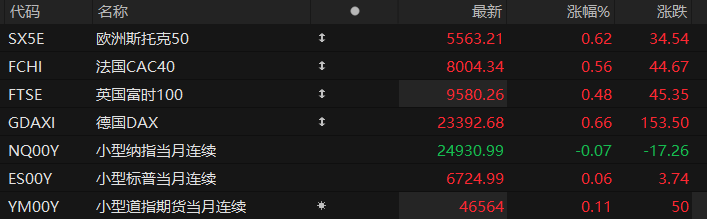

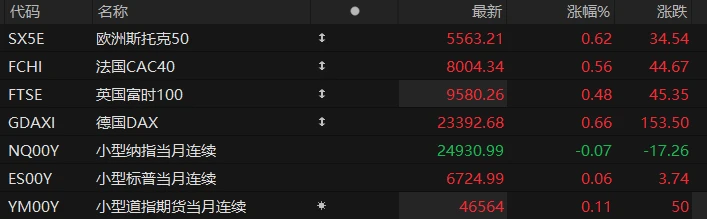

U.S. stock index futures were mixed in pre-market trading on Tuesday, while major European indices generally rose. As of press time, the Nasdaq... S&P 500 futures fell 0.07%, S&P 500 futures rose 0.06%, and Dow Jones futures rose 0.11%.

In terms of individual stocks, high-performing stocks rose in pre-market trading, with Kohl's Department Store among them. Stocks surged nearly 28%; the company's third-quarter net sales were $3.407 billion, exceeding the expected $3.33 billion; the company raised its full-year guidance; automation technology company Symbotic jumped nearly 16%, Zoom Video Communications rose over 5%, and Best Buy... The stock rose more than 3%, with the latest quarterly revenue exceeding market expectations.

Alibaba The stock surged as much as 5% in pre-market trading after its earnings report exceeded expectations, with strong growth in its two core businesses: AI+cloud and consumer products.

Nvidia Google shares plunged over 4% pre-market after announcing plans to sell TPUs directly to Meta, but then surged over 4% pre-market.

Federal Reserve Governor Milan delivered a speech on the 25th, calling for a significant reduction in interest rates to support economic growth. This statement provided a new signal for the future policy direction of the Federal Reserve.

In her speech, Milan stated that current monetary policy is hindering economic development and that the US economy needs significant interest rate cuts. However, she also pointed out that as progress continues, the need for rapid action on interest rates is decreasing.

Milan also shared his views on the management of the Federal Reserve's balance sheet, arguing that the Fed should not have an excessively large share in the market. This implies increasing the proportion of short-term Treasury bills and reducing the holdings of mortgage loans, medium-term notes, and long-term bonds.

Hot News

U.S. retail sales rose 0.2% month-over-month in September, significantly below expectations, while auto sales declined.

Data released Tuesday by the U.S. Commerce Department, delayed due to the government shutdown, showed that unadjusted retail sales rose 0.2% in September, following a 0.6% increase in August. Excluding automobiles and gasoline, sales rose only 0.1%, significantly below the expected 0.3%.

Of the 13 retail categories, eight saw growth, with gas stations, personal care stores, and general retailers performing best. Notably, automobile sales declined for the first time in four months, while discretionary consumer goods such as electronics, apparel, and sporting goods also showed weakness.

Data shows that consumer spending momentum weakened towards the end of a generally robust third quarter. While a strong stock market continued to support consumption by high-income groups, inflationary pressures and a cooling job market have begun to impact low- and middle-income households. The consumer confidence index has fallen to near historical lows, suggesting that future consumption trends may continue to face pressure.

Deutsche Bank: This round of Bitcoin crash is more difficult to recover from due to two factors that are completely different from the past.

In a report on Monday, Deutsche Bank analyst Marion Laboure listed two key factors that distinguish the current bear market from previous ones. She wrote: "Unlike previous crashes that were mainly driven by retail speculation, this year's downturn is occurring against the backdrop of significant institutional participation, policy changes, and global macroeconomic trends."

Deutsche Bank cited data pointing to the first reason: the usage of cryptocurrencies in retail trading has dropped from 17% this summer to 15%. This is crucial because steadily expanding adoption and use is one of the core supports for the bullish logic of Bitcoin.

The second reason this crash may differ from previous ones is that institutional investors now hold Bitcoin through ETFs (Exchange Traded Funds). The first Bitcoin ETFs were approved in January 2024, and the asset experienced a surge of up to 600%. This is also the first time Bitcoin has seen a deep correction of at least 30% since Bitcoin ETFs began trading.

Deutsche Bank stated that while institutional participation has driven up prices in recent years, this same institutional exposure has now created a vicious cycle of declining liquidity and increased selling pressure. Both of these factors suggest that Bitcoin, as the "leader" of the crypto market, may face even greater difficulties in escaping its current slump.

Musk: Grok 5 has a 10% chance of achieving real-time data on the AGI X platform; that's key.

Tesla CEO Elon Musk stated that his AI... The Grok 5 model that xAI, an AI company, is about to launch has a 10% probability of achieving artificial general intelligence (AGI).

He believes that the key to achieving human-level reasoning ability lies not in the static training datasets used by competitors, but in real-time data.

In a recent interview at the Barron's Investment Conference, Musk stated that xAI's biggest competitive advantage lies in the data it acquires through the social media platform X.

He said, "Grok 5 is the first time I've felt that the possibility of us achieving AGI is not zero, although the probability is not high."

AGI refers to systems that can reach or surpass human reasoning abilities on any task, not just models like ChatGPT, Claude, or Grok that perform limited tasks.

Musk had previously predicted that AGI could be achieved around 2030, and claimed that the technology could achieve world peace by "disarming all of humanity."

US Stocks Focus

Alibaba's Q3 revenue increased by 4.8% year-on-year, with cloud business revenue surging by 34% and instant retail revenue growing strongly by 60%.

Alibaba Group reported Q3 revenue of RMB 247.8 billion, a year-on-year increase of 4.8%, slightly exceeding market expectations. However, adjusted net profit plummeted by 72% year-on-year to RMB 10.35 billion, indicating significant pressure on profitability. Following the earnings release, Alibaba's stock price rose by over 4% in pre-market trading.

Alibaba Cloud Intelligence Group was a highlight of the company's performance, with revenue surging 34% year-on-year to RMB 39.82 billion, exceeding market expectations of RMB 37.99 billion. Xu Hong, CFO of Alibaba Group, stated in the earnings report that Alibaba's capital expenditure on AI + cloud infrastructure over the past four quarters was approximately RMB 120 billion. Instant retail revenue reached RMB 22.906 billion, a year-on-year increase of 60%, primarily driven by increased order volume from "Taobao Flash Sale," launched at the end of April 2025.

The financial report specifically noted that revenue from AI-related products achieved triple-digit year-on-year growth for the ninth consecutive quarter and is being rapidly adopted by a wide range of enterprise customers. According to Omdia's report, Alibaba Cloud ranks first in the Chinese AI cloud market with a 35.8% market share. In terms of profitability, Cloud Intelligence Group's adjusted EBITA increased by 35% year-on-year to RMB 3.6 billion, demonstrating that the business maintained healthy profitability while experiencing rapid growth.

AI chip The competition intensifies! Meta reportedly shifts to Google TPUs, threatening Nvidia's "throne"?

According to market sources, Google is intensifying its efforts in the artificial intelligence (AI) chip race to challenge Nvidia's dominance in this field. Meta is a potential major customer for Google's self-developed AI chip, the TPU (Tensor Processing Unit).

TPU is a chip specifically designed by Google for AI tasks to accelerate machine learning. Compared to GPUs—where Nvidia holds an absolute dominant position—TPUs have a greater advantage in energy efficiency in certain scenarios.

Reports indicate that Google is currently marketing its self-developed TPUs to customers, including Meta, the parent company of Facebook and Instagram. Meta is reportedly internally discussing investing billions of dollars to integrate Google's TPUs into its data centers starting in 2027. Internally, Meta also plans to lease TPU computing power from Google Cloud as early as next year. Currently, Meta's AI infrastructure mainly relies on NVIDIA's graphics processing units (GPUs).

Following the news, Alphabet's stock price rose more than 4% in pre-market trading, while Nvidia's stock price fell more than 4% in pre-market trading.

NIO Q3 revenue increased by 16.7% to RMB 21.8 billion, with vehicle gross margin reaching a record high of 14.7%. Both Q4 revenue and delivery guidance are set to new highs.

On November 25, NIO released its latest financial report, showing that it delivered 87,071 smart electric vehicles in the third quarter, a year-on-year increase of 40.8%, and its total revenue reached RMB 21.8 billion (US$3.06 billion), a year-on-year increase of 16.7%. Its three major brands, NIO , Ledao, and Firefly, all achieved market breakthroughs, laying the foundation for the company to enter a new growth cycle.

The company expects to deliver 120,000 to 125,000 vehicles in the fourth quarter, representing a year-on-year increase of 65.1% to 72.0%, with total revenue projected to be between RMB 32.8 billion and RMB 34 billion, representing a year-on-year increase of 66.3% to 72.8%. Following the release of the financial report, NIO's US-listed shares rose by more than 9% in pre-market trading.

Founder, Chairman and CEO Li Bin stated that the all-new ES8 set a record for the fastest delivery of over 10,000 units among pure electric vehicles priced above 400,000 RMB in the Chinese market, the Ledao L90 has maintained its position as the top-selling large pure electric SUV for three consecutive months, and the Firefly has rapidly gained a leading position in the small intelligent high-end electric vehicle market since its first delivery.

(Article source: Hafu Securities) )