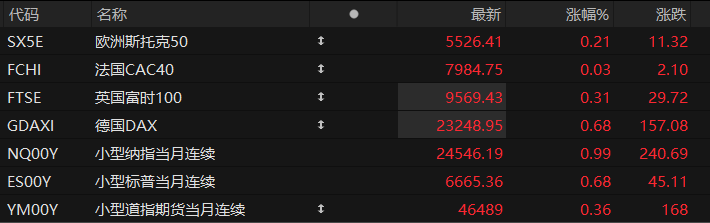

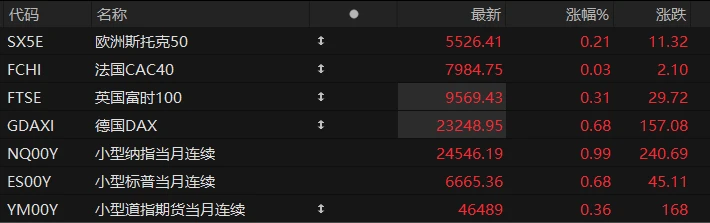

U.S. stock index futures rose across the board in pre-market trading on Monday, while major European indices also generally gained. As of press time, the Nasdaq... S&P 500 futures rose 0.99%, S&P 500 futures rose 0.68%, and Dow Jones futures rose 0.36%.

In terms of individual stocks, cryptocurrency concept stocks rose across the board in pre-market trading, with BTCS up over 5%, and CLSK, CIFR, and BKKT up over 4%; Bitcoin prices rebounded today, briefly breaking through the $85,000 mark. Alibaba The Qianwen App, which saw a pre-market gain of over 4%, surpassed 10 million users in just one week of public beta testing and will release its rankings before the market opens tomorrow.

Morgan Stanley Michael Wilson, chief U.S. equity strategist, said on Monday that the "darkest hour" of the current U.S. stock sell-off may be over, and any short-term dips should be seen as good opportunities to position for 2026.

The strategist wrote in their research report that they view "any further declines in the short term as an opportunity to increase holdings and position for next year." The Morgan Stanley team is optimistic about the consumer discretionary, healthcare, financial, industrial, and small-cap sectors.

Wilson reiterated his forecast that the S&P 500 will trade around 7,800 points by the end of 2026. This target is among the top of the strategists' portfolios, and if achieved, it would mean the index has achieved double-digit gains for the fourth consecutive year. 7,800 points would be approximately 18% higher than the current level, meaning the S&P 500 would not only fully recover its losses since the October high but would also set a new record.

It is worth noting that after Wilson issued a broadly bullish commentary last Monday, US stocks entered a volatile week.

Hot News

Economists have raised their 2026 US GDP growth forecasts, with tariff shocks being the biggest downside risk.

According to a survey released Monday by the National Association for Business Economics (NABE), mainstream economists expect U.S. economic growth to pick up slightly next year, but the job market will remain weak, and the Federal Reserve will slow the pace of further interest rate cuts.

The survey, conducted from November 3 to 11, polled 42 professional forecasters. The results showed that the median forecast for U.S. economic growth in 2026 was 2%, up from 1.8% in the October survey and in stark contrast to the 1.3% forecast in June.

The main drivers of growth will come from increased personal consumption and rising business investment, but almost all respondents believe that the Trump administration’s massive tariffs will drag down economic growth by at least 0.25 percentage points or more.

The survey states: "Respondents believe that, in terms of both probability of occurrence and potential impact, the 'tariff shock' is the biggest downside risk to the U.S. economic outlook."

In addition, stricter immigration enforcement is also expected to dampen economic growth, while increased productivity is seen as the most likely factor to drive better-than-expected economic performance.

Goldman Sachs Latest assessment: The Federal Reserve will cut interest rates in December, and then cut them twice more next year!

Goldman Sachs recently projected that the Federal Reserve will implement its third consecutive interest rate cut at its December meeting. The bank believes that slowing inflation and a cooling labor market provide policymakers with room to further ease monetary policy.

"The risks for next year lie in more rate cuts, as news on core inflation has been favorable, while the deterioration in the labor market... may be difficult to curb with the moderate acceleration in cyclical growth that we expect," Goldman Sachs chief economist Jan Hatzius said in a report.

Goldman Sachs also predicts that the Federal Reserve will cut interest rates twice more in 2026, in March and June, eventually bringing the federal funds rate down to a range of 3.00%–3.25%.

The bank’s baseline view is that the Federal Reserve will become increasingly convinced that the trend of slowing inflation will continue and that monetary policy will not need to remain at a clearly restrictive level.

Goldman Sachs analysts said the Federal Reserve may maintain a cautious tone in the short term, but the trajectory of core price and wage growth suggests that the policy stance may gradually transition to a neutral level next year.

Moody's Chief Economist: Inflation could have remained at a low level without Trump's aggressive policies.

Moody's Analytics chief economist Mark Zandi points out that the situation would be completely different today if President Trump hadn't taken radical measures on trade and immigration this year.

Zandi pointed out on social media on Sunday (November 23) that prices have risen sharply since the pandemic began and are still climbing at an alarming rate, putting the United States in an affordability crisis.

The economist pointed out, "Currently, consumer price inflation is close to 3%, far above the Federal Reserve's inflation target, and there are indications that future inflation will be even higher, which could have been avoided."

US Stocks Focus

Novo Nordisk Alzheimer's trial failed, causing the stock price to plummet by more than 10%.

On Monday (November 24) local time, Danish pharmaceutical giant Novo Nordisk announced the results of a late-stage trial of semaglutide for Alzheimer's disease. The stock fell more than 10% as it failed to meet the target.

Novo Nordisk stated that data from two large-scale clinical trials showed no significant efficacy in treating early-stage Alzheimer's disease with semaglutide, with no significant improvement observed in thousands of patients participating in the studies. The goal of the trials was to slow the rate of cognitive decline in patients by at least 20%.

The two trials reportedly enrolled nearly 4,000 patients. The drug being tested was Novo Nordisk's Rybelsus, an oral version of smegglutide, which is currently only approved for the treatment of type 2 diabetes.

Even before Novo Nordisk announced the trial, analysts asserted that the chances of success were slim, with UBS estimating the probability at only 10%. Novo Nordisk itself described the trial as a "lottery ticket," implying that its prospects were uncertain but its potential was enormous.

The latest round of negotiations ended without result, and BHP Billiton announced it was abandoning its acquisition of Anglo American.

On Monday local time, global mining giant BHP said it would no longer seek to acquire Anglo American after holding new talks with the company.

It is understood that BHP Billiton, headquartered in Melbourne, Australia, first approached Anglo American, a London-listed company, in April last year with a potential takeover offer, citing the significant synergies that would result from the integration of the two companies’ high-quality copper mines and other businesses.

However, this acquisition proposal, valued at approximately $50 billion, was rejected several times by Anglo American. Subsequently, Anglo American and Canada's Teck Resources... The company has reached a merger agreement and will submit it to shareholders for a vote next month.

BHP Billiton said in a statement on Monday that it has had further discussions with the Anglo American board and is no longer considering a merger between the two companies.

well-known Apple Whistleblower: Rumors of Cook's retirement are completely false; OpenAI is aggressively poaching hardware talent.

In his latest communications, renowned Apple leaker Mark Gurman definitively refuted rumors that Apple CEO Tim Cook would retire in the first half of next year. He also revealed that OpenAI is poaching Apple employees at an astonishing pace, impacting the consumer electronics industry. The giants were very unhappy.

As background, about two weeks ago, an "insider" revealed that Apple was "speeding up" the arrangements for the CEO handover, and stated that 65-year-old Cook would resign between the end of January next year (after the next financial report is released) and the annual developer conference in June next year.

In response, Gurman stated bluntly that, based on information he has gathered in recent weeks, Cook is unlikely to leave before June next year. In fact, he would be shocked if the rumor were true. Furthermore, regarding some viewing this as Apple releasing a "test balloon" to allow Wall Street to prepare, Gurman stated that this is not the case, and the report was simply false.

Gurman added that John Tenus, senior vice president of hardware engineering, is indeed at the heart of discussions regarding his potential succession to Cook, for a simple reason: at 50 years old, Tenus is the youngest member of Apple's executive team and has the longest potential tenure. Furthermore, Tenus is at the core of new device development and enjoys high regard from Cook.

(Article source: Hafu Securities) )