The next Federal Reserve Chairman will likely be announced soon.

"I know who I'm going to choose." According to China News Service, on November 30th local time, US President Trump told the media that he had decided on his next Federal Reserve Chairman. Bloomberg reported that Trump did not reveal the name of his nominee that day, but clearly stated that he hoped his nominee would be able to lower interest rates.

Previously, U.S. Treasury Secretary Scott Bessant revealed that Trump was "very likely" to nominate a new Federal Reserve chairman before Christmas this year.

It is reported that Trump has a shortlist of five candidates. These five candidates are: Federal Reserve Governors Chris Waller and Michelle Bowman, former Federal Reserve Governor Kevin Warsh, White House National Economic Council Director Kevin Hassett, and BlackRock . Rick Reed, Head of Fixed Income.

"I think I already know my choice," Trump told the media in the Oval Office. "I really want to replace the person in that position right now, but someone is stopping me."

Regardless of who Trump chooses to serve as Federal Reserve Chairman, he will need to be confirmed by the Senate.

Top candidate

Currently, the leading candidate for the next Federal Reserve Chairman is Kevin Hassett, Director of the White House National Economic Council.

Born in 1962, Hassett is 63 years old this year. He worked as an economist in the research department of the Federal Reserve Board of Governors in the 1990s.

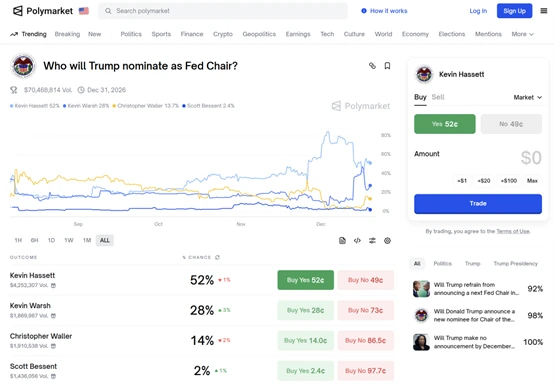

According to betting data from the market prediction platform Kalshi, Hassett's probability of being nominated is currently 58%, a significant increase from less than 40% last Tuesday. This may be because Hassett has close ties with Trump and is considered the candidate most aligned with Trump's policy inclinations.

Hassett began advising Trump on economic policy as early as his first term. On issues such as trade, taxes, inflation, and Federal Reserve interest rate cuts, Hassett's views were largely aligned with Trump's; he also believed the Fed should cut rates, arguing that they could have been "much lower."

On November 20, Hassett said in a media interview that if he were to become the chairman of the Federal Reserve, he would immediately cut interest rates and support a 50 basis point rate cut in December.

Like Trump, Hassett also criticized the Federal Reserve for a series of actions during former President Biden's term and the pandemic that triggered a surge in U.S. inflation.

He pointed out that the Federal Reserve began raising interest rates during Trump's first term when the tax cuts were passed, but then cut rates just before the 2024 presidential election. "They made some bad decisions, and in my opinion, those decisions were partisan," Hassett said. "I think the Fed needs a thorough 'clean-up,' and I'm confident that whoever the president chooses will set about fixing the problems and work to make the Fed independent again."

In addition, Hassett himself is also somewhat controversial. For example, on October 1, 1999, he co-authored the book "Dow Jones 36,000 Points" and made a prediction in the book that caused him a lot of controversy: when the Dow Jones closed at 10,273 points, Hassett predicted that the US stock market would rise sharply and the Dow Jones would rise to the 36,000-point mark within 3-5 years.

Contrary to expectations, Hassett's predictions in the book came to be completely opposite to reality. With the bursting of the dot-com bubble, the US stock market experienced a sharp decline in the following years, leading to "The Dow Jones at 36,000 Points" being dubbed "the worst investment book in history" and serving as a symbol of uncontrolled investor optimism, earning it a "legendary" negative reputation in the industry.

Subsequently, whenever the US stock market underperformed, this book would be brought up for ridicule. Ultimately, it took the Dow Jones Industrial Average 22 years, until 2021, to reach the level predicted by Hassett.

Regardless of Hassett's forecasting ability, he has publicly stated that he would be willing to accept the position of Federal Reserve Chairman if invited.

Other leading candidates include Chris Waller and Michelle Bowman, both appointed to the Federal Reserve by Trump during his first term. Both share Trump's view that interest rates should continue to be lowered.

Kevin Warsh also has ties to the Federal Reserve, having served as a Fed governor from 2006 to 2011, and is another "old acquaintance" of Trump's. Trump interviewed Warsh for the position of Fed chairman before Powell's nomination.

Another candidate is Rick Reid. He is the head of fixed income at BlackRock , a bond expert who manages $2.4 trillion in assets, and previously served on the Federal Reserve's Financial Markets Investment Advisory Committee.

Like other candidates, Reid believes the Federal Reserve should cut interest rates in December.

It's worth noting that besides the five individuals mentioned above, another candidate is the current U.S. Treasury Secretary, Bessant. Although Bessant himself has publicly stated that he has no interest in the position, his name is repeatedly mentioned. Trump has also repeatedly indicated that he is the most suitable candidate. "We're considering sending him (Bessant) to the Federal Reserve, but he doesn't want to get involved at all; he prefers being Treasury Secretary," Trump said.

The market generally believes that anything is possible until the final result is announced.

The Federal Reserve may be starting a cycle of significant interest rate cuts.

Historically, the nomination of the Federal Reserve Chairman and Governors has been the most direct way for US presidents to influence the Federal Reserve.

Trump nominated current Federal Reserve Chairman Jerome Powell during his first term, but later regretted it because Powell failed to cut interest rates at the pace he had hoped for.

Now, regardless of who is ultimately elected, the quality that Trump values most is loyalty to him.

“This is the worst standard I can think of for a Federal Reserve chair,” said Alan Blinder, a professor at Princeton University and former vice chairman of the Federal Reserve.

Ned Davis Research, an American investment research firm, also believes that Hassett would be the "worst choice" from the perspective of the Federal Reserve's independence, citing his poor communication skills.

However, it seems that nominating Hassett or any other candidate will increase Trump's influence over the Federal Reserve.

Dongwu Securities Chief Economist Lu Zhe previously told the Times Weekly that, to date, the influence of Trump's faction within the Federal Reserve has been limited and has not yet had a substantial impact on the Fed's monetary policy. However, if Trump continues to cultivate his cronies within the Fed through various means, his control over monetary policy could be significantly strengthened.

"If Trump achieves his goals, the Federal Reserve may begin a significant interest rate cut cycle, increasing the risk of double-dip inflation in the United States and weakening the credibility of the dollar," Lu Zhe said.

Wang Yanxing, a senior researcher at the Chongyang Institute for Financial Studies at Renmin University of China, predicted in an article that if Hassett is formally nominated before Christmas, Wall Street will witness an epic "Christmas rally." In the short term, market expectations will shift directly from "precautionary rate cuts" to "stimulus rate cuts." Funds will flood into stocks, Bitcoin, and junk bonds. The US dollar index may plunge in the short term due to rate cut expectations, further benefiting export-oriented companies and multinational giants.

If Hassett is formally nominated, Wang Yanxing believes that in the long run, Hassett is very likely to become the "weakest Fed chair" in history. Once inflation soars, the market will no longer trust the Fed, and long-term bond yields will skyrocket, which would have disastrous consequences for the US economy.

(Article source: Time Weekly)