The pressure on American businesses is becoming increasingly apparent.

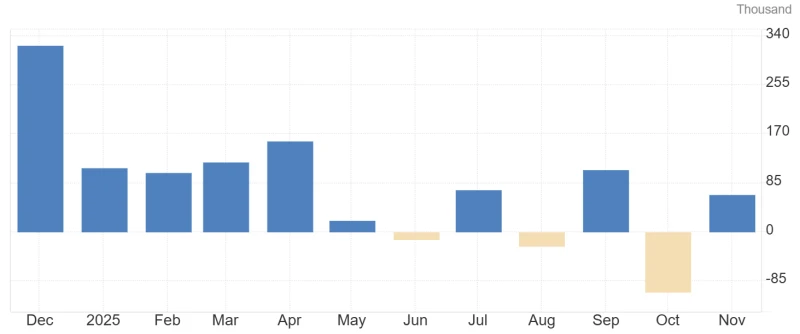

On November 13 local time, according to S&P Global... According to data released by S&P Global Market Intelligence , as of the end of October this year, there were 655 bankruptcy filings among large U.S. companies, which is almost the same as the 687 filings for the whole of 2024. The total number of bankruptcies this year is likely to reach a 15-year high.

October alone saw 68 new bankruptcies, slightly higher than the revised figure of 66 in September, while August's 76 cases remained the highest monthly figure since 2020.

Amid high financing costs, weakening demand, and frequent corporate defaults, tensions are rising in the US credit market. Some sectors are experiencing more pronounced cash flow pressures, while sudden defaults by a few large companies are increasing market sensitivity to potential risks.

The number of bankruptcies among large enterprises continues to rise.

S&P's statistics show that the industrial sector has seen the highest concentration of bankruptcies this year (98 cases), followed by the consumer discretionary sector (80 cases). These two sectors are most sensitive to tightening financial conditions due to the combined effects of trade policy uncertainty, supply chain volatility, and rising costs.

In September of this year, two bankruptcies that attracted market attention further amplified these concerns: auto parts... First Brands Group filed for bankruptcy protection, declaring liabilities exceeding $10 billion, catching debt investors off guard; the bankruptcy of used car retailer Tricolor Holdings led to JPMorgan Chase's bankruptcy. Write off approximately $170 million in risk exposure.

Although several research institutions subsequently concluded that these two cases were more of "isolated incidents," the continuous reactions they triggered in the credit market indicate that investors are becoming increasingly vigilant about the marginal risks of corporate defaults.

JPMorgan Chase CEO Jamie Dimon bluntly stated in a conference call, "When you see one cockroach, it usually means there are more." This comment has been widely quoted by the market, reflecting that the investment community's attention to "credit tail risk" has far exceeded the levels of 2023 or 2024.

The October bankruptcy list also included Office Properties Income Trust (OPI), a real estate investment trust with liabilities exceeding $1 billion. While filing for bankruptcy, the REIT reached a restructuring support agreement with some creditors in an effort to adjust its asset structure and improve its solvency. Amidst the overall pressure on office REITs, OPI had previously become one of the most frequently shorted office REITs.

The number of corporate bankruptcies has been rising year by year since 2022, which coincides with the increase in financing costs following the Fed's interest rate hike cycle.

Credit spreads widening

In addition to the rising number of bankruptcies, price signals in the US credit market are also putting pressure on the market.

In October, the CDX North American High Yield index rose to 343bp mid-month, a temporary high; although it fell back to 328bp at the end of the month, it was still significantly higher than the low of 302bp in September.

The continued rise in interest rate spreads reflects the market's increased demand for risk compensation from highly leveraged companies.

This trend suggests that refinancing is becoming increasingly difficult, and higher funding costs will be transmitted more quickly to companies with fragile cash flow. Analysts believe that while the ultimate impact of the defaults by First Brands and Tricolor may be limited, similar isolated incidents are likely to continue to occur, especially in industries with high profit volatility.

In terms of industry structure, S&P data shows that among the 655 companies that have filed for bankruptcy this year, 345 have been classified into specific industries, with the industrial, consumer discretionary, and healthcare sectors accounting for a total of 223 cases.

Driven by both corporate demand adjustments and tightening financing conditions, credit risk is showing signs of increased concentration. Market observers believe that while credit spreads have fallen from their mid-month highs, they have not yet returned to previous lows, indicating that investors remain cautious about risk control in the latter part of the economic cycle. With slowing corporate profit growth and cost pressures unlikely to ease quickly, volatility in the credit market is likely to remain relatively high.

(Article source: CBN)