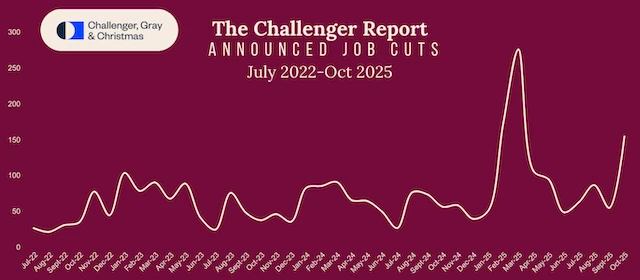

AI AI penetration, weak consumer spending, and rising costs are driving companies to accelerate spending cuts and adjust their workforce structures, rewriting the tense situation in the labor market.

A new report from employment consulting firm Challenger, Gray & Christmas (CGC) shows that U.S. companies announced 153,000 layoffs in October, a surge of 183% month-over-month, marking the highest monthly figure since 2003, and a 175% increase compared to the same period last year. So far this year, U.S. companies have announced approximately 1.1 million layoffs, a 65% increase year-over-year, making it the year with the largest number of layoffs since the pandemic began.

In the report, CGC Senior Vice President Andrew Challenger wrote: "This is the highest number of layoffs in October in more than two decades. Some industries are correcting after the post-pandemic hiring boom, but the proliferation of artificial intelligence, weak consumer and corporate spending, and rising cost pressures are forcing companies to tighten their belts, freeze hiring, or lay off staff."

The technology industry is the hardest hit.

The report shows that the technology, retail, and service industries remain the sectors with the most concentrated layoffs. Among them, the technology industry announced 33,300 layoffs in October, almost six times that of September, making it the sector most affected by AI integration and automation.

Layoffs in the consumer goods industry have increased to 3,400; non-profit organizations impacted by the government shutdown have laid off a total of 27,700 people this year, a staggering 419% increase year-on-year.

Looking at the cumulative figures for the year, the five industries with the most layoffs were government, technology, warehousing, retail, and services, accounting for more than 70% of the total.

Challengers argue that the difficulty for laid-off workers to find new jobs has increased significantly, with "longer job search cycles and fewer job openings." This trend may further loosen the supply-demand balance in the labor market, meaning that the momentum for job growth is weakening.

The report was released as the U.S. government was shut down due to the inability of the two parties in Congress to reach a consensus on the budget, forcing the collection and release of official labor market data to be suspended. This made private sector data, including the CGC report, an important alternative indicator for market observation.

However, analysts caution that the report is highly volatile. Furthermore, earlier this week's ADP employment data showed that the U.S. private sector added 42,000 net jobs in October, reversing two consecutive months of decline, indicating that businesses are maintaining a degree of resilience while cautiously expanding.

Expectations of a Federal Reserve rate cut are rising.

This year's wave of layoffs is closely related to the accelerated application of AI technology. The CGC report states that AI-driven business restructuring is changing the structure of corporate workforce needs, especially in the technology and media industries, where large-scale modeling technology is replacing some jobs, becoming a significant trend in the labor market by 2025.

"The current AI wave is similar to the industry revolution of 2003—a disruptive technology is redefining job requirements," said Andy Challenger, a careers expert at the company. He believes that with new job creation falling to a multi-year low, companies announcing layoffs in the fourth quarter will have a combined impact on consumer spending and economic confidence.

Meanwhile, Federal Reserve Governor Adriana Milan recently stated that current labor demand has not yet reached ideal levels, and he expects the Fed to cut interest rates in December. "Based on the information I have now, I expect we will ultimately cut rates in December," Milan said.

The market expects a 62% chance of the Federal Reserve cutting interest rates by 25 basis points in December. Although Powell's speech last week cooled bets on a rate cut, most institutions believe that if the weak employment situation persists, monetary policy will remain accommodative.

Analysts believe that the combined effects of AI penetration, cooling consumption, and fiscal uncertainty have led businesses to adopt defensive measures, while the prolonged re-employment cycle for laid-off workers may slow the pace of economic recovery. If layoffs accelerate while new job creation remains weak, the resilience of the job market is weakening. In the coming months, the Federal Reserve may have to weigh the economic slowdown against inflation risks once again.

(Article source: CBN)