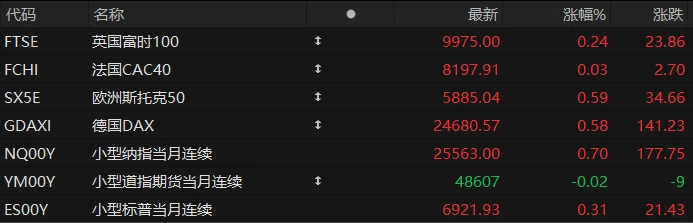

U.S. stock index futures were mixed in pre-market trading on Monday, while major European indices generally rose. As of press time, the Nasdaq... S&P 500 futures rose 0.70%, Dow Jones futures fell 0.02%, and S&P 500 futures rose 0.31%.

In terms of individual stocks, leading tech stocks rose collectively in pre-market trading, with chip stocks performing strongly, including Intel. Micron Technology rose more than 4%. ASML TSMC rose more than 3%. AMD rose nearly 3%, Nvidia rose 4.5% Tesla The average increase was about 1.5%.

Most popular Chinese concept stocks weakened in pre-market trading, with XPeng Motors among them. Baidu fell nearly 3%. NIO JD.com fell more than 2% Alibaba and other stocks saw slight declines.

US oil stocks surged in pre-market trading, with Chevron leading the gains. ConocoPhillips rose nearly 7%. ExxonMobil rose 6% Oil and gas rose nearly 4%. Equipment and services concepts both strengthened, Schlumberger Halliburton Stocks rose about 9%, with Baker Hughes up over 6%. This followed Trump's statement that the US plans to "take over" Venezuela after the weekend's overthrow of Nicolás Maduro's regime.

U.S. Treasury bonds are poised for their first rise in a week after the U.S. military's arrest of Venezuelan President Maduro led to a drop in oil prices, easing market concerns about persistent inflation. On Monday, most global bonds rose as concerns about a global supply glut caused crude oil futures prices to fall. Even if Venezuela resumes oil production in the future, it will only make up for the production losses of the past two decades, and the market will still face a huge surplus this year with OPEC+ and other oil-producing countries continuing to increase production.

While escalating geopolitical concerns typically spur demand for safe-haven assets like US Treasuries, US stock index futures rose on Monday, driven by gains in tech stocks. Treasuries also lagged behind swap contracts, a signal of recovering risk appetite. (Deutsche Bank) Strategist Henry Allen and his team stated, "Historically, geopolitical shocks have tended to have a short-lived impact." "This may seem surprising, but it's because markets typically trade based on macroeconomic variables such as growth and inflation, rather than the geopolitical shock itself."

Ahead of Friday's key jobs report, traders will next focus on the U.S. December ISM manufacturing data, due later on Monday, for the latest clues about the health of the economy.

Hot News

US oil stocks rallied across the board, but the positive logic behind the situation in Venezuela remains questionable.

U.S. oil stocks rallied in pre-market trading on Monday, as investors closely watched the aftermath of the U.S. military action taken over the weekend against Venezuela, the world's largest oil-holding country. Following the globally impactful military action, U.S. President Trump announced that the U.S. would "manage" Venezuela, repeatedly emphasizing that Venezuela's oil resources were a core policy objective. Trump declared that major U.S. oil companies would go to Venezuela. The question remains: are U.S. oil companies willing to invest significant sums in Venezuela?

In a report last Sunday, Jefferies anticipated that, under the premise of an "orderly transition," Venezuela could increase production by approximately 500,000 barrels per day over the next three to five years through existing joint ventures, including with Chevron . Jefferies emphasized that further growth beyond that level could be more complex and costly. (Royal Bank of Canada) Helima Croft, head of commodity strategy at [company name], also warned that the road to recovery for Venezuela's oil industry will be very long. She stated that oil industry executives believe at least $10 billion annually is needed to turn things around, and a "stable and secure environment" is an absolute prerequisite.

At the same time, sluggish international oil prices are also hindering large-scale investments by oil giants. Due to the consensus that "supply will exceed demand," international oil prices are expected to fall by nearly 20% in 2025, the largest annual drop since 2020.

Is Trump forcing interest rate cuts to pay off debt? Yellen warns: The risks of US "fiscal dominance" are escalating!

Several leading figures in the U.S. economic community said on Sunday that the long-term risks posed by the ever-increasing federal debt are becoming the primary concern facing the U.S. economy. These risks include a scenario where the size of the debt forces the central bank to maintain low interest rates to minimize debt repayment costs, rather than focusing its policy on curbing inflation—a scenario known as "fiscal dominance."

In response, former U.S. Treasury Secretary and former Federal Reserve Chair Janet Yellen stated at the American Economic Association's annual meeting in Philadelphia on Sunday that the preconditions for fiscal dominance in the U.S. are clearly strengthening. Yellen noted that President Trump had "publicly demanded" that the Federal Reserve lower interest rates, with the explicit aim of reducing the government's debt repayment costs.

Yellen had previously warned that if Trump succeeded in forcing the Federal Reserve to maintain low interest rates to alleviate government debt pressure, the United States could become a "banana republic." According to the Congressional Budget Office's projections, the U.S. federal deficit will reach $1.9 trillion this year, bringing total debt to approximately 100% of GDP. This ratio is expected to rise to around 118% of GDP over the next decade.

Analysts warn: AI-driven inflation is the most overlooked risk in 2026.

Analysts point out that global stock markets may be ignoring a major threat: rising inflation, partly driven by the technology investment boom.

US stock indices are projected to achieve double-digit gains and reach record highs by 2025. Meanwhile, the focus on artificial intelligence... The AI frenzy and expectations of looser monetary policy have also propelled European and Asian stock markets to record highs. Looking ahead to 2026, stimulus measures from the US, European, and Japanese governments, along with the AI boom, are expected to reignite global economic growth. This has also prompted fund managers to prepare for a renewed acceleration in inflation, fearing that central banks will end their rate-cutting cycles and apply the brakes to curb the influx of loose funds into "AI-obsessed" markets.

Trevor Greetham, head of multi-asset management at Royal London Asset Management, said that while he currently holds large-cap tech stocks, he wouldn't be surprised if global inflation rises significantly by the end of 2026. Greetham pointed out that tighter monetary conditions will dampen investor interest in speculative tech assets, increase financing costs for AI projects, and compress tech company profits and share prices.

US Stocks Focus

Goldman Sachs After a significant upward revision of its target price, TSMC's stock price surged 7%, marking its biggest gain in eight months.

On Monday, January 5th, TSMC's stock price surged as much as 6.9%, marking its largest single-day gain since April of last year and reaching a new high, pushing the Taiwan Weighted Index above the 30,000-point mark. This surge occurred after Goldman Sachs raised its target price for the company by 35% to NT$2,330, further strengthening market confidence in the long-term growth of demand related to artificial intelligence .

In a report, Goldman Sachs analyst Bruce Lu noted that TSMC is expected to invest approximately $150 billion in capacity expansion over the next three years, while its profit margins continue to improve. The bank emphasized that artificial intelligence has become the engine driving TSMC's "growth for many years to come."

TSMC's leading performance spurred a general rally in the Asian technology sector. Samsung Electronics of South Korea surged over 7%, while SK Hynix also rose nearly 3%. The strong performance of these two memory giants directly boosted market sentiment, with the Seoul Composite Index closing up 3.43%, a record closing high. Although some investors remain cautious about short-term volatility in the sector, the semiconductor... Sector performance has become the primary driver of Asian markets today.

Taiwan's weighted index closed up 2.6% at 30,105.04 points, marking its third consecutive day of gains and its largest single-day increase since November 20 last year.

Oracle bone script How to reverse the market narrative? UBS: OpenAI faith restored, debt pressure proven manageable.

Since its mid-September high, Oracle's stock price has experienced a sharp correction of -41%. This is not merely a technical adjustment, but a direct reflection of the market's shattered confidence in the "OpenAI complex." Investors are currently extremely anxious: Can OpenAI deliver on its trillion-dollar promise? Will Oracle's massive $88 billion net debt overwhelm its balance sheet?

In its latest research report on January 4th, UBS offered a strongly contrasting view, reiterating its "buy" rating. UBS believes the market has overpriced OpenAI's default risk and Oracle's financing pressures. It argues that if OpenAI completes its new round of financing, GPT-6 is released as scheduled in Q1, and Oracle alleviates capital expenditure pressure through off-balance-sheet financing, the market narrative will fundamentally reverse in the first half of 2026.

Despite numerous uncertainties, Oracle's growth story remains the most aggressive among tech giants. Company guidance indicates that revenue growth will accelerate from 16% to 46% from FY26 to FY28. UBS believes that the stock price decline of over 36% (relative to the average decline in the AI sector) has overreacted to financing and execution risks. Once funding is secured and infrastructure is delivered on schedule, Oracle will see a significant valuation recovery.

Tesla's market share in China has shrunk for two consecutive years.

Despite a slight recovery in shipments in December, Tesla 's Chinese factory is projected to see a significant decline in shipments for the full year of 2025 compared to 2024. The global automaker, led by Elon Musk, the world's richest man, is struggling amid a significant slowdown in global sales and has lost its dual titles as the world's number one electric vehicle manufacturer and the number one in China's electric vehicle market share.

According to preliminary statistics from the China Passenger Car Association, Tesla Last year, it shipped 851,732 electric vehicles from its Shanghai Gigafactory, a decrease of approximately 7% compared to the same period of the previous year. December alone saw 97,171 units shipped, marking only the fourth month in 2025 to show year-on-year growth. It's worth noting that this latest statistic does not break down the proportion of exports within China's shipments; however, the majority of these vehicles are sold locally in the Chinese market.

In a challenging year (2025), Tesla relinquished its title as the world's largest electric vehicle manufacturer to China-based BYD. Undoubtedly, Tesla faces increasingly fierce competition in the Chinese electric vehicle market. Emerging electric vehicle manufacturers like Xiaomi are launching new electric vehicle models that are futuristic in terms of technology and emphasize highly intelligent driving functions, and are continuously winning over Chinese consumers.

(Article source: Hafu Securities) )