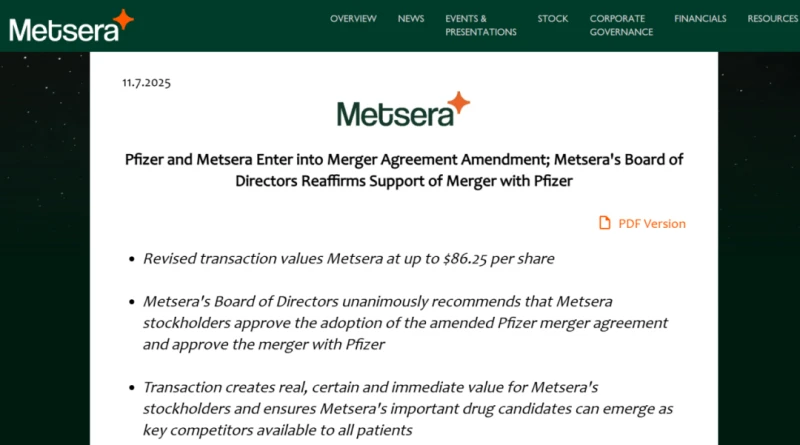

[Introduction] Pfizer An amendment to the merger agreement with Metsera was reached, valuing Metsera at up to $86.25 per share in the revised transaction.

Pfizer and Novo Nordisk The battle for Metsera has seen its latest developments!

On November 7 local time, Metsera announced that it had entered into a revised merger agreement with Pfizer . Under the agreement, Pfizer will acquire Metsera for up to $86.25 per share, including $65.60 in cash and contingent value rights (CVR) per share, with the holder entitled to pay an additional $20.65 in cash per share.

In September of this year, Pfizer made a $7.3 billion takeover bid for Metsera. Recently, Novo Nordisk suddenly entered the fray, offering an even higher price to disrupt the deal, and the two companies immediately began a major business battle.

In its press release, Metsera stated that the proposed transaction by Novo Nordisk would pose "unacceptably high" legal and regulatory risks to Metsera and its shareholders compared to Pfizer.

Metsera's board of directors reiterated its support for the merger with Pfizer.

According to Metsera's official website, Pfizer and Metsera have reached an amendment to their merger agreement, and the Metsera board of directors reiterated its support for the merger with Pfizer.

The revised transaction values Metsera at $86.25 per share, and the Metsera Board of Directors unanimously recommended that Metsera shareholders approve the adoption of the revised Pfizer merger agreement and approve the merger with Pfizer. This transaction creates real, definite, and immediate value for Metsera shareholders and ensures that Metsera's key drug candidates become key competitors for access to all patients.

In terms of price, the $86.25 per share is significantly higher than Pfizer's previous offer of $70 per share, and slightly higher than Novo Nordisk's "better offer" of $86.20 per share. The Metsera board stated that the revised terms represent the best deal for shareholders in terms of both value and the certainty of transaction completion.

Furthermore, given recent developments, including a call from the U.S. Federal Trade Commission regarding the potential risks of proceeding with the proposed Novo Nordisk structure under U.S. antitrust laws, the Metera Board of Directors further determined that the proposed Novo Nordisk transaction would pose unacceptably high legal and regulatory risks to Metera and its shareholders compared to the proposed Pfizer merger, including the risk that the initial dividend may never be paid or may subsequently be challenged or withdrawn.

Metsera remains committed to the merger with Pfizer, believing it will bring direct and substantial value to Metsera shareholders. The two companies expect to close the deal quickly following the shareholders' meeting on November 13.

The Metsera Board of Directors unanimously reaffirmed its recommendation that Metsera common shareholders vote at a special meeting to adopt the revised Pfizer merger agreement and approve the merger with Pfizer in accordance with the terms and conditions set forth in the revised Pfizer merger agreement.

Two giants launch a multi-billion dollar bidding war

Public information shows that Metsera is a " weight loss drug" that has emerged in the pharmaceutical market in recent years. "A rising star." Founded in 2022 and headquartered in New York, the company focuses on developing treatments for obesity and related metabolic diseases, with technology originating from the metabolic disease research team at Imperial College London.

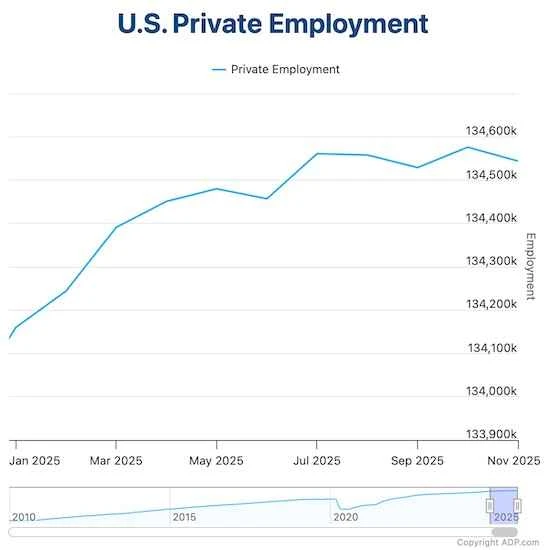

With its disruptive technology platform and differentiated pipeline, Metsera has emerged as one of the most promising challengers in the global metabolic disease field. Following its Series A and Series B funding rounds in 2024, Metsera went public on Nasdaq in January 2025. Metsera went public. As of the closing bell on November 7, Metsera's stock price was $83.18 per share, bringing its total market capitalization to $8.74 billion.

In September of this year, global pharmaceutical giant Pfizer reached an acquisition agreement with Metera to acquire all of the latter's outstanding shares for $47.50 per share in cash, with a total transaction value of up to $7.3 billion. An additional payment of $22.50 per share is linked to specific clinical and regulatory milestones.

It is understood that Pfizer's acquisition of Metsera is intended to address its setbacks in the research and development of weight-loss drugs . Earlier this year, Pfizer terminated development of its independently developed GLP-1 receptor agonist, Danuglipron, due to tolerability issues, and another candidate drug, PF-06954522, was abandoned in August due to safety concerns. Pfizer's acquisition of Metsera aims to quickly enter the weight-loss drug market and compete with Eli Lilly. The "two giants" of the GLP-1 drug field, Novo Nordisk and others.

However, a "spoiler" suddenly emerged in this near-finalized acquisition. At the end of October, Novo Nordisk submitted a competitive offer of $8.5 billion, and on November 4, it raised the acquisition price to a maximum of $10 billion (including $7.2 billion in equity value and $2.8 billion in cash conditional value).

In contrast, Novo Nordisk's offer had a significant competitive advantage. Following Novo Nordisk's involvement, Pfizer announced that it had filed a lawsuit in a Delaware court against Metera, its board of directors, and Novo Nordisk. The lawsuit accused Metera of breaching its obligations under the merger agreement between Pfizer and Metera, constituting breach of fiduciary duty, and willful interference with the contract. On November 5th, local time, the court dismissed Pfizer's request.

According to the Financial Times, citing two sources familiar with the matter, Pfizer submitted a new offer before Wednesday's deadline, raising its bid to match Novo Nordisk's, which allowed Pfizer to remain on the table.

As the two companies clashed, Metsera's stock price soared, rising from approximately $36 per share in September to $83 per share today. However, shareholders still have room for profit compared to Pfizer's acquisition offer.

Everbright Securities The research report previously mentioned that Pfizer's major acquisition, following Eli Lilly and Novo Nordisk, represents another top global pharmaceutical company's ultimate endorsement of the value of the GLP-1 market. This not only confirms the enormous potential and long-term prosperity of the weight-loss drug market, but also highlights the industry's urgent need for and fierce competition in next-generation therapies (such as oral formulations and multi-target drugs). The global GLP-1 R&D race has entered its "second half," where the depth of the industry chain, the ability to iterate technologies, and cost control will become the keys to success.

(Source: China Fund News)