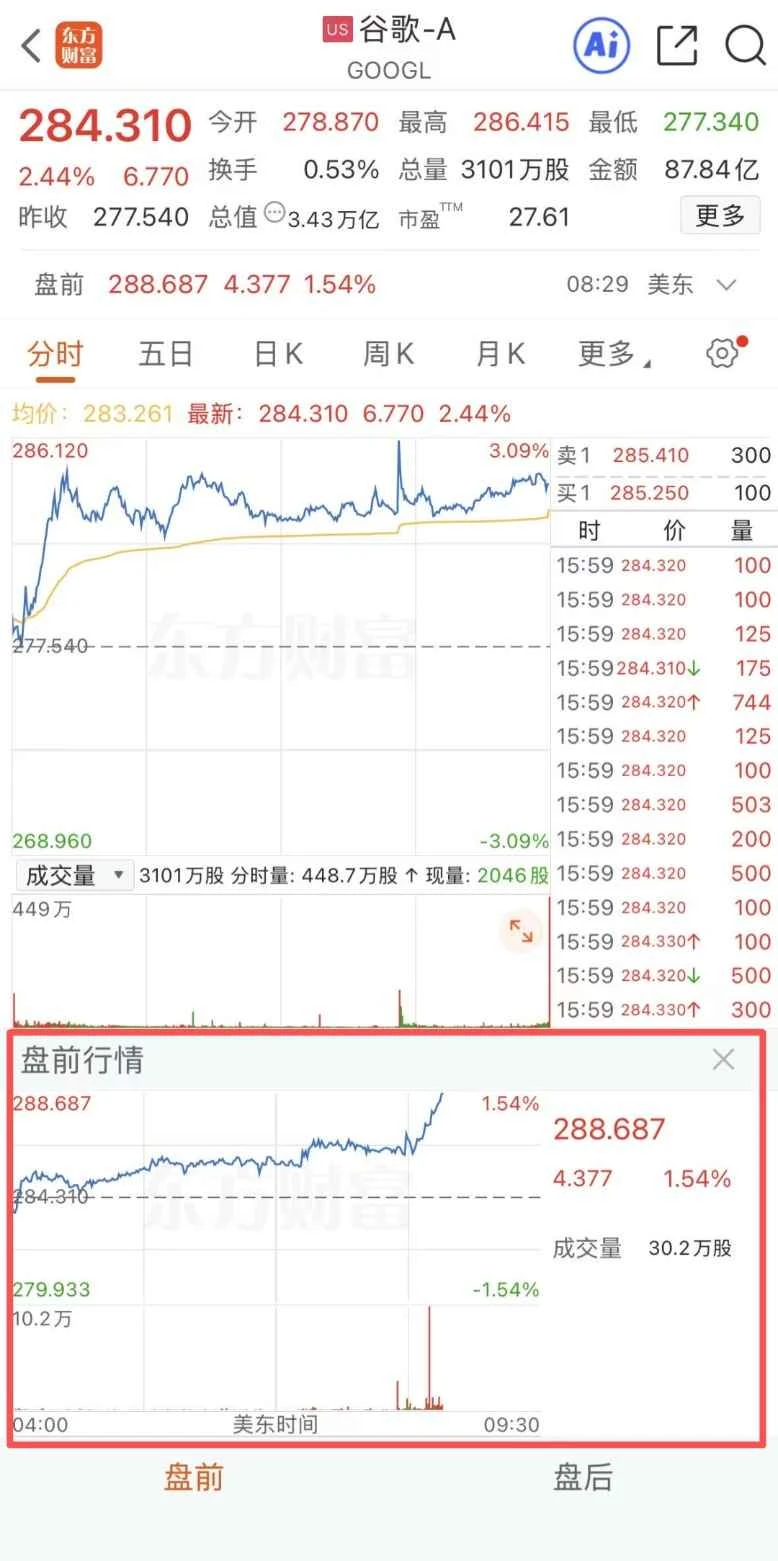

Nvidia US stocks extended their gains in pre-market trading, currently up 5.75%. This followed Nvidia's Q3 revenue and Q4 revenue outlook both exceeding market expectations. CEO Jensen Huang stated that Nvidia has sufficient new Blackwell chips to meet growing demand. Several brokerages have raised their target prices for the company.

Related reports

Jensen Huang refutes "AI bubble theory"! Nvidia's net profit surges 65% as GPUs sell out.

Amidst global tech market turmoil and escalating debates over AI valuations, Nvidia delivered a strong third-quarter earnings report.

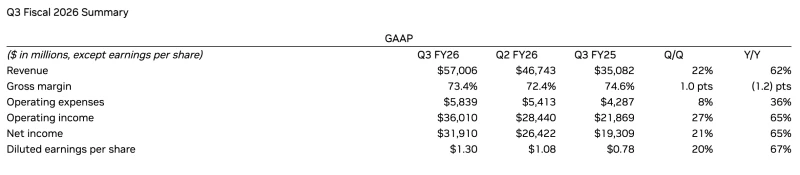

On November 19th, Eastern Time, Nvidia released its financial results for the third fiscal quarter of 2026. The report showed that Nvidia's revenue for the quarter reached $57.006 billion, a year-on-year increase of 62%, exceeding the expected $54.2 billion; net income under Generally Accepted Accounting Principles (GAAP) reached $31.91 billion, a year-on-year increase of 65%.

(Financial results, source: Nvidia official website)

In fact, prior to the earnings release, the market generally expected Nvidia to exceed expectations again and raise its guidance. However, compared to the frenzied market in the first half of the year, investor sentiment has become more cautious. From hedge funds' risk-averse approach to analysts' concerns about the speed of return on capital expenditures, multiple signals have made this earnings report a key point for the year-end adjustment of the technology market.

Looking at the overall financial report, Nvidia refuted market doubts about "peak growth" and "AI bubble" with results far exceeding expectations. Nvidia founder and CEO Jensen Huang said in the earnings call: "There are many claims about an AI bubble. But from our perspective, the situation is quite different."

Meanwhile, Nvidia gave strong performance guidance, expecting fourth-quarter sales to reach $65 billion, plus or minus 2%, higher than the consensus expectation of $62 billion.

In other words, after several quarters of sustained better-than-expected growth, Nvidia is still able to maintain its growth momentum on a high base. This is undoubtedly a shot in the arm for the current market, which is facing tight liquidity and increased volatility in tech stocks.

By the close of trading on the US stock market that day, Nvidia's stock price rose 2.85% to $186.52, bringing its total market capitalization to $4.53 trillion.

The demand for computing power has increased, and cloud GPUs have sold out.

In Nvidia's industry structure, data centers This business segment continues to be the core driver of growth. In the third fiscal quarter, revenue from this segment reached $51.2 billion, representing a 66% year-over-year increase and a 25% sequential increase, significantly exceeding market expectations of $49.1 billion, and accounting for nearly 90% of total revenue.

Further breakdown shows that the "computing business" (GPU products) in data centers contributed $43 billion, while the "networking business" brought in $8.2 billion. This means that both high-end GPUs used for training large models and high-speed network components supporting large clusters are experiencing growth.

Currently, Blackwell is Nvidia's core computing power cash cow. Nvidia founder and CEO Jensen Huang stated in an earnings call that Blackwell product sales far exceeded expectations, and GPU products used in cloud servers are "sold out."

Previously, Jensen Huang stated that Nvidia had shipped 6 million Blackwell GPUs in the past few quarters. The previous generation Hopper architecture chip platform shipped a total of 4 million units and generated $100 billion in revenue over its entire lifecycle (2023-2025).

Blackwell's strong sales are evident. According to Jensen Huang, visible revenue from Blackwell and Rubin has already exceeded $500 billion for the next five quarters leading up to 2026, with orders for approximately 20 million GPUs. During the earnings call, Nvidia CFO Colette Kress reiterated the $500 billion revenue forecast, adding that "this number will continue to grow."

Meanwhile, outside of data centers , Nvidia's other business units also saw growth. Gaming AI PC business generated $4.3 billion in revenue, a 30% year-over-year increase; professional visualization business generated $760 million in revenue, a 56% year-over-year increase; automotive and robotics businesses... The business generated $592 million in revenue, a 32% year-over-year increase.

With multiple business lines progressing in tandem, NVIDIA has further solidified its position in the full-stack AI ecosystem. Notably, NVIDIA has been continuously expanding its AI ecosystem alliances this year.

The day before the earnings release, Nvidia and Microsoft... Anthropic announced a strategic partnership worth tens of billions of dollars. Under the agreement, Nvidia will invest up to $10 billion in Anthropic, and Microsoft up to $5 billion. Anthropic will adopt the Grace Blackwell and Vera Rubin systems and gain access to up to 1GW of computing power. This deal not only signifies Nvidia's continued deep integration with upstream and downstream partners in the industry but also represents the ongoing release of new demand for large-scale AI training and inference clusters.

Amidst heated debate over AI, Jensen Huang asserts there is "no bubble."

In the capital markets, hedge fund positions were reduced from historical highs in the lead-up to the third quarter, the Nasdaq fluctuated, and concerns about overheated AI investment increased in the market.

In the third fiscal quarter, billionaire Peter Thiel sold all of his shares in Nvidia. A 13F filing by the Thiel Macro Fund shows that Thiel sold approximately 537,742 Nvidia shares between July and September, and as of September 30, he no longer held any Nvidia shares. Subsequently, SoftBank disclosed in its latest second fiscal quarter report that it had sold all of its Nvidia shares in October, totaling 32.1 million shares.

However, Nvidia's earnings report is, in a sense, a direct response to the funding situation. Whether it's order volume, product demand, corporate budget allocations, or the AI caps (capital expenditures) of major tech giants in the second half of the year, there are no signs of slowing down. Nvidia's stock closed higher on the day the earnings report was released, reflecting its role as an "anchor" in a highly volatile environment.

In response to external doubts about the overheated investment in AI, Jensen Huang gave a very direct reply: "There are many claims about an AI bubble. But from our perspective, the situation is completely different."

He also stated that the demand for computing power is accelerating and expanding exponentially, whether for model training or inference. "We have entered the era of artificial intelligence... " A virtuous cycle is emerging. The artificial intelligence ecosystem is expanding rapidly—more new foundational model builders, more AI startups, covering more industries and more countries. Artificial intelligence is becoming ubiquitous and omnipotent.

In a recent interview, Huang also mentioned that unlike the large amount of idle infrastructure during the dot-com bubble of the 1990s, key computing resources such as GPUs in the AI industry are now almost all in practical use.

One analyst told reporters that a misconception about Nvidia's demand is that AI investment is viewed as a short-cycle, linear growth. In fact, whether looking at the training scale of Anthropic, OpenAI, and Meta, or at the AI sovereignty strategies of various countries and the demand for physical AI, the expansion path of AI is more like a "parallel explosion."

Citigroup maintained its "buy" rating on Nvidia in a report on November 10th, raising its price target from $210 to $220. Analysts Atif Malik and Papa Sylla pointed out that AI chips are facing challenges due to limited CoWoS (Advanced Packaging System) capacity. Supply will remain below demand until 2026.

Dongcai Illustrated Guide: Some Useful Tips