Porsche, once known as a "money-printing machine" for luxury cars, has entered its darkest hour.

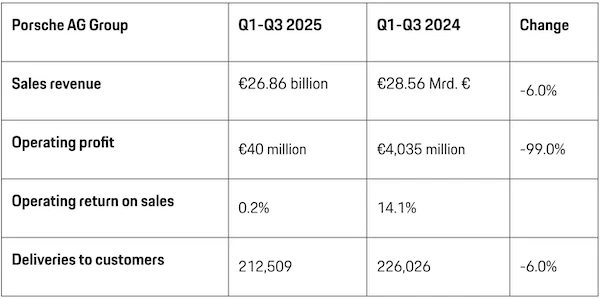

Porsche recently released its financial data for the first three quarters of 2025. The data shows that in the first three quarters of this year, Porsche's revenue declined by 6% year-on-year to €26.864 billion; operating profit declined by 99% year-on-year to €40 million, compared to €4.035 billion in the same period last year; and the operating profit margin was 0.2%, a sharp drop from 14.1% in the same period last year.

Looking back at 2020-2023, Porsche's operating profit defied the pandemic and steadily increased, reaching €4.2 billion, €5.3 billion, €6.8 billion, and €7.3 billion respectively. At its peak in 2023, Porsche's operating profit margin reached 18%, earning it the nickname "money-printing machine" among luxury car manufacturers.

In just two years, Porsche's business has taken a sharp turn for the worse. In 2024, its operating profit fell to 5.6 billion euros, a year-on-year decline of more than 23%, and in the first three quarters of this year, it plummeted by 99%.

Regarding the unusually sharp drop in operating profit this year, Porsche's official website indicates five main reasons: firstly, special expenses related to product strategy adjustments; secondly, the challenging market environment in China, especially for luxury goods. The car track; thirdly, the battery The expenses include: 1) “one-time” expenses related to the event; 2) organizational change expenses; and 3) expenses related to increased U.S. import tariffs.

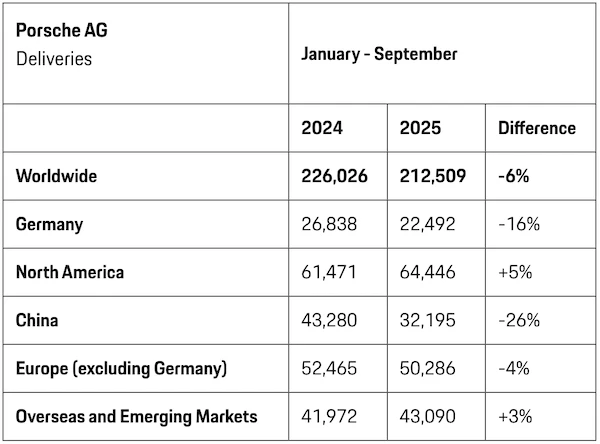

In terms of sales, Porsche saw a year-on-year decline in both the Chinese and European markets in the first three quarters of this year. The Chinese market experienced the largest drop, declining by 26% to 32,000 units, while sales in Germany fell by 16% to 22,500 units. Sales in the entire European market (excluding Germany) declined by 4% to 50,000 units. These declines in key markets resulted in an overall 6% drop in Porsche's sales for the first three quarters of the year, to 212,500 units.

Regarding non-recurring gains and losses, Porsche incurred approximately €2.7 billion in special expenses related to its strategic restructuring in the first nine months of 2025. In addition, the impact of US import tariffs resulted in several hundred million euros in additional costs. Porsche expects total costs related to the strategic restructuring to reach approximately €3.1 billion in fiscal year 2025.

The so-called strategic restructuring refers to the adjustment of Porsche's electric and gasoline product plans. In late September of this year, Porsche announced a major shift in its electric vehicle strategy, slowing down its electrification process and planning to launch more gasoline and plug-in hybrid models in the future.

With electrification goals temporarily put on hold, Porsche's development plan for a new electric vehicle platform, originally scheduled for the 2030s, will be readjusted—the platform will be restructured in collaboration with other brands within the Volkswagen Group.

In addition, according to foreign media reports, Porsche revealed in its third-quarter earnings call that three models will be discontinued as part of a product strategy adjustment, including the best-selling gasoline-powered Macan, as well as the existing 718 Boxster and Cayman.

In addition to adjusting its product strategy, Porsche is also taking multiple measures to overcome its current operational difficulties.

In response to the impact of tariffs, Porsche plans to raise prices in the U.S. market to ensure reasonable profit margins.

Previously, Porsche had also announced a layoff plan to cut 1,900 jobs by 2029. During this earnings call, Porsche also revealed that it initiated a new round of consultations between management and employee representatives in October, and the company promised to promptly inform the public of the discussion results after the confidential meetings concluded.

Just days before its financial report was released, Porsche announced a change in leadership. Current CEO Jürgen Obermüller will step down at the end of the year, and Michael Leiters will succeed him as CEO, effective January 1, 2026. Obermüller served as Porsche CEO from October 2015 and succeeded Herbert Diess as head of the Volkswagen Group in September 2022, initiating a "dual CEO" model that simultaneously led two giant corporations. This model has been highly controversial over the past three years.

Porsche CFO Jochen Breckner stated, "We have further clarified our strategic direction and are now firmly implementing our clear decisions. We expect 2025 to be Porsche's performance low point, with significant improvement expected from 2026 onwards."

As of the close of trading on October 24, Porsche's share price was €34.81, a drop of nearly 58% compared to its IPO price of €82.50 in 2022.

(Article source: CBN)