Lauren Taylor Wolfe, co-founder of investment firm Impactive Capital, warned on Tuesday that the situation surrounding artificial intelligence... The surge in enthusiasm for (AI) exhibits all the characteristics of a bubble.

In a recent interview, she stated, " We are absolutely in the midst of an AI bubble right now. It will burst. I don't know when it will burst, or how big it will be. A lot of people will lose money."

Wolf made these remarks as enthusiasm for artificial intelligence continued to drive the market higher, with investors betting that the technology would transform industries and boost corporate profits. Wolf stated that investors are underestimating the risks posed by the surge in AI-related spending by major technology companies.

“Compared to the hundreds of billions of dollars in free cash flow generated by the Big Seven tech giants, trillions of dollars are earmarked for AI-related spending. They will have to borrow money to invest in all of these capital expenditures, and we haven’t seen a return on investment yet,” she added.

Some analysts even believe that the S&P 500 has almost become an artificial intelligence index. Wolf argues that the mismatch between capital expenditures and profit potential makes it difficult to justify current valuations.

“Tell me how many trillions of dollars in profits will be generated in the next five years? They simply can’t do that. That kind of math doesn’t work,” she said.

Wolf also noted that the current environment is reminiscent of the late 1990s, when investors chased anything related to the internet regardless of valuation or business model. She pointed out that in the internet age, the right approach is not to short "bubble companies," but to focus on what others are not paying attention to.

"Owning a railway company in 2000 was better than buying Cisco at a P/E ratio of 35." "Okay. So what we're doing today is looking for our railroad," she said.

Coincidentally, JonesTrading's chief market strategist, Michael O'Rourke, recently stated, "I absolutely believe we are in the midst of an AI bubble." He cited recent mega-deals in the tech sector as an example of how overheated the market has become.

He highlighted Google's $15 billion data center. The project and OpenAI's approximately $1.5 trillion AI infrastructure plan were highlighted, noting the stark contrast between the company's $13 billion in annual revenue and its lack of profitability.

"This is where investors should recognize the disconnect," he pointed out.

He added that the next round of earnings reports from major tech companies may reveal whether spending on AI infrastructure has finally "hit a wall."

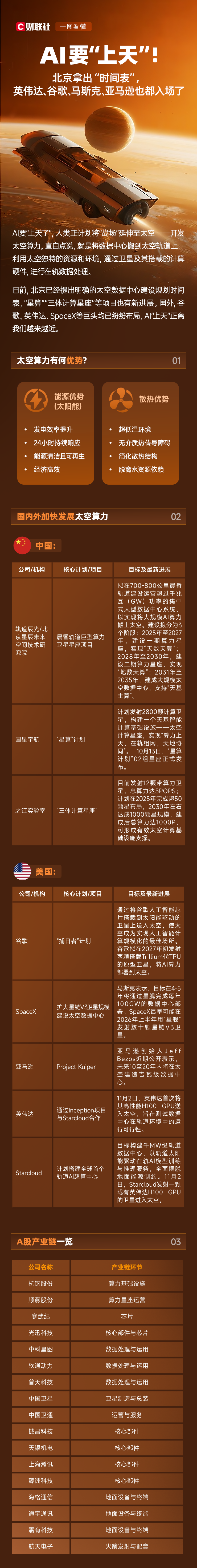

(Article source: CLS)