After opening, Biren Technology's stock price once rose by nearly 120%, with a total market value of over HK$100 billion. By the close, the increase had fallen back to 75.82%, with a total market value of HK$82.571 billion.

BYD: Cumulative sales of new energy vehicles to reach 4.6 million units by 2025, a year-on-year increase of 7.73%.

On January 4th, BYD announced its production and sales report for December 2025. The company sold a total of 4.602 million new energy vehicles in 2025, a year-on-year increase of 7.73%. Passenger vehicle sales reached 4.545 million units, a year-on-year increase of 6.94%, while commercial vehicle sales reached 57,013 units, a year-on-year increase of 161.83%. Pure electric vehicle sales totaled 2.2567 million units, a year-on-year increase of 27.86%, while plug-in hybrid electric vehicle sales totaled 2.29 million units, a year-on-year decrease of 7.91%.

Unitree Technology: The media reports are inaccurate and did not involve any application for the "green channel".

Recently, some media outlets published reports related to Unitree Robotics' IPO (hereinafter referred to as "the Report"), which were widely reprinted by numerous media outlets, online platforms, and self-media. According to a reporter from the Securities Times, Unitree Robotics stated that the content of the Report concerning the dynamics of its IPO process is inconsistent with the facts, and Unitree Robotics has not applied for any "green channel" related matters. The Report misled public perception and has seriously infringed upon Unitree Robotics' legitimate rights and interests. Unitree Robotics has reported the matter to the relevant authorities and urged the relevant parties to retract the false report. Unitree Robotics hereby solemnly declares that it reserves the right to pursue legal action. Currently, Unitree Robotics' IPO process is progressing normally, and relevant progress will be disclosed in accordance with laws and regulations. We thank the public for their concern and support for the company.