On Wall Street, the term "Big Short" specifically refers to Michael Burry, who accurately predicted the 2008 subprime mortgage crisis. The 2015 film "The Big Short" was based on his life.

On November 3, Michael Burry's hedge fund Scion Asset Management disclosed its third-quarter holdings report, showing that the fund held put options with a notional value of over $1 billion (accounting for 80% of its total assets), betting on two major AI star stocks— Nvidia. (Nvidia) and data analytics company Palantir.

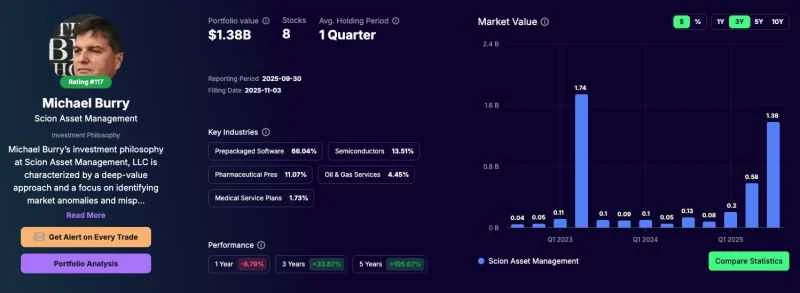

Image source: Gainify, a stock analysis platform

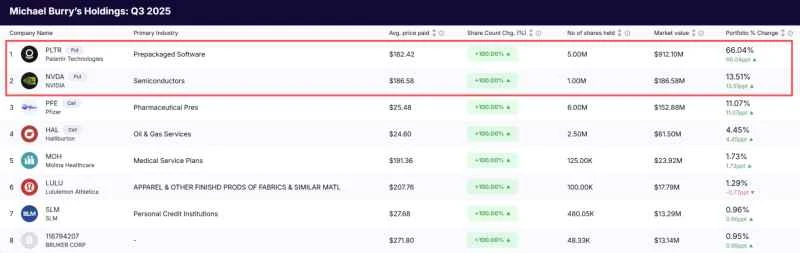

The day after the report was released, Nvidia's stock price fell 3.96%, while Palantir's fell even more sharply, by 7.95%. Over the past four trading days, Nvidia's stock has fallen by a cumulative 9%, wiping out $455.1 billion (approximately RMB 3.24 trillion) in market value.

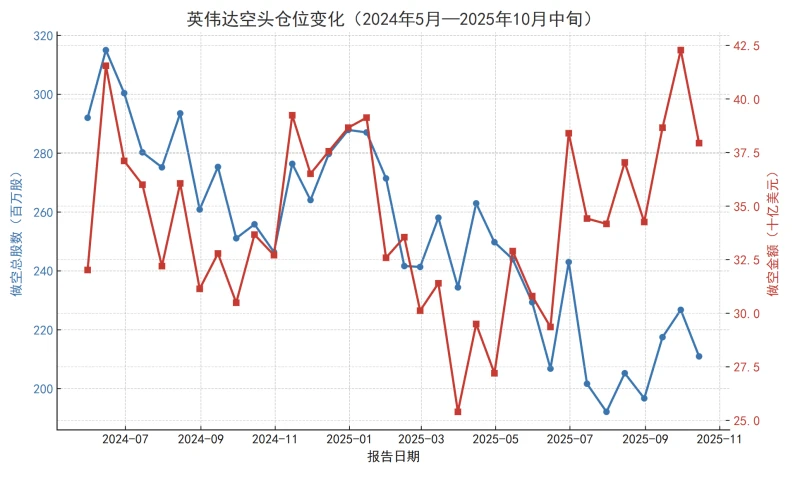

However, data shows that market interest in shorting Nvidia is declining.

In response to the AI bubble, some large investment banks have made a "two-pronged approach" of supporting the AI while simultaneously shorting it.

The "big short" has targeted Nvidia for the second time this year.

Currently, Scion Asset Management has total holdings of approximately $1.38 billion, with the majority of its funds concentrated in put options on Nvidia and Palantir.

As of the end of the third quarter of 2025, the fund held 5 million Palantir put options worth approximately $912 million and 1 million Nvidia put options worth approximately $187 million.

A put option gives the holder the right to sell a stock at a specific price in the future; it is a typical short-selling tool.

This marks the second time this year that Michael Burry has targeted Nvidia.

The fund had established a short position of 900,000 shares of Nvidia worth over $97 million in the first quarter, but these positions had been completely liquidated in its second-quarter report released in August.

Since the position report only discloses the situation at the end of the quarter, there are two extreme possibilities for the profit or loss of Michael Burry's first short position in Nvidia:

● If he had bought put options early in the first quarter and liquidated them before Nvidia's stock price rose in April, he could have made a substantial profit.

● If he had bought put options when Nvidia's stock price was low in the first quarter, and the expiration date was after Nvidia's stock price had risen, he would likely have lost money.

Nvidia's stock performance in 2025: a cumulative decline of 19.29% in Q1 and a cumulative increase of 45.77% in Q2.

Michael Burry's renewed investment in the third quarter reflects his assessment of the risks of an AI bubble. He had already been "pre-empting" this move on social media before disclosing his holdings.

Last week, after nearly two years of silence, he returned to the social media platform X, posting a still from the movie "The Big Short" featuring Christian Bale as himself, with the caption:

"Sometimes we see bubbles. Sometimes we can take action against them. Sometimes, the only way to win is not to get involved."

He then shared several more pictures.

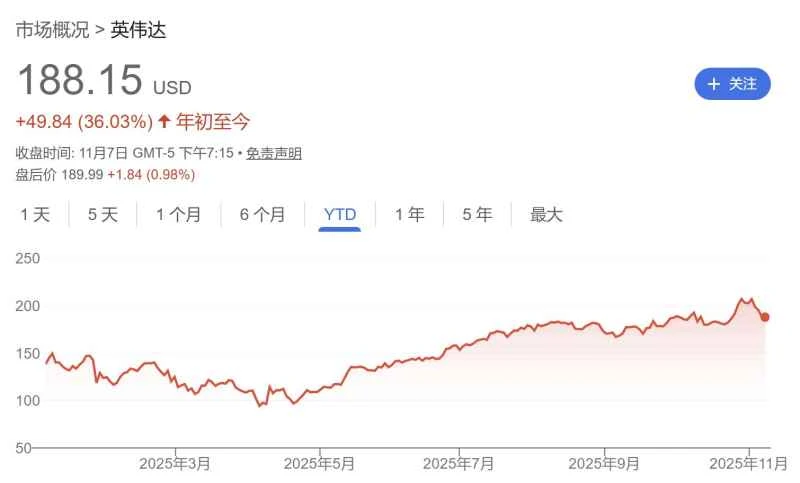

The first chart shows that the current growth level of capital expenditure (Capex) in the U.S. technology industry is comparable to that during the dot-com bubble of 1999-2000.

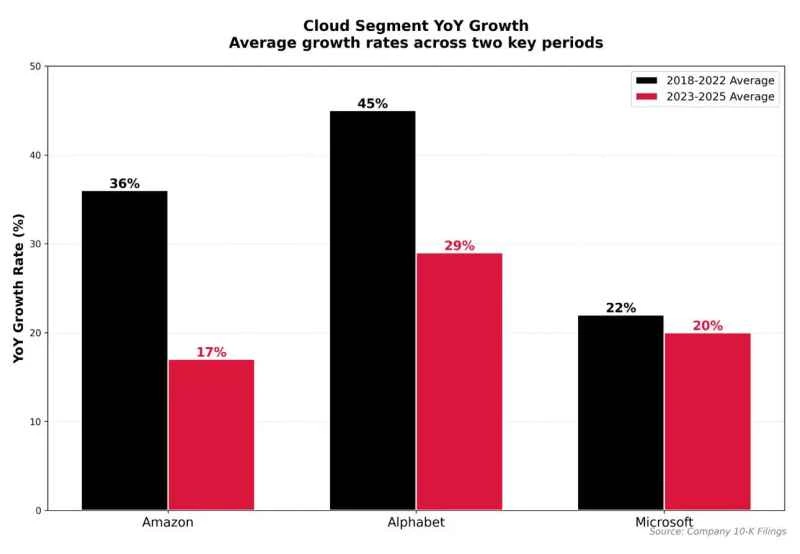

The second chart shows Amazon Alphabet and Microsoft The growth of its cloud business has slowed significantly.

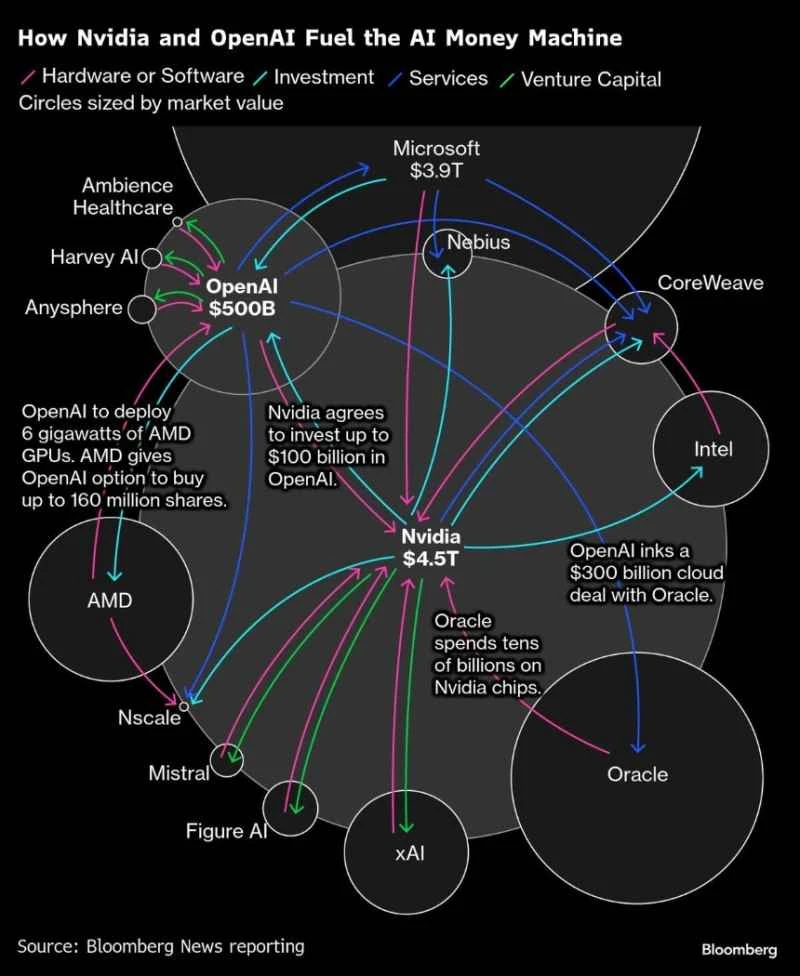

The third one is about "revolving financing" among AI companies such as Nvidia.

Image source: Michael Bury's X account

Michael Burry's short-selling and comments drew fierce backlash from Palantir executives.

In an emotional interview with CNBC, Palantir CEO Alex Karp stated that the two companies shorted by Burry are actually the two most profitable companies in the AI field, calling the behavior "super strange" and even "crazy." Karp emphasized, "Every time they short us, we double down on delivering even better results. To be honest, part of the reason is to make them lose money."

On November 3, Palantir released its third-quarter earnings report. The company's revenue for the quarter was $1.18 billion, a significant year-over-year increase of 63%. According to data compiled by Bloomberg, Palantir's revenue has exceeded analysts' expectations for 21 consecutive quarters. The company also provided strong guidance for the fourth quarter. However, Palantir's stock price fell 11.24% this week, but its year-to-date gain has exceeded 135%, with a market capitalization of $424.1 billion. Analysts suggest that the market is concerned about Palantir's high valuation multiple, with its performance and guidance not matching its valuation, indicating a "sell the news" sentiment in the market.

She successfully shorted the "Wooden Sister" ETF, but suffered a setback with Tesla.

Michael Burry's claim to fame was his foresight of the enormous risks in the U.S. subprime mortgage market between 2005 and 2007, and his subsequent massive short selling that netted him billions of dollars during the 2008 financial crisis. This experience earned him the reputation of a Wall Street "doomsday prophet," and was even featured in the bestselling book "The Big Short" and adapted into a film.

In the second quarter of 2021, Michael Burry shorted Cathy Wood's Ark Innovation ETF (ARKK). Between June 2021 and June 2022, ARKK's stock price plummeted by nearly 70%.

However, the "Big Short's" predictions are not always accurate. In recent years, several of his high-profile forecasts have deviated significantly from reality:

● In the second quarter of 2021, he heavily shorted Tesla , holding over 1 million Tesla put options, but Tesla... The stock price surged against the trend, forcing him to liquidate his entire position and exit the market.

● In early 2023, he issued a single-word warning on social media – “Sell.” The market, however, began a strong rally driven by the AI boom. Two months later, he admitted, “I was wrong to say sell.”

According to statistics, Michael Burry has made many "disastrous" predictions over the past few years. If investors had bought the S&P 500 index after each of his pessimistic pronouncements, they would have made considerable profits.

As some market participants have said, "Spotting a bubble is one thing, and profiting from it is another."

Market interest in shorting Nvidia is declining.

According to Marketbeat, a market data analysis website, from the end of June 2024 to October 15, 2025, Nvidia's short positions decreased from approximately 315 million shares to approximately 211 million shares, a reduction of more than 100 million shares.

From the end of June 2024 to October 15, 2025, Nvidia's short positions decreased by more than 100 million shares (blue line).

This divergence has also raised questions about the timing of Michael Burry's short selling.

Jon Najarian, co-founder of market analysis firm Market Rebellion, analyzed that given that Nvidia and Palantir's stock prices were at high levels for most of the third quarter, the put options Michael Burry disclosed at the end of the quarter are likely already "deeply in the red." According to his calculations, unless both stocks continue to fall significantly from their current prices (Nvidia needs to fall another 7%, and Palantir needs to fall another 5%), Burry's trades will hardly reach the break-even point.

Angelo Zino, a technology analyst at CFRA Research, believes that a correction in tech stocks after their significant gains was to be expected, and Michael Burry's comments may have only exacerbated market anxieties and provided an opportunity for the correction.

Investment banks are "preparing for both scenarios": lending on one hand and short selling on the other.

On November 5, the Monetary Authority of Singapore (MAS) explicitly stated in its annual Financial Stability Review report that some stock markets, particularly the technology and AI sectors, are exhibiting “relatively tight valuations.” The MAS warned that a reversal in market optimism regarding AI’s ability to generate future returns could trigger “a sharp correction in broader stock markets and further defaults in the private credit market.”

On the same day, Deutsche Bank Analyst Jim Reed also stated, " There is a clear risk aversion in the market, as concerns about the high valuations of tech stocks are dampening investor sentiment."

On November 6th, Goldman Sachs Technology, media, and telecommunications (TMT) industry expert Peter Bartlett believes that the asymmetry in earnings reports is prompting investors to reconsider the risk-reward ratio before the end of the year, especially given current portfolio levels and the rapid and sharp rise in certain market sectors in recent months. This negative deviation highlights that at current valuation levels, the risks faced by investors significantly outweigh the potential returns.

In response to the "AI bubble" theory, investment banks are actively participating in AI investments while also preparing hedging tools to mitigate potential risks.

According to the Financial Times, Deutsche Bank 's investment banking... The department has sent a message to the data center. The industry has injected billions of dollars in loans , primarily financing data center operators serving Microsoft , Amazon , and Google. These loans are typically secured by long-term service contracts, providing stable returns.

For example, in recent months, Deutsche Bank has provided debt financing to Sweden's EcoDataCenter and Canada's 5C, which together raised more than $1 billion to fuel their expansion.

Meanwhile, the bank's executives are already discussing how to manage its exposure in the data center and AI sectors.

The bank is reportedly exploring various hedging options, including shorting a portfolio of AI-related stocks to hedge against potential devaluation of its loan assets. Purchasing debt default protection (such as through synthetic risk transfer transactions) is also an option.

This strategy of "lending while shorting" reflects the complex mindset of large financial institutions toward the AI industry: they are unwilling to miss out on the industry's development dividends, but they are also wary of risks such as rapid depreciation of infrastructure and the fact that the profit model has not yet been fully validated.

(Source: Daily Economic News)