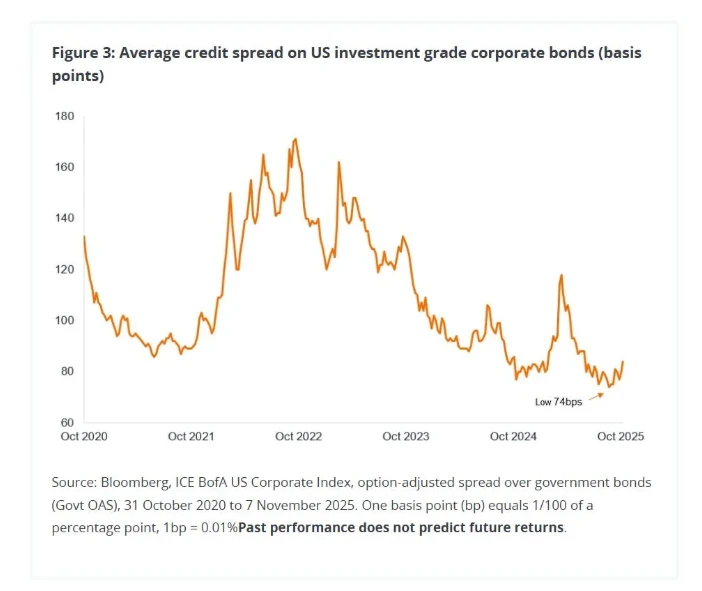

Following the end of the US government shutdown, US Treasury yields continued to rise due to increasingly hawkish rhetoric from the Federal Reserve. The 10-year Treasury yield moved further away from 4.0%, reaching 4.15% today. With official data releases delayed during the shutdown, the September non-farm payroll data, to be released on November 20th, may become a crucial indicator.

On November 12, local time, US President Trump signed the temporary funding bill passed by Congress, ending the 43-day federal government shutdown. Following the shutdown, yields on US Treasury bonds across all maturities continued to rise, with the 10-year Treasury yield climbing from 4.06% to around 4.15%.

Chart: 10-year US Treasury yield trend in the second half of the year

(Data source: Choice Data, compiled by Cailian Press)

Influenced by factors such as the implementation of interest rate cuts and the US-China trade negotiations, US Treasury yields initially fell and then rose in early November. On October 20, the 10-year US Treasury yield hit a low of 3.95% for the year.

The fixed income research team at Xingzheng Securities believes that the expected interest rate cut in October has increased uncertainty regarding subsequent cuts, leading to greater market divergence in pricing in a December rate cut. Meanwhile, the lifting of the US government shutdown, which had been weighing on the US equity market, before the next Fed decision will likely result in a repricing of expectations for US Treasury bonds.

Recently, hawkish voices have increased within the Federal Reserve. Cleveland Fed President Hammark stated last week that the Fed should maintain stable interest rates to continue putting downward pressure on inflation. Minneapolis Fed President Kashkari, however, shifted from dovish to hawkish, stating that the fundamental resilience of economic activity is stronger than expected and that he does not support the Fed's previous rate-cutting decision, remaining cautious about the best course of action at the December meeting. Fed Chairman Powell stated at the end of October that a December rate cut is far from a certainty.

Zhejiang Commercial Bank The FICC team wrote that, following the pronouncements of hawkish officials, there was some large-scale selling in the March 2025 SOFR futures contract and the January 2026 federal funds futures contract, prompting the market to lower its expectations for the magnitude of the rate cut at the December 10 FOMC meeting.

According to the latest data from the CME FedWatch Tool, the probability of a 25 basis point rate cut by the Federal Reserve in December has fallen to 44.4%, while the probability of keeping rates unchanged has risen to 55.6%. The CME's probability of a December rate cut has been fluctuating since late October, reaching 94.2% on October 15th, dropping to 66.9% on November 7th, then to 50.1% on November 13th, and finally settling at 44.4% today.

Furthermore, the lack of official data during the government shutdown makes it difficult to assess the trajectory of the US economy. Several key data points that significantly influence the Federal Reserve's decision on whether to cut interest rates, including September non-farm payrolls, October CPI, and October non-farm payrolls, will be delayed. It is currently confirmed that the September non-farm payrolls data will be released on November 20th.

According to the ADP employment data released in early November, the number of ADP jobs in the United States increased by 42,000 in October, significantly exceeding the expected 30,000, and reversing the situation of a revised decrease of 32,000 in the previous month (revised to 29,000 this time).

The Zheshang Bank FICC team believes that hawkish voices within the Federal Reserve are growing stronger, with even Fed mouthpiece Nick Timiraos recently writing multiple articles emphasizing this divergence. They do not rule out the risk of skipping the December rate cut and are awaiting guidance from this week's economic data.

In the long run, the fixed income research team at Xingzheng Securities believes that against the backdrop of an accelerating expansion of the capital expenditure cycle and the credit cycle, the resilience of the US economic fundamentals may exceed market expectations. Coupled with the constraint of persistently high inflation, the Federal Reserve's room for interest rate cuts in 2026 may be very limited. Furthermore, the temporary easing of the US-China trade dispute and the lifting of the US government shutdown will further boost US economic growth momentum, thus putting some pressure on US Treasury bond performance.

(Article source: CLS)