① The European Central Bank warned that stablecoins could be defrauded by Eurozone banks . ① They can drain valuable retail deposits, and a "bank run" could have a profound impact on the stability of the global financial system; ② The market capitalization of stablecoins has exceeded $280 billion. Although the scale is still small, they have attracted much attention because the issuers have become one of the largest buyers of US Treasury bonds.

On Monday (November 24), the European Central Bank warned that stablecoins could siphon valuable retail deposits from eurozone banks , and that a run on these currencies could have a profound impact on the stability of the global financial system.

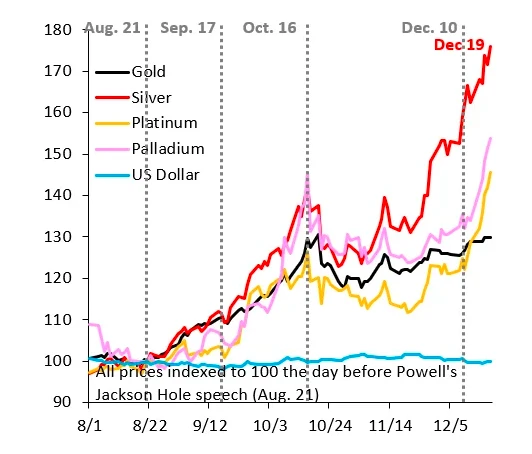

Stablecoins are a special type of cryptocurrency designed to maintain a constant value, typically pegged to the US dollar. It is pegged 1:1 and backed by physical assets such as U.S. Treasury bonds or gold.

The market capitalization of stablecoins has exceeded $280 billion. Although still small in scale, they have attracted attention because their issuers have become one of the largest buyers of U.S. Treasury bonds.

The European Central Bank stated in its Financial Stability Review on Monday that stablecoins are designed as a store of value and for cross-border payments. Stablecoins are tools, but their primary use is for purchasing crypto assets. Currently, approximately 80% of all transactions executed on centralized crypto trading platforms globally involve stablecoins.

“The significant growth of stablecoins could lead to an outflow of retail deposits, weakening a vital source of funding for banks and exacerbating overall funding volatility,” the European Central Bank said.

The main risk comes from a potential run on the currency by investors, as the two largest stablecoins are among the largest holders of U.S. Treasury securities, with asset reserves comparable to the world’s top 20 money market funds.

The European Central Bank added, "A run on these stablecoins could trigger a sell-off of their reserve assets, thereby impacting the operation of the U.S. Treasury market."

Such runs could also affect the Eurozone if EU entities jointly issue interchangeable stablecoins with non-EU entities, because EU regulations are stricter and investors are more likely to choose to redeem the stablecoin within the EU framework.

"This could lead to insufficient reserve assets for issuers under EU regulation, making it impossible to meet the combined redemption demands from EU and non-EU holders, thereby amplifying the risk of bank runs in the EU region," the European Central Bank said.

(Article source: CLS)