Cryptocurrencies continued their decline on Wednesday, with Bitcoin briefly falling below $89,000, further dampening investor confidence. However, with Nvidia... Strong earnings reports boosted market risk appetite, driving cryptocurrency prices to rebound from their lows.

As of press time, CoinMarketCap data shows that the total market capitalization of cryptocurrencies is $3.12 trillion, a drop of $1.15 trillion from its year-to-date high. Bitcoin rebounded to $92,000 after hitting a low of $88,526 on Wednesday; Ethereum fell to $3,020, down a third from its August high.

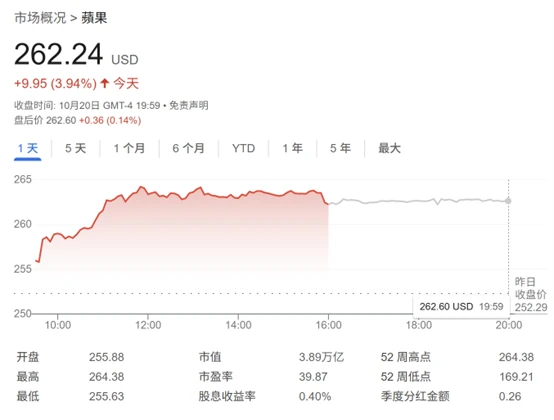

The chart shows the 1-hour price movement of Bitcoin.

According to CoinGlass data, 175,825 traders' accounts were forcibly liquidated in the past 24 hours, with a total liquidation amount of $657.51 million. The largest single liquidation order was an Ethereum settlement on the Hyperliquid exchange, with a transaction size of $24.22 million.

Analysts point out that the next psychological threshold for Bitcoin is around $85,000 and $80,000.

Can't see the direction

The crypto market has been weak for nearly a month following the historic liquidation in October, when over $19 billion in leveraged cryptocurrency positions were forcibly liquidated, exposing the market's vulnerability. This event triggered a chain reaction of margin calls, capital outflows from exchanges, and a sharp decline in new buyer interest.

James Butterfill, Head of Research at CoinShares, said investors are now groping in the dark, unable to find any direction from the macroeconomy and only seeing what the on-chain whales are doing, which is causing them great concern.

From a macro perspective, both factors that drove Bitcoin's price to record highs this year have temporarily stalled. The market had earlier anticipated multiple interest rate cuts by the Federal Reserve and increasing institutional investor acceptance of cryptocurrencies. However, the Fed's continued announcements of a slower pace of rate cuts, coupled with the volatile price movements of cryptocurrencies, have dampened investor enthusiasm.

Matthew Hougan, chief investment officer at Bitwise Asset Management, believes the market may be nearing the end of the sell-off, but market sentiment remains unsettling, and cryptocurrencies may have further downside potential before a rebound.

(Article source: CLS)