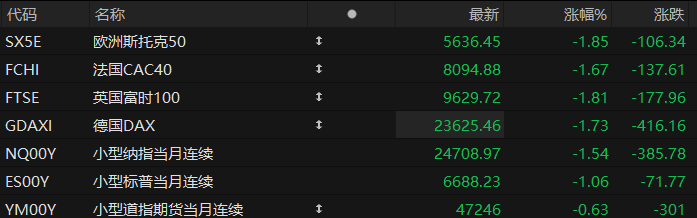

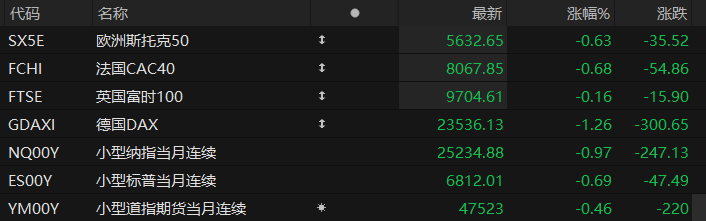

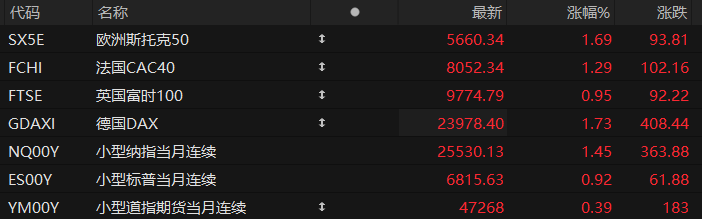

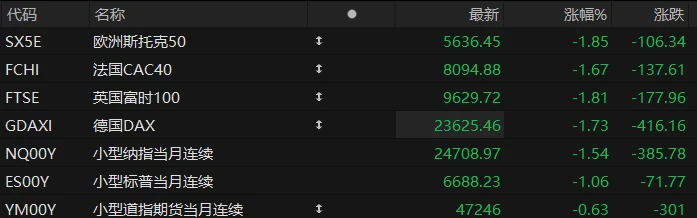

U.S. stock index futures fell across the board in pre-market trading on Friday, while major European indices also generally declined. As of press time, the Nasdaq... S&P 500 futures fell 1.54%, S&P 500 futures fell 1.06%, and Dow Jones futures fell 0.63%.

In terms of individual stocks, Tesla Nvidia shares fell 4% in pre-market trading. Micron Technology fell more than 3%. Chip stocks, including AMD, all declined.

Bitcoin fell as low as $95,985.4, down nearly 3% on the day. Spot gold fell more than 2% to $4,087.08 per ounce. Spot silver fell more than 1.8%.

The Chicago Board Options Exchange (CBOE) measures market fear. The volatility index (VIX) climbed above 22. Traders have lowered their expectations for a Federal Reserve rate cut in December to below 50%.

According to Bank of America The latest client fund flow data shows that hedge funds and other institutional clients are the largest net sellers of individual stocks and exchange-traded funds this year, having already sold more than $67 billion worth of stocks by 2025.

In the first week of November, hedge funds and other large investors saw their largest net selling of tech stocks in two years, fueled by heightened concerns about overvaluation. Meanwhile, repeated inflows from retail investors helped sustain the rally in mega-cap tech stocks and more speculative sectors of the market. However, this pattern appears to be evolving. Bank of America points out that retail enthusiasm has shown initial signs of fatigue after the market's sustained rise.

Hot News

The schedule for releasing key US economic data has been set.

The U.S. Commerce Department will release a timeline for the publication of revised third-quarter GDP figures and other economic data, including PCE. Investors will have access to key data in the coming weeks to assess the direction of U.S. economic growth and inflation.

According to the U.S. Department of Commerce, the revised GDP figure for the third quarter will be released at 8:30 a.m. ET on November 26 (9:30 p.m. Beijing time). At 10:00 a.m. on the same day (11:00 p.m. Beijing time), the Department of Commerce will also release October's personal income, spending, and PCE price index.

The final GDP figure for the third quarter is scheduled to be released at 8:30 a.m. Eastern Time on December 19 (9:30 p.m. Beijing Time). In addition, the October international trade report will be released at 8:30 a.m. Eastern Time on December 4 (9:30 p.m. Beijing Time).

However, uncertainty remains regarding the release of some labor data. The U.S. Labor Secretary stated that it is uncertain whether the Bureau of Labor Statistics will be able to release the October Consumer Price Index, and while the September jobs report has been collected, it has not yet been processed. The Labor Secretary also expressed hope that the September jobs data will be released next week.

American economists and historians have joined forces to warn that the United States has made a huge mistake by mortgaging its future!

The unsustainability of U.S. public debt is becoming a major concern in American society. On Thursday, the Peterson Foundation, a U.S. think tank, released a series of papers warning of the risks posed by U.S. national debt. Leading U.S. economists and historians agree that the United States is facing a dangerous fiscal gamble.

Richard Haass, president emeritus of the Council on Foreign Relations, and Carolyn Kissane, a professor at New York University, criticized the United States for squandering emergency funds during a period of stability. This means that the U.S. government has very little surplus funds to finance large-scale military operations or stimulate the economy during crises.

Currently, the United States spends approximately $1 trillion annually on debt repayment, exceeding its annual defense spending. Economist Heather Long believes that the 2020s are rapidly becoming an era in which the United States is burdened with a persistently large deficit. Despite a low unemployment rate, the annual budget gap in the United States will remain high, accounting for about 6% of GDP, a stark contrast to American history.

Beyond the unsustainability of US debt, the dollar system also faces enormous challenges. Historian Harold James points out that the US is currently conducting an extremely dangerous dollar experiment, which is also an experiment in the international monetary system, and the fundamental driving force... It is a form of financial gambling.

Goldman Sachs Warning: Power shortages may become the biggest bottleneck to the development of AI in the United States.

Goldman Sachs stated in a recent report that the United States is making strides in artificial intelligence. The biggest obstacle in the field of AI is not chips, rare earth elements, or talent, but electricity.

With the rapid development of AI and data centers The surge in demand has overwhelmed the U.S. power grid, with these large facilities now accounting for about 6% of total U.S. electricity consumption. Goldman Sachs analysts predict that the proportion of electricity consumed by data centers could nearly double to 11% by 2030, pushing parts of the U.S. power grid beyond critical load limits.

Meanwhile, Goldman Sachs points out that while the US power grid is under pressure, China is quietly stockpiling energy. Goldman Sachs predicts that by 2030, China's effective reserve power generation capacity will reach approximately 400 gigawatts—more than three times the total expected electricity consumption of global data centers .

“A reliable and sufficient power supply could be the key to winning this competition, especially given that power infrastructure bottlenecks are difficult to resolve quickly,” Goldman Sachs said.

US Stocks Focus

Bridgewater's latest 13F report reveals: a significant reduction of 2/3 of its Nvidia and Microsoft holdings . Google shares all reduced

On Friday (November 14) local time, Bridgewater, one of the world's largest hedge funds, raised funds from U.S. securities firms . Bridgewater has filed a Report on its Holdings as of the end of the third quarter of 2025, or Form 13F, with the Securities and Exchange Commission (SEC). The filing shows that as of September 30, 2025, Bridgewater's total holdings amounted to $25.5 billion, an increase from $24.8 billion at the end of the second quarter.

Nvidia, previously ranked third in holdings, has fallen to sixth. Data shows that Bridgewater reduced its holdings by nearly 4.72 million shares in the third quarter, which also placed Nvidia on Bridgewater's "Top Sells" list. As of the end of the third quarter, Bridgewater held 2.51 million Nvidia shares, a 65.3% decrease from the 7.23 million shares at the end of the second quarter. In the second quarter of this year, Bridgewater increased its Nvidia holdings by a significant 154.37%. This reduction indicates that Bridgewater is becoming more cautious about Nvidia's future performance.

In addition to Nvidia, Bridgewater also significantly reduced its holdings in iShares Core MSCI Emerging Markets ETF (IEMG), Google A, SPDR Gold ETF (GLD), Microsoft , and other assets in the third quarter, as the growth of these assets slowed down during the quarter.

Last week, Bridgewater Associates founder Ray Dalio again warned that the US economy may have entered the later stages of a "major debt cycle," and that the Federal Reserve's loose monetary policy is stimulating further expansion of the bubble. The moment the Fed is forced to tighten monetary policy will be the moment the bubble bursts.

Supply shortages worsen, Samsung reportedly raises memory chip prices by 30%-60%.

According to media reports citing sources familiar with the matter, Samsung Electronics will raise server chip prices by 30% to 60% this month, up from September levels.

Samsung had previously delayed announcing formal pricing for its October supply contracts, with two sources adding that pricing details are typically released monthly. This price surge could exacerbate the cost pressures on large enterprises building data infrastructure. Meanwhile, rising memory chip prices could also drive up the cost of other products such as smartphones and computers.

However, for Samsung, which lags behind competitors in the field of advanced artificial intelligence chips, this supply shortage presents an opportunity to improve profitability. The company has stronger pricing power in the memory chip market than competitors such as SK Hynix and Micron (MU.US).

Google rejects European Commission's demand to break up its business and will appeal the antitrust ruling.

On Friday (November 14) local time, Google announced that it will appeal the European Commission's antitrust ruling. The company rejected the European Commission's demand to break up certain business units.

In September of this year, the European Commission fined Google €2.95 billion ($3.4 billion). This decision stemmed from an investigation four years ago, which began with a complaint from the European Publishers Council. The European Commission formally accused Google in 2023 of favoring its own platform and excluding competitors in its advertising services.

The European Commission has asked Google to propose measures by November to address conflicts of interest in the ad technology supply chain and has recommended that Google sell parts of its business.

Google said Friday it has submitted a proposal to EU regulators to make its online advertising technology more accessible to publishers and advertisers, but will not split up the business.

(Article source: Hafu Securities )