Pinduoduo Pinduoduo will release its earnings report before the market opens on November 18th, Eastern Time. Analysts expect Pinduoduo to achieve revenue of 108.73 billion yuan in Q3 2025, an increase of 9.44% year-on-year; and earnings per share of 14.89 yuan, a decrease of 11.95% year-on-year. (The above data uses US-GAAP accounting standards.)

I. Brief Review of Q2 Financial Report

Driven by fierce competition in the e-commerce industry and continued efforts to increase support for merchants, Pinduoduo achieved revenue of 104 billion yuan in the second quarter, a year-on-year increase of 7%, a further slowdown compared to the first quarter; operating profit was 25.8 billion yuan, a year-on-year decrease of 21%; and net profit was 30.68 billion yuan, a year-on-year decrease of 4%.

II. Q3 Earnings Preview

1. Domestic Main Site Business: Strategic investment deepened, awaiting long-term value realization.

This quarter, Pinduoduo's domestic main platform business remained in a clearly defined strategic investment period. The "100 billion yuan support" strategy launched since Q2 is not a short-term stimulus, but a systematic project that will continue throughout the second half of the year. In addition, the platform has also reduced merchants' operating costs and enhanced their willingness and ability to operate in the long term by relaxing merchant restrictions, providing a series of operational tools (such as helping to reduce refund and return rates), and direct subsidy policies.

Management has clearly conveyed to the market a message of "being willing to sacrifice short-term profits in order to give back to the ecosystem in the long term." Co-CEOs Zhao Jiazhen and Chen Lei both emphasized in the Q2 conference call that the profit performance this quarter is unsustainable, and that profitability will inevitably fluctuate in the future as investment increases.

From the cost perspective, continued investment in resources such as merchant subsidies, tool development, and traffic support will continue to squeeze profit margins in the short term. From the revenue perspective, the monetization rate (commission rate) is unlikely to improve under fierce competition, and may even decline slightly due to reduction or exemption policies.

Despite facing fierce industry competition, Pinduoduo also experienced a positive marginal change in the third quarter:

Competitive pressure has eased temporarily: The recent "food delivery war" that has attracted market attention has significantly restrained Alibaba. JD.com This diverts the funds and strategic attention of major competitors. This provides Pinduoduo, which was not involved, with a rare strategic window of opportunity, allowing it to more calmly absorb the cost pressure brought by "merchant subsidies" and focus on building its own ecosystem.

The negative impact is expected to narrow: the base effect created by the large-scale rollout of national subsidies in August and September last year will gradually weaken, and its negative impact on Pinduoduo's GMV growth is expected to narrow in the second half of the year.

Putting aside short-term fluctuations, investors need to recognize that the domestic e-commerce market has entered a phase of "zero-sum game": Alibaba's counterattack and Douyin's increased investment in e-commerce mean that the competitive landscape is unlikely to fundamentally ease in the medium term. Pinduoduo's main website growth rate is expected to further converge with the industry average, bidding farewell to its previous ultra-high-speed phase.

Against this backdrop, investors should focus on the quality of its growth drivers. The key focus this quarter is whether Pinduoduo can demonstrate stronger business resilience and growth certainty through proactive investment control, given that its peers are generally facing profit pressures.

2. Temu: Strategically flexible response to challenges, with the US market recovery and globalization progressing in tandem.

In the third quarter of 2025, Temu's core narrative was demonstrating strong strategic adaptability in the face of external policy challenges. Through rapid restart and optimization of its operating model, its key US market saw a significant recovery, while accelerated global expansion opened up space for long-term growth.

(1) Rapid transformation under tariff impact and recovery of the US market

In the third quarter, Temu successfully navigated the significant challenge posed by the US's elimination of tariff exemptions for packages under $800. This policy had led to a sharp increase in costs for its relied-upon "fully managed" model. Temu's response was clear and swift: in the short term, it relaunched the "new fully managed model" as a transition, maintaining its core customer base by leveraging algorithms and traffic allocation to cultivate an image of extremely low prices; simultaneously, the core strategy was to accelerate the development of the "semi-managed" model, which could fundamentally optimize the tariff structure.

This transformation has yielded significant results. Analysis shows that under the semi-managed model, tariffs are levied based on the cost of goods rather than the final selling price, drastically reducing the impact of tariffs on the final price from approximately 54% to 13%-18%. This key adjustment has enabled Temu to regain its price competitiveness. Data shows that Temu's US GMV achieved strong quarter-on-quarter growth in the third quarter, and downloads also returned to the top of the app store charts, indicating that the US business has weathered the most difficult period and returned to normal operations.

(2) Accelerated globalization layout, diversifying risks and expanding new growth poles

While stabilizing its US business, Temu accelerated its global expansion to reduce its reliance on a single market. Europe and Latin America have become new growth engines. Second-quarter 2025 data shows that Temu's user base in the EU and Latin America grew by 74% and 122% year-on-year, respectively, now accounting for 60% of its global users. This multi-market strategy, while potentially impacting overall scale in the short term due to resource diversification, is ultimately a necessary choice to break through growth ceilings and enhance business resilience in the long run.

In summary, Temu effectively mitigated the looming tariff crisis in the third quarter, demonstrating the resilience of its business model and the agility of its team. However, the increased logistical complexity and management costs resulting from multi-market, multi-mode operations, along with ongoing investment to maintain growth, mean that its profit margins will remain under pressure in the short term. Investors should focus this quarter on whether its GMV growth momentum can be sustained and whether the unit economics model has been optimized under the new model, laying the foundation for future profitability.

3. Duoduo Grocery: Strengthening supply chain barriers and seizing the growth window.

In the third quarter, Pinduoduo's agricultural e-commerce business continued to consolidate its strategic position. The core platform "Duoduo Maicai" maintained a stable daily order volume of over 30 million orders, directly connecting with more than 500,000 farmers through the "farmland cloud group buying" model, optimizing the fresh produce loss rate to below 8%, and demonstrating significant supply chain efficiency advantages.

While competitors (such as Meituan Select) strategically scaled back, Pinduoduo did not slow down. Instead, it seized the strategic window of opportunity created by market consolidation and accelerated its expansion. The company's management clearly stated in the Q2 earnings call that it will continue to increase investment in areas aligned with its business plan. This indicates that Pinduoduo views Duoduo Maicai (多多买菜) as a long-term strategic investment, aiming to address the shortcomings of traditional e-commerce in the fresh produce supply chain, and is determined to make more substantial long-term investments in product variety, service quality, and delivery speed.

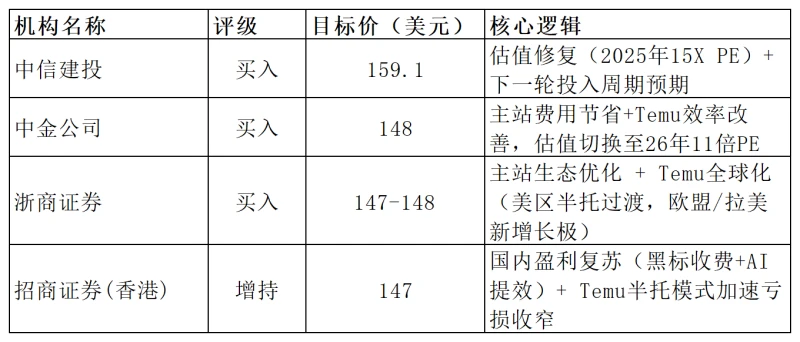

III. Institutional Views

IV. Option Signals

As of November 13, 2025, Pinduoduo's implied volatility was 39.84%, placing it at the 32nd percentile (IV) of its historical volatility over the past year, which is considered moderately low. This suggests that current option prices may be relatively "cheap," but market expectations for future volatility are not extreme.

The Put/Call ratio of 0.74 indicates a slight bullish bias in the short term, but recent volatility suggests that market sentiment is wavering.

The current implied daily volatility of the options market is 6.36%.

V. Summary

Overall, Pinduoduo remained in the strategic deepening phase of "investing to create space" in the third quarter of 2025. While its domestic main platform proactively offered discounts to merchants, dragging down short-term profits, it is expected to solidify its ecosystem foundation. Temu successfully mitigated the US tariff crisis through flexible business model transformation and opened up new growth drivers through its global expansion. Meanwhile, Duoduo Grocery continued to strengthen supply chain efficiency, consolidating its core business. These three businesses collectively outline Pinduoduo's development path of "emphasizing long-term value over short-term performance." The key to this financial report lies in verifying whether its strategic investments have effectively translated into stronger business resilience and clearer growth certainty.

(Article source: Hafu Securities) )