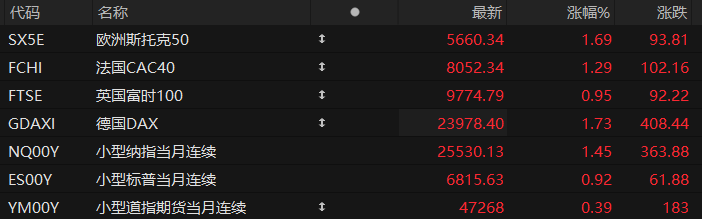

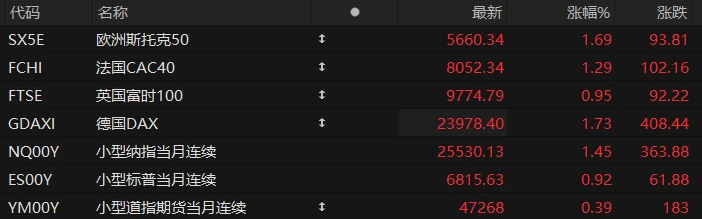

U.S. stock index futures rose across the board in pre-market trading on Monday, while major European indices also generally gained. As of press time, the Nasdaq... S&P 500 futures rose 1.45%, S&P 500 futures rose 0.92%, and Dow Jones futures rose 0.39%.

In terms of individual stocks, Nvidia The "Big Seven" tech stocks led the pre-market gains, rising over 3%. Cryptocurrency-related stocks also rose, with IREN up 6.8%, Bitfarms up 5.5%, Circle Internet Group up 3.8%, and Bullish... It rose 4.7%, and Coinbase rose 2.9%.

US stock futures, gold, and silver all rose, while safe-haven assets such as US Treasury bonds and the Japanese yen fell. Bitcoin rose more than 4%, and Ethereum rose more than 5%. Spot gold broke through $4,100 per ounce for the first time since October 27, rising 2.6% on the day. Spot silver rose more than 3.7% to $50.12 per ounce.

US media reported on November 9 that the US Senate has reached an agreement to end the federal government shutdown. According to CCTV News, on the evening of November 9, local time, as the US federal government shutdown had lasted 40 days, US President Trump told the media upon returning to the White House, "It looks like we're very close to ending the shutdown."

Deutsche Bank Jim Reed stated, "Once the government reopens, the market will face a large amount of delayed data releases. The historical precedent of the 2013 government shutdown suggests that the September jobs report may be one of the earliest to be released, possibly within three business days of the government reopening." (UBS Group) Paul Donovan stated, "Normally, when a shutdown ends, the economy rebounds to make up for the drag on growth during the shutdown, but this time it could cause more lasting damage."

Hot News

Is the US stock market about to undergo a dramatic shift within a year? This leading indicator has already sounded the alarm.

As more and more Wall Street heavyweights, tech giant executives, and other industry insiders become aware of artificial intelligence Warning signs of an AI bubble have emerged, and the market no longer seems as confident in AI as it once was, as evidenced by last week's sell-off that swept the entire industry.

As we all know, the current bull market in US stocks is almost entirely supported by the AI boom. Therefore, when confidence in the AI field shows signs of collapse, investors are undoubtedly most concerned about the future of the broader US stock market. Some market experts suggest that investors take a look at a market indicator that is rarely paid attention to - the "gold-platinum ratio".

Data shows that this leading indicator is weakening rapidly. Historically, this could mean a "bloodbath correction" for US stocks within the next year, with a potential drop of up to 16%. Mark Hulbert, a columnist for the well-known financial media outlet MarketWatch, pointed out in a recent article that this ratio has fallen by nearly 40% from its high in April to its low in July. Historically, in the year following such a sharp drop in the ratio, US stocks often experience double-digit pullbacks, typically around 16%.

Morgan Stanley's Wilson remains bullish: Strong earnings support further upside potential for US stocks in 2026.

Despite the risks that US stocks have faced this year, such as trade tensions and government shutdowns, Morgan Stanley... Wall Street institutions remain bullish, believing that strong corporate earnings growth will drive the stock market up in 2026, while uncertainty about the interest rate outlook and policy disruptions are only short-term headwinds.

On November 10, according to media reports, Morgan Stanley strategist Michael Wilson pointed out that there are "clear signs" that corporate profits are recovering and that U.S. companies are enjoying better pricing power. He also noted that earnings forecast revisions have bottomed out, meaning that the number of analysts lowering their forecasts relative to the number of raising them has reached an inflection point.

In his research report, Wilson stated that while the Federal Reserve's policy guidance and the government shutdown have put pressure on stock prices recently, these are temporary obstacles on the road to a robust rally driven by earnings growth in 2026. The S&P 500 is still up 14% this year and is on track for its third consecutive year of growth.

Meanwhile, this earnings season has far exceeded expectations, according to Bloomberg. According to data from the National Bureau of Statistics, S&P 500 companies saw their third-quarter profits grow by nearly 15%. Several investment bank strategists expect technology companies to once again drive most of U.S. earnings growth next year, with UBS predicting the S&P 500 will reach a record 7,500 points by the end of 2026, an increase of more than 11% from current levels.

Emerging from Trump's shadow, dollar volatility falls to its lowest level before the election.

The foreign exchange market has recovered from the sharp fluctuations caused by the "Trump shock" at the beginning of the year, with the dollar volatility index falling back to pre-US presidential election levels. This indicates a significant easing of investor concerns about the uncertainty of Trump's policies, and the market is returning to traditional driving factors.

Data from CME Group shows that an index measuring expected volatility in the dollar against the euro and yen fell to its lowest level in more than a year this month, after surging sharply following Trump's election last November. Meanwhile, the dollar index has recovered most of its losses for the year, approaching levels seen before Trump's victory.

Analysts believe that a series of tariff agreements reached between the US and major trading partners such as the EU and China have reduced market volatility, and the US economy has withstood the tariff shock better than expected. Market participants say investors have learned to view policy headlines rationally and are no longer overreacting. Chris Turner, head of market research at ING, noted, "The world is learning to coexist with Trump, and investors have learned to treat headlines with a calm attitude."

The global central bank interest rate-cutting cycle is nearing its end, eliminating another factor of market instability. Analysts say this shift means the dollar is regaining its role as a traditional safe-haven asset and portfolio stabilizer. The dollar, which previously plummeted in tandem with risk assets following Trump's tariff announcement in April, is now again reacting to traditional factors such as interest rate differentials.

US Stocks Focus

apple satellite internet Strategy Revealed!

In his latest newsletter, well-known leaker Mark Gurman revealed Apple 's satellite internet strategy, which has been in the works for nearly 10 years. He specifically mentioned that the iPhone to be released next year will support 5G NTN (non-terrestrial network) technology, further expanding the user base of this technology.

Gurman revealed that in addition to 5G NTN, Apple is developing several satellite features: including building APIs for third-party developers to access satellite communications; enabling its own Maps app to connect to satellite, allowing iPhones to navigate without cellular networks; and an enhanced satellite messaging feature that supports sending images in addition to text messages.

Apple was prepared to provide funding for a significant upgrade to GlobalStar to roll out all these features. The facilities. But now a key variable has emerged: GlobalStar is seeking a sale, and satellite internet giant SpaceX is the most likely buyer.

Storage giants surge to new highs! Price hike cycle ignites Goldman Sachs SanDisk doubled its price increase Target price

Memory chip stocks have increased fivefold in the past two months SanDisk shares continued to rise in pre-market trading on Monday, poised to hit a new all-time high of $250 during the day. Rumors of a significant price increase, coupled with Goldman Sachs doubling its target price, further fueled market sentiment. Following SanDisk 's lead, Seagate Technology... Micron Technology Both stocks surged significantly in pre-market trading on Monday and are expected to hit new all-time highs today.

According to supply chain sources, SanDisk's NAND flash memory has become one of the most sought-after commodities in the technology sector. Due to the company's 50% price increase for flash memory contracts in November, several storage module manufacturers, including Transcend, InnoDisk, and Apacer, have suspended shipments to reassess their product pricing. Transcend, in particular, has suspended quoting and shipping since November 7th, anticipating that the flash memory shortage will continue and prices may continue to rise.

Meanwhile, a report titled "SanDisk: Supply Shortage Continues to Worsen, Driving Significant Model Leverage," authored by Goldman Sachs analysts James Schneider et al., also attracted attention in the capital markets. Goldman Sachs raised its earnings per share forecasts for SanDisk for fiscal years 2025-2027 by 69.2%, 83.6%, and 85%, respectively, while also raising its 12-month price target for the company from $140 to $280.

shell The company released its third-quarter results, reporting a net profit of 747 million yuan, a year-on-year decrease of 36.1%.

Beike announced its Q3 2025 results, with total transaction value of RMB 736.7 billion (US$103.5 billion), essentially flat year-over-year. Existing home sales totaled RMB 505.6 billion (US$71 billion), up 5.8% year-over-year. New home sales totaled RMB 196.3 billion (US$27.6 billion), down 13.7% year-over-year. Net revenue was RMB 23.1 billion (US$3.2 billion), up 2.1% year-over-year.

Net profit was RMB 747 million (US$105 million), a decrease of 36.1% year-on-year. Adjusted net profit was RMB 1.286 billion (US$181 million), a decrease of 27.8% year-on-year. The number of stores as of September 30, 2025 was 61,393, an increase of 27.3% year-on-year. The number of active stores as of September 30, 2025 was 59,012, an increase of 25.9% year-on-year.

Will ordinary people be able to invest in unlisted AI giants? Robinhood, the "home base for retail investors," has a new plan.

Robinhood, a well-known brokerage firm extremely popular among retail investors in the United States, is reportedly planning to open a channel for amateur investors to invest in unlisted artificial intelligence companies whose valuations have risen sharply in recent years.

Robinhood CEO Vlad Tenev stated that his focus is on enabling "ordinary people" to participate in the rapid growth of privately held AI companies, rather than worrying about a potential bubble in the sector. " Artificial intelligence will trigger widespread disruption, and we want people to have access to the core forces driving that disruption," he noted. Robinhood currently plans to offer tradable shares of a new fund managed by its subsidiary, Robinhood Ventures, which will invest in a highly concentrated group of five or more "best-in-class" privately held companies—potentially leveraging to enhance returns.

This move by the popular brokerage firm comes at a time when fund managers are seeking to attract smaller investors as a new source of capital for the private market. In August, US President Trump issued an executive order making it easier for employers to include assets such as private equity and private credit in 401(k) retirement plans. Companies including Blue Owl and Blackstone Group... Asset management companies, including Apollo Group, are moving beyond the scope of institutional investors and actively attracting individual investors.

(Article source: Hafu Securities) )