I. Overview of US Stock Index Options

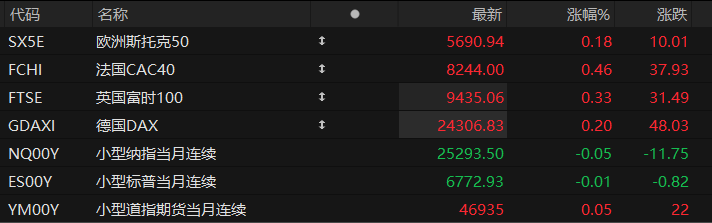

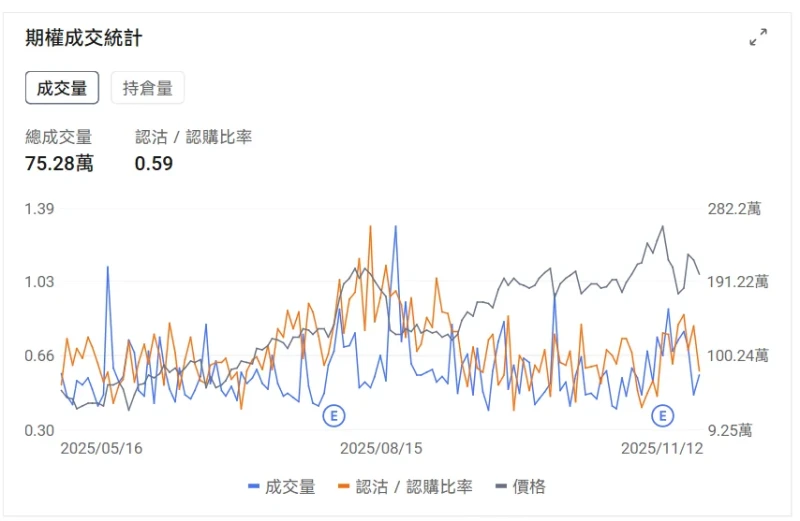

Trading volume in the US stock index options market has increased slightly, as has the put/call ratio, indicating some short selling.

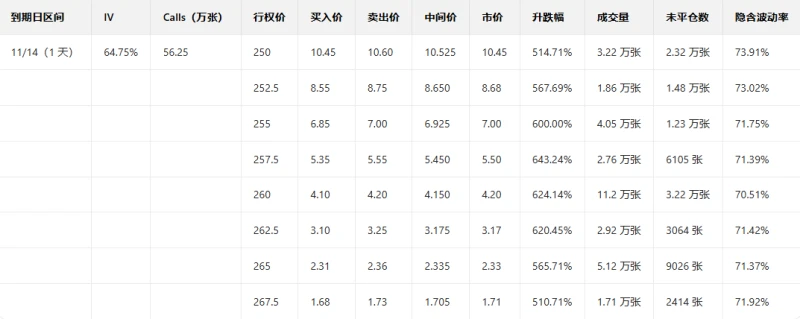

The volume distribution of S&P 500 index options expiring today shows a divergence between call and put order distributions, with put orders peaking at 6800 points and call orders peaking at 6900 points.

Nasdaq contracts expiring today 100 Index Options Trading Volume Distribution: Call single peak at 25500, Put single peak at 25200.

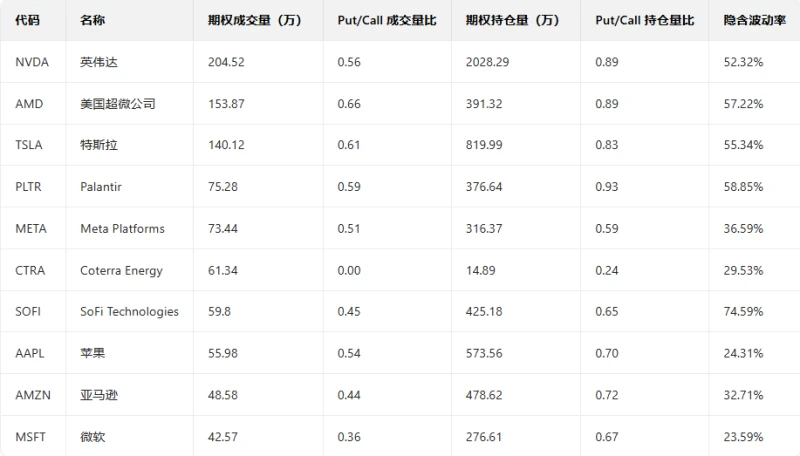

II. US Stock Options Trading Volume Ranking

1. Advanced Micro Devices (AMD) rose 9.00% in the previous trading day, with the put/call ratio increasing and trading volume rising significantly the day before.

Looking at the call orders expiring this Friday, many have seen price increases of over 6 times.

Observing the large orders with unusual activity in options trading, the trading volume of large investors was relatively neutral before the market closed.

Chip giant AMD held its Financial Analyst Day for the first time in three years, outlining its growth prospects for the next few years and its plans for AI data centers. The infrastructure boom has further fueled the industry. AMD predicts that its annual revenue growth will exceed 35% over the next three to five years, primarily driven by strong demand for data center products.

In her speech at the event, AMD CEO Lisa Su pointed out that within the same period, the revenue growth rate of the AI data center business will exceed 80% annually, and it will occupy a double-digit share of the overall market. According to Su's prediction, by 2030, AI chips... The overall market size will reach $1 trillion, including GPUs, CPUs, networking, and related products. Previously, Nvidia... CEO Jensen Huang once stated that broader spending on AI infrastructure will reach $3 trillion to $4 trillion by 2030.

2. Palantir fell 3.56% in the previous trading day, with the put/call ratio declining the day before and trading volume rising slightly.

Looking at the call orders expiring this Friday, many have more than doubled in price.

Observe the large orders with unusual activity in options trading; there was a significant increase in large-volume transactions just before the market closed.

Top 10 US Stock Options Trading Volume Ranking

Top 10 US Stocks by Implied Volatility (Underlying Asset Market Cap > $10 Billion, Options Trading Volume > $100,000)

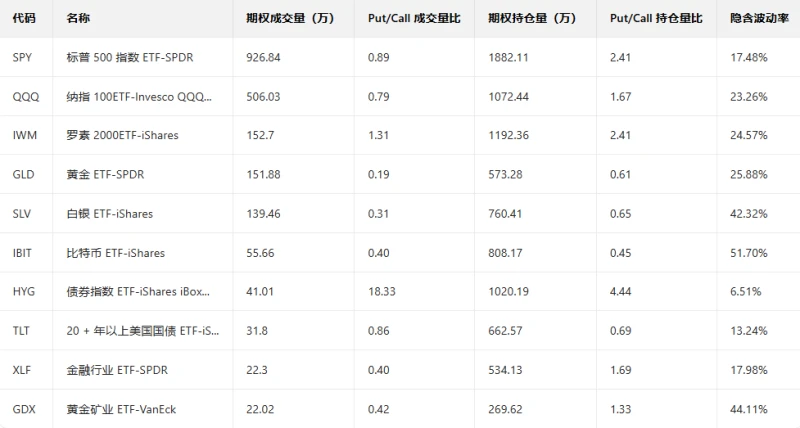

III. Top Ten US Stock ETF Options Trading Volume Ranking

Top 10 US Stock ETFs by Implied Volatility (Based on: Market Cap > $10 billion)

(Article source: Hafu Securities) )