Goldman Sachs The latest forecast indicates that the Federal Reserve will implement its third consecutive interest rate cut at its December meeting. The bank believes that slowing inflation and a cooling labor market provide policymakers with room to further ease monetary policy.

"The risks for next year lie in more rate cuts, as news on core inflation has been favorable, while the deterioration in the labor market... may be difficult to curb with the moderate acceleration in cyclical growth that we expect," Goldman Sachs chief economist Jan Hatzius said in a report.

Goldman Sachs also predicts that the Federal Reserve will cut interest rates twice more in 2026, in March and June, eventually bringing the federal funds rate down to a range of 3.00%–3.25%.

The bank’s baseline view is that the Federal Reserve will become increasingly convinced that the trend of slowing inflation will continue and that monetary policy will not need to remain at a clearly restrictive level.

Goldman Sachs analysts said the Federal Reserve may maintain a cautious tone in the short term, but the trajectory of core price and wage growth suggests that the policy stance may gradually transition to a neutral level next year.

In addition, Goldman Sachs pointed out that since the Federal Reserve started its rate-cutting cycle, financial conditions have eased significantly, which has helped stabilize corporate borrowing costs and household credit flows.

The bank expects the Federal Reserve to complete its first substantial easing cycle since the COVID-19 pandemic-era adjustment by mid-2026, at which point interest rates will be significantly lower than last year’s peak, but still higher than the ultra-loose levels of the past decade.

Goldman Sachs made the above prediction at a time when Williams, the third-in-command at the Federal Reserve and president of the New York Fed, was... He made dovish remarks last Friday, saying he believes there is still room for further rate cuts in the short term, significantly increasing expectations for a rate cut in December.

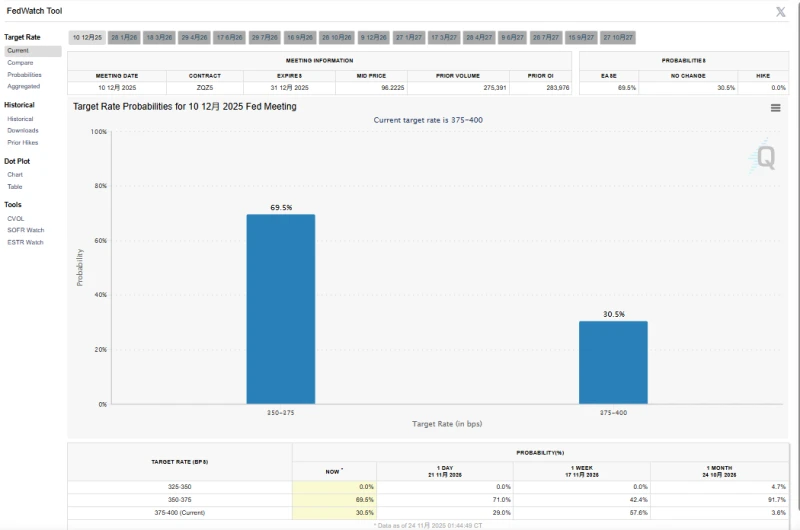

According to CME FedWatch data, the market currently expects a 30.5% probability that the Federal Reserve will keep interest rates unchanged in December, while the probability of a 25 basis point rate cut has risen to 69.5%, a significant increase from about 42% a week ago .

However, in stark contrast to Goldman Sachs, two other major Wall Street investment banks— Morgan Stanley—[ are mentioned]. and JPMorgan Chase —After the release of the September non-farm payroll report, all analysts abandoned their predictions of a Fed rate cut in December.

Data released by the U.S. Bureau of Labor Statistics last Thursday showed that U.S. nonfarm payrolls unexpectedly surged by 119,000 in September, significantly exceeding market expectations of 50,000. The unemployment rate rose to 4.4% from 4.3% in August, a new high since 2021. Furthermore, the combined job gains for July and August were revised downwards by 33,000.

Following the release of the September non-farm payrolls data, Morgan Stanley quickly withdrew its previous forecast of a 25-basis-point rate cut at the Fed's December meeting, citing the employment report's indication of continued economic resilience. JPMorgan Chase subsequently followed Morgan Stanley 's lead and also abandoned its December rate cut forecast.

(Article source: CLS)