On October 29th local time, Nvidia Nvidia's stock price surged, closing at $207.04, with a total market capitalization of $5.03 trillion, an increase of $146 billion (approximately RMB 1,036.381 billion) overnight.

Nvidia 's total market capitalization jumped from $4 trillion to $5 trillion in just 113 days, while it took 410 days to go from $3 trillion to $4 trillion. This $5 trillion market capitalization already surpasses the total market capitalization of the stock markets in countries like the UK, France, and Germany, and is approaching the total value of the Indian stock market ($5.3 trillion).

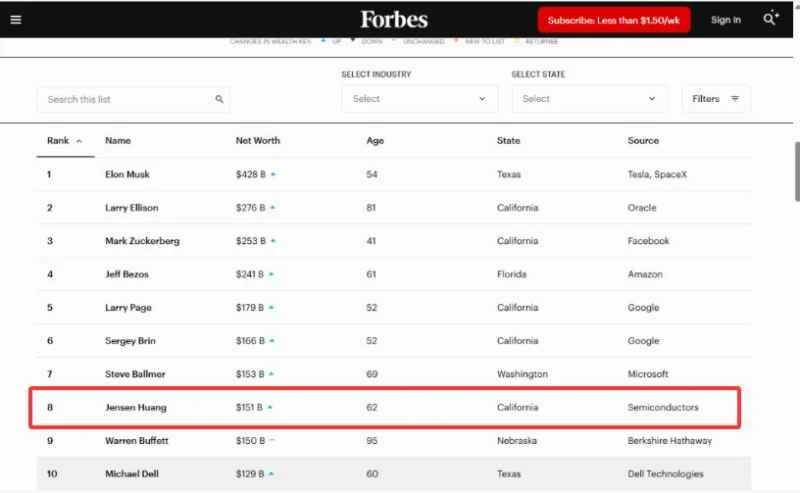

With the surge in Nvidia's stock price, Forbes' real-time billionaires list shows that Jensen Huang's personal wealth has risen to eighth place on the Forbes list.

Image source: Forbes Rich List

A netizen shared a screenshot on the social media platform X showing that Nvidia's market value once exceeded $5.1 trillion, and Tesla... CEO Elon Musk also expressed his admiration.

On the morning of October 29th, Beijing time, NVIDIA held its GTC conference in the US capital, where CEO Jensen Huang took the stage to discuss the cutting-edge prospects of the AI industry.

Unlike previous press conferences with a clear focus, Huang's speech this time covered a wide range of topics, including 6G, quantum computing, physical AI, and robotics , which are currently being hyped by global capital markets. It has a place in nuclear fusion and autonomous driving.

At the press conference, Jensen Huang stated that Blackwell and the next generation of Rubin chips are driving the company into an unprecedented sales growth cycle. Huang also refuted claims about artificial intelligence. Concerns about a market bubble have emerged, with the company's latest generation of chips projected to generate up to $500 billion in revenue in the coming quarters.

Goldman Sachs, a Wall Street financial giant The latest research report points out that the $500 billion figure is significantly higher than Wall Street's expectations.

The bank's analysis team pointed out that this target is 12% higher than the $447 billion consensus reflected in the market through Visible Alpha Consensus Data, and also 10% higher than Goldman Sachs' forecast of $453 billion.

Daily Economic News, based on publicly available information

Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Investors should make their own decisions and bear their own risks.

(Source: Daily Economic News)