Tech stocks are experiencing increased volatility!

US tech stocks plunged this week, with the Nasdaq, dominated by tech stocks, experiencing a sharp decline. The index fell by more than 3% in a single week, marking its worst week since April.

8 companies related to artificial intelligence The combined market capitalization of closely related leading companies evaporated by over $800 billion (approximately 5.7 trillion yuan) in a single week. Across the entire US stock market, the market capitalization of US companies related to AI lost nearly $1 trillion. Among them, Nvidia alone... One company alone lost nearly $350 billion.

This round of tech stock sell-offs began a few days after Palantir, a government contractor and AI developer, released its earnings report. Market concerns about the company's overvaluation triggered a sharp drop in its stock price, which then spread to its peers. Some analysts point out that the massive capital expenditures related to artificial intelligence , and its increasing reliance on debt financing, have raised concerns about an "AI bubble."

Notably, over the weekend, tech giant Meta was hit with another piece of bad news: it was revealed that the company was making huge profits from a massive amount of fraudulent advertising. Internal documents show that Meta's revenue in 2024 was approximately $16 billion from fraudulent and prohibited product advertisements.

Eight tech giants saw their stock prices plummet by over $800 billion in a single week.

Concerns overvaluation of artificial intelligence companies prompted investors to withdraw from the market, leading to the first weekly decline in three weeks for US stocks. The Nasdaq Composite Index, which closely tracks large-cap tech stocks, fell 3% this week, its worst performance since April; the S&P 500 Index also fell 1.6% this week, ending a three-week winning streak.

The recent downturn in the US stock market was primarily dragged down by artificial intelligence (AI) concept stocks. This week, AI leader Nvidia saw a weekly drop of over 7%, wiping out $348.5 billion in market capitalization; Microsoft... Oracle also fell by more than 4%, wiping out over $150 billion in market value; The stock fell nearly 8%, resulting in a market capitalization loss of over $66 billion; among other AI concept stocks, Palantir fell more than 11%, and Broadcom... Amazon fell more than 5%, Meta fell more than 4%, Google fell 0.84%, and Amazon fell 4%. It rose slightly by 0.08%.

Throughout the week, the market capitalization of U.S. companies closely associated with the artificial intelligence boom evaporated by nearly $1 trillion. Among them, the combined market capitalization of the eight most valuable AI-related companies, including Nvidia , Meta, Palantir, and Oracle , shrank by over $800 billion in a single week. This situation has raised concerns among market analysts, who are beginning to question the sustainability of current high valuations.

Florian Yelpo, head of macro at Lombard Odier Investment Managers, noted: “The sheer scale of capital expenditures related to artificial intelligence, and its increasing reliance on debt financing, is reminiscent of the crazy and questionable investments during the tech bubble of 2000.”

Data shows that the four tech giants—Alphabet (Google's parent company), Amazon , Meta, and Microsoft— spent a total of $112 billion in capital expenditures in the third quarter. Meanwhile, the industry is borrowing hundreds of billions of dollars to fund the expansion of artificial intelligence. (JPMorgan Chase) Analysts say retail investors, known for buying on dips, chose to remain on the sidelines this week. In a report to clients, the bank stated that retail investors reduced their holdings after Palantir released its earnings report on Tuesday and took profits on quantum computing stocks, which have also surged this year.

The Financial Times points out that concerns about overvaluation of Silicon Valley tech companies emerged this week alongside signs of weakness in the US labor market and declining consumer confidence. The University of Michigan's consumer sentiment index fell to a three-year low in November. The historic US federal government shutdown, resulting in a lack of key economic data, has fueled investor concerns that the labor market may have deteriorated significantly since the end of September. Mike Zigmont of Visdom Investment Group stated, "Perhaps the risk of a recession is spreading right under our noses."

The Chicago Fed's estimated hiring rate declined for the sixth consecutive month in October, while Amazon , Paramount, and Target... The recent wave of layoffs announced by companies like Nvidia has further unsettled investors. Stephen Yiu, chief investment officer of Blue Whale Growth Fund, said, "The hiring situation is very weak, and the Fed's policy is lagging behind, requiring faster rate cuts." This investor, who holds a large stake in Nvidia, added, "We do not hold any other stocks in the 'Big Seven' and are deeply concerned about these companies' cash-burning model to maintain competitiveness."

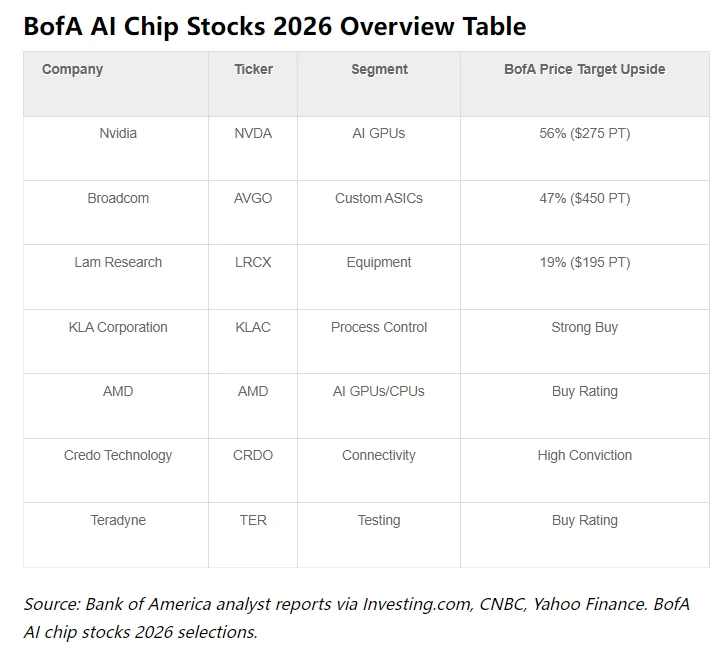

This round of tech stock sell-offs began after government contractor and AI developer Palantir released its earnings report on Tuesday. Market concerns about the company's overvaluation triggered a sharp drop in its stock price, which then spread to its peers. Additionally, comments this week from OpenAI CFO Sarah Fryer regarding the possibility that the $500 billion valuation startup might seek "backstop" funding from the U.S. government have also fueled speculation about its financial health. The company has secured $1.4 trillion in infrastructure commitments through a complex network of deals with chipmakers like Nvidia, AMD, and Broadcom , as well as cloud partnerships with Microsoft , Amazon, and Google. These connections mean that the tech giants' expected growth over the next few years is now deeply tied to OpenAI.

OpenAI CEO Sam Altman reassured the market on social media Thursday, saying that startups do not need government guarantees and predicting that the company’s revenue will “grow to hundreds of billions of dollars by 2030.”

It's worth noting that the impact of this sell-off may not be limited to the technology sector. Analysts predict that if investor confidence fails to recover, other industries could also be affected, leading to broader market volatility. Key stakeholders, including market analysts and institutional investors, will be closely watching the upcoming earnings reports of tech giants to assess their financial health and future prospects.

Meta was attacked by air force.

On November 9, according to CCTV News, internal documents from the US company Meta revealed that approximately 10% of the company's revenue in 2024, or about $16 billion, came from fraudulent and prohibited product advertisements, highlighting loopholes in the oversight of its advertising business.

An internal Meta document reveals that the social media giant failed to identify and block a massive amount of illegal advertising for at least three years, exposing billions of users on its platforms—Facebook, Instagram, and WhatsApp—to content including investment scams, online gambling, and illegal medical products. The company estimates that its platforms push approximately 15 billion fraudulent ads to users daily.

The document also reveals that many fraudulent ads actually originate from advertisers already flagged as "suspicious" by Meta. However, Meta's control system only bans advertisers when the system determines there's a greater than 95% probability of fraud. For higher-risk advertisers who don't meet the ban criteria, Meta raises ad spend as a form of warning. The document further points out that because Meta's ad personalization system targets ads based on user interests, users who have clicked on fraudulent ads may see more fraudulent ads.

It is understood that Meta is aware its products have become a significant part of the global fraud economy. A May 2025 report by Meta's security division estimated that approximately one-third of successful fraud cases in the United States were linked to Meta. In another internal document from 2025, the company stated that it planned to reduce revenue from fraudulent advertising in the future, but was concerned that a decrease in this revenue could impact its overall business prospects.

In response, a Meta spokesperson stated that they had "actively" addressed the relevant advertisements, emphasizing that the estimate of 10% of last year's revenue being fraudulent and prohibited product advertisements was a "rough and overly broad estimate," and that subsequent reviews found many advertisements to be legitimate. The spokesperson also pointed out that the leaked documents were "one-sided" and did not reflect all the measures the company had taken to resolve the issue.

(Source: Securities Times)