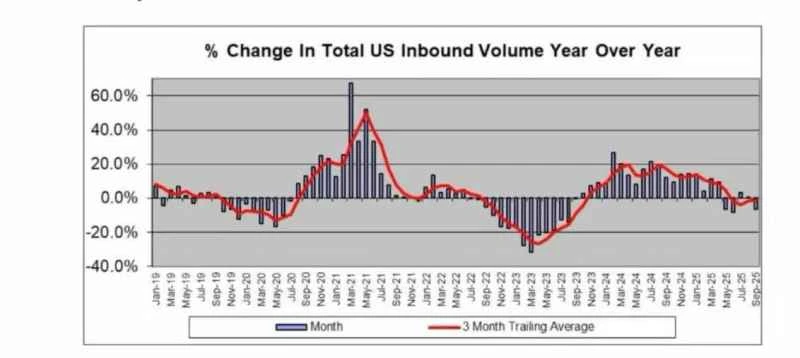

At the end of October, data on US container throughput were released one after another, showing that US container imports continued to decline year-on-year in September.

Data from supply chain technology and data provider Descartes shows that U.S. container cargo imports fell 8.4% year-on-year in September to 230.8 TEUs, the largest monthly drop in recent years, affected by the Trump administration’s global tariff policies.

Data from the major industry report, "The McCown Report on the Top 10 U.S. Ports," also shows that in September, the import container throughput of the top 10 U.S. ports fell by 6.6% year-on-year, a stark contrast to the trend in previous months. John McCown, the industry analyst and author of the report, predicts that the "continued and more significant" downward trend will continue until 2026.

Descartes attributed the decline in imports in September to a combination of weak seasonal demand and cautious sentiment related to tariffs.

Trade experts and shipping professionals interviewed by CBN reporters also believe that the volatility caused by tariffs and weak domestic demand in the United States are the main reasons for the current sluggish throughput at US ports.

Yan Guangpu, an anti-dumping financial expert at Daoyue Legal Consulting, told CBN reporters that, based on feedback from a large number of foreign trade businesses, in addition to tariffs, inflation has indeed led to a decline in domestic demand in the United States; in short, "American consumption power is declining."

Tariff factors led to a rush to Hong Kong in the first two months.

For example, the Port of Oakland, the third largest container port on the U.S. West Coast, saw its imports of empty containers decrease by 12.8% year-on-year in September, while its exports of loaded containers decreased by 3.5%.

The National Retail Federation (NRF) projects that import cargo volumes at major U.S. ports will decline by 5.6% in 2025 compared to 2024 due to the new tariffs. The federation also expects monthly import volumes at major U.S. container ports to fall below 2 million TEUs for the remainder of the year, as most holiday goods are delivered earlier than usual and tariffs continue to rise.

“The peak sales season is over, mainly because retailers imported large quantities of goods in advance before the so-called ‘reciprocal tariffs’ took effect,” said Gold, NRF’s vice president in charge of supply chain and customs policy.

More industry tariffs are set to take effect in the future. The NRF cited examples including a 25% tariff on all upholstered furniture (regardless of country of origin) and the same tariff on cabinets and bathroom vanities, which will be increased in January next year.

"The continued volatility in U.S. tariff policy is creating enormous economic uncertainty," said Hackett, founder of Hackett Consulting, who assisted the NRF in writing the report.

The Drewry East-West Contract Freight Index, which reflects market demand, fell 3% in the 12 months ending in September, marking its first year-on-year decline since July 2024. The index aggregates freight rates from companies including Walmart . The average contract freight rate paid by more than 100 multinational freight companies, including retailers, on 17 major shipping routes.

A veteran in the maritime logistics industry on the US West Coast told CBN reporters that some tariff policies had a very short window between announcement and implementation. Shipping, logistics, customs brokerage, and shippers were constantly refreshing the US Customs website. The hasty changes caused great trouble for all parties in terms of pricing, so shippers and importers are generally quite cautious now.

He also told reporters that many small and medium-sized retailers in the United States are currently troubled by tariff policies. A large amount of cash flow is tied up in order to pay tariffs, and financial difficulties are real. Data shows that the overall volume of imports in the United States is largely contributed by large retailers, but small and medium-sized importers are very sensitive to tariff policies.

The data from the McCown report also shows that the decline in container imports at the top 10 U.S. ports in September occurred after a slight increase of 0.2% in August and 3.2% in July.

McCown stated that the growth in these two periods "was primarily due to advance loading to get goods into ports before the new tariffs took effect." Prior to these temporary increases, the throughput of the aforementioned 10 major ports declined by 8.3% and 6.6% in June and May, respectively.

In fact, the revised "reciprocal tariffs" that took effect on August 7 included a key exemption clause for goods already in transit, which temporarily mitigated the impact.

McCown explained, “If containers are loaded at their last foreign port of call before August 7 and enter the United States before October 5, the new tariffs will not apply.” This grace period means that most cargo arriving in August, as well as some cargo arriving in September, particularly long-haul routes from Asia to the U.S. East Coast, have avoided the impact of the new tariffs.

McCown also warned in the report that "if the current tariff policy is not adjusted, the volume of U.S. imported containers will continue to decline year-on-year for a long period of time next year, and more significantly."

A further significant decline is expected.

In 2024, the total volume of inbound freight to the United States increased by 15.2% compared to 2023. However, as mentioned above, the NRF predicts that the total volume of inbound containers in 2025 will decrease compared to 2024. The association expects freight volume in the last four months of 2025 to decrease by 15.7% compared to the same period in 2024.

McCown believes this prediction is reasonable, stating, "In the coming months, we will soon see a continued double-digit percentage decline in cargo volumes at most U.S. ports, and this sharp drop in cargo volumes will not end by the end of 2025 but will continue into 2026."

McCown also observed that global supply chains are adjusting faster than expected. He stated, "If a manufacturing site was previously considered unattractive because of 10% higher costs, it now becomes very attractive if it can save 25% on tariffs."

McCown said that manufacturers in countries facing high U.S. tariffs "may now find other tariff-free markets relatively more attractive."

This shift is already evident in global data. Despite a decline in U.S. container throughput, global container throughput has hit record highs for two consecutive months as of August.

The McCown report shows that container exports from the Far East increased by 4.6% year-on-year in August, while "container imports to Africa, the Middle East/India and Europe all increased significantly and are trending upward, while container throughput in the United States remained sluggish or even declined."

Meanwhile, exports to the US from various regions have slowed. Data from Descartes shows that imports from countries such as South Korea, Germany, and Italy also declined year-on-year in September. At the same time, some Southeast Asian and South Asian countries have expanded their market share, with imports from Indonesia, Thailand, Vietnam, and India all increasing; however, month-on-month data shows that trade momentum in Asia has slowed almost across the board.

Yan Guangpu told CBN reporters that if the US maintains strong sales and consumption momentum , entrepot trade can still be profitable. For example, in previous years when the US economy was doing well, traders who adopted similar strategies achieved very good profits. However, this year is different from previous years. In addition, the US is currently experiencing a significant shift towards consumption downgrading, and the overall trade ecosystem has been enriched by cross-border e-commerce. The overall situation is more complex.

Currently, the US is experiencing persistently high inflation and its manufacturing PMI has contracted for five consecutive months. (S&P Global) Data shows that the US composite PMI hit its lowest level since February this year in September, with consumers curbing spending under pressure from high prices and borrowing costs, directly dragging down container freight demand from Asia.

On October 30, Federal Reserve Chairman Jerome Powell stated that the base case expectation is that the additional tariffs will lead to inflation, potentially causing the inflation rate to rise by another 0.2, 0.3, or 0.4 percentage points, but this should be a one-off effect. He also indicated that it will take some time for the tariffs to be passed on to consumers.

According to estimates from the Yale Budget Lab, all tariffs imposed by the Trump administration in October, extending into 2025, will cause a short-term price increase of 1.7%, equivalent to a loss of $2,400 in income for the average American household in 2025.

(Article source: CBN)