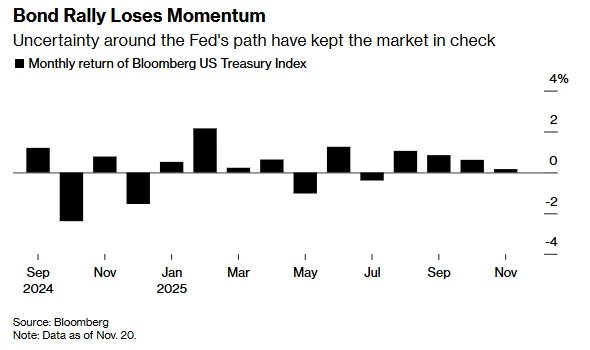

The U.S. Treasury market is highly likely to post its best rally since 2020 this year. Ahead of a shortened trading week due to the Thanksgiving holiday, the Bloomberg U.S. Treasury Index has risen in eight of the previous ten months and is still slightly up so far in November.

However, despite the overall optimistic market sentiment, the US bond market has recently remained below its October price highs, with yields fluctuating within a narrow range. Market observers point out that this situation is likely to persist for some time, given the lack of new safe-haven buying and the absence of major economic data releases before the Fed's December meeting.

"For a meaningful rebound to occur, the market needs some hard data to back it up," said Kathy Jones, chief fixed income strategist at Gain Capital.

Analysts point out that the trading range of the $30 trillion U.S. bond market has been narrowing recently due to a lack of clear signals from employment and inflation data—partly due to data distortions caused by the government shutdown—which is leading to disagreements among Federal Reserve policymakers and making it increasingly uncertain whether a third rate cut this year can be achieved by the end of the year.

“The 10-year Treasury yield clearly lacks a catalyst to fall below 4% again,” said Kevin Flanagan, head of fixed income strategy at WisdomTree. He added that Treasury bonds across the entire yield curve are “stuck in a quagmire.”

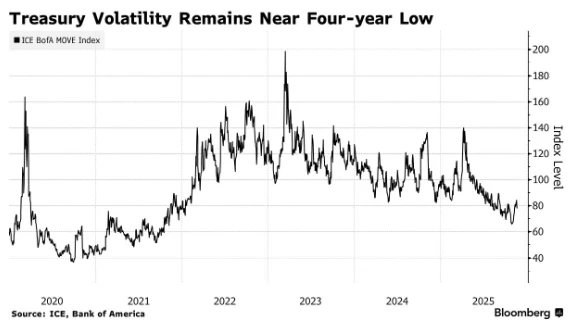

Volatility indicators in the bond market reflect this lack of confidence: while market volatility has rebounded from the four-year low reached last month, it remains near historically low levels.

Last Thursday, the long-awaited official U.S. jobs data for September was finally released, 48 days late, but the mixed results failed to quell the debate about the Federal Reserve's policy path. This continued until New York Fed President Williams... Last Friday, it was stated that with the labor market weakening, there is room for interest rate cuts in the near term, which has raised the probability of a December rate cut back to around 65%.

However, prior to Williams's speech, several Federal Reserve officials had expressed caution regarding further rate cuts. Federal Reserve Governor Michael Barr stated that the Fed needs to proceed cautiously when considering additional rate cuts. Chicago Fed President Austan Goolsby hinted that he remains concerned about another rate cut next month.

Will the Federal Reserve be the next flashpoint?

Many industry insiders say that whether the US Treasury market can emerge from its recent slump and maintain or even extend its year-to-date gains may ultimately depend on the Federal Reserve's actions.

From a macroeconomic perspective, investors remain optimistic that the Federal Reserve will lower interest rates from the current level of slightly below 4% to around 3% within the next year—a move that will benefit the bond market in the long run. (JPMorgan Chase) The latest survey (released last Thursday before the release of the September non-farm payrolls report) shows that net long positions in the U.S. Treasury market remain near their highest level since April.

Bond market bulls believe that against the backdrop of a continued cooling US labor market, short-term data uncertainty will only delay, not halt, the Federal Reserve's easing cycle. Traders have already fully priced in a 25-basis-point rate cut by the end of January and a cumulative cut of approximately 90 basis points over the next 12 months.

Deutsche Bank Economists Matthew Luzzetti and others wrote that "if the Fed does not cut rates in December, it is expected to balance its decision-making with a slightly dovish stance, leaving room for a rate cut in January. For the FOMC at present, the policies in December and January are somewhat interchangeable."

Kelsey Berro, executive director of fixed income at Morgan Asset Management, pointed out that a further decline in the stock market could act as a tailwind for the bond market, triggering an influx of safe-haven funds. Affected by the Federal Reserve's hawkish stance and concerns about high valuations, the S&P 500 has already fallen by about 5% from its October peak.

However, in the absence of major catalysts in the short term, the market may still lack the motivation to make bold moves ahead of the Fed's December decision.

Mitsubishi UFJ Securities George Goncalves, head of U.S. macro strategy at Americas, said he expects the Federal Reserve to cut interest rates next month, and U.S. Treasuries to rebound slightly before the end of the year. As the central bank continues its rate-cutting cycle, U.S. Treasuries are expected to rise further next year. However, with the year-end approaching, people may find it "difficult to build enough confidence to make significant trades."

Amar Reganti, a fixed-income strategist at Hartford Funds, said that a rate cut in December is currently more likely than no rate cut. However, he added, "Currently, U.S. inflation is above target and the labor market is indeed weak, but these are lagging indicators, and we cannot predict the extent of their development. Therefore, both arguments (regarding a rate cut or not) have their merits."

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)