① Wall Street heavyweights and tech giant executives warned of an AI bubble, leading to a sell-off of AI-related stocks and impacting the upward trend of US stocks; ② Market experts suggested paying attention to the "gold/platinum ratio" indicator, which suggests that US stocks may experience a 16% drop within the next year.

As more and more Wall Street heavyweights, tech giant executives, and other industry insiders become aware of artificial intelligence Warning signs of an AI bubble have emerged, and the market no longer seems as confident in AI as it once was, as evidenced by last week's sell-off that swept the entire industry.

As we all know, the current bull market in US stocks is almost entirely supported by the AI boom. Therefore, when confidence in the AI field shows signs of collapse, investors are undoubtedly most concerned about the future of the broader US stock market. Some market experts suggest that investors take a look at a market indicator that is rarely paid attention to - the "gold-platinum ratio".

Data shows that this leading indicator is weakening rapidly. Historically, this could mean a "bloodbath correction" for US stocks within the next year, with a potential drop of up to 16%.

The gold/platinum ratio, discovered by Darien Huang, former finance professor at Cornell University, and Mete Kilic, finance professor at the University of Southern California, is a new tool for determining short-term buying and selling opportunities. Their 2019 study published in the *Journal of Financial Economics* found a close correlation between the gold/platinum ratio and future stock market performance.

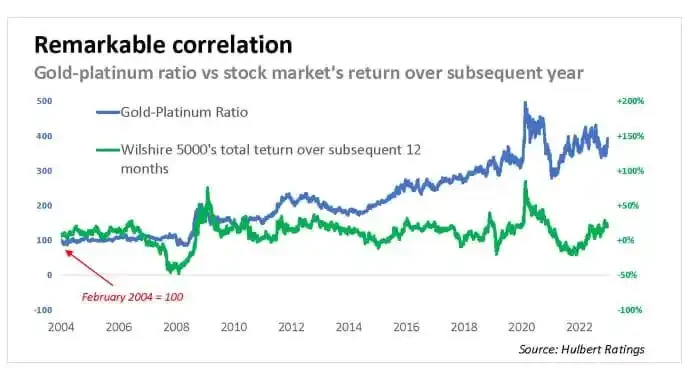

They pointed out that over the past 20 years, the gold-to-platinum ratio has shown an impressive positive correlation with stock market performance. The chart below shows that when the gold-to-platinum ratio is trending upward, the stock market tends to rise, and vice versa. Researchers found that this ratio "outperforms almost all existing return forecasting metrics" when predicting market returns over the following 12 months.

In his latest article, Mark Hulbert, a columnist for the well-known financial media outlet MarketWatch, pointed out that this ratio dropped by nearly 40% from its high in April to its low in July. Historically, in the year following such a sharp drop in the ratio, US stocks often experience double-digit drawdowns, typically around 16%.

Why is this ratio a reliable timing indicator? Hulbert explains that while gold prices are related to economic and geopolitical risks, platinum primarily reacts only to economic fundamentals, particularly demand related to manufacturing and automobiles.

"Therefore, when this ratio declines as it did earlier this year, it signifies a decrease in geopolitical risk. In turn, this means the stock market doesn't need such high expected future returns to compensate investors for their risk. In this environment, if fundamentals and earnings expansion fail to keep pace with valuation expansion, stock prices are more likely to face a pullback," he wrote.

Of course, the gold/platinum ratio isn't always accurate. Furthermore, it cannot predict when the stock market will begin to decline within the next 12 months. According to research, one possibility is that the stock market may continue to rise for several months before a crash; another possibility is that the stock market will experience a period of steady decline lasting several months.

But Hulbert emphasized that regardless of the trend, the fact that the gold/platinum ratio—an academically recognized market timing indicator—has experienced one of its most dramatic and largest drops in history is not good news.

(Article source: CLS)