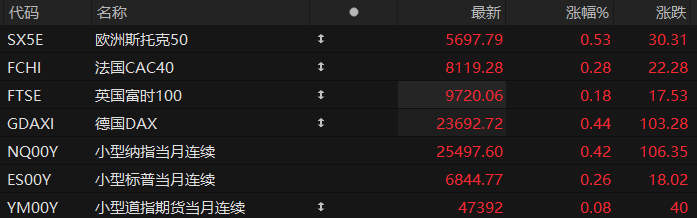

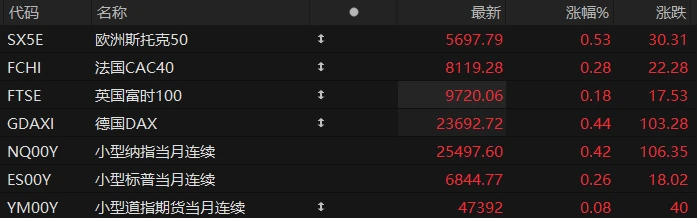

U.S. stock index futures rose across the board in pre-market trading on Tuesday, while major European indices generally gained. As of press time, the Nasdaq... S&P 500 futures rose 0.42%, S&P 500 futures rose 0.26%, and Dow Jones futures rose 0.08%.

In terms of individual stocks, most prominent tech stocks rose in pre-market trading, with Oracle among them. , Intel It rose by more than 1%.

Popular Chinese concept stocks showed mixed performance, with XPeng Motors among them. Alibaba fell more than 4%. Pony.ai fell more than 1%. It rose by more than 3%.

Bitcoin stabilized and rebounded, surpassing the $87,000 mark. Most US cryptocurrency stocks rose in pre-market trading, with Bitmine Immersion Technologies up nearly 4%, and CleanSpark and MARA Holdings up over 2%.

Tom Lee, co-founder and head of research at Fundstrat, a financial market research firm known as the "Wall Street strategist," predicts that U.S. stocks will perform strongly in December, with the S&P 500 potentially climbing to a high of 7,300 points by the end of the year, which would represent a 10% increase from current levels.

Tom Lee stated, "The S&P 500 only needs to rise 2% to reach 7,000 points. From the current level, I think the index could see a 5% or even 10% gain in December." He pointed out that the Federal Reserve's end of quantitative tightening (QT) will be the main driver of the market rally. He compared the current situation to September 2019, when US stocks rose more than 17% in the three weeks following the end of QT.

Tom Lee also believes that the volatility in the US stock market in November prompted a healthy rebalancing of positions. Furthermore, he believes the Federal Reserve's dovish stance will continue to support the stock and cryptocurrency markets.

Hot News

Hassett's victory is in sight! Will the market have to listen to the Fed's "shadow chairman" for the next five months?

If White House National Economic Council Director Kevin Hassett is indeed nominated by Trump to be the next Federal Reserve Chairman, he may effectively serve as a "shadow Fed Chairman" for up to five months—and the market will undoubtedly be watching his every word closely!

Since Trump made it clear that he would fire current Federal Reserve Chairman Jerome Powell—or at least refuse his re-election—investors have been speculating about how the next Fed chairman would be chosen. Now, the countdown to the complete revelation of this suspense has undoubtedly begun.

Even Nick Timiraos, a renowned journalist known as the "new Fed mouthpiece," wrote an article on Monday admitting that the selection process for the Fed chair appears to be nearing its end, with Trump leaning towards his longtime advisor, Hassett. Timiraos believes that if Hassett is ultimately nominated, it will be because he meets two key criteria set by Trump—loyalty and credibility in the markets…

However, with Hassett's victory seemingly imminent, many industry insiders are viewing this as a wake-up call for the politicization of the Federal Reserve. The market's focus will likely shift beyond interest rate trends to the extent to which the Federal Reserve Board will support Trump's desire to keep interest rates low even with high inflation and an overheated economy.

The surge in silver prices has not dampened Wall Street's bullish enthusiasm. How high can it rise next year?

As 2025 draws to a close, silver can be considered one of the most surprising asset classes this year. On Monday, international silver prices broke through $58 per ounce, setting a new historical high, with a year-to-date increase of over 100%.

Such a rapid increase has not deterred bullish investors. Clem Chambers, CEO of Online Blockchain PLC, said his selling price is $95/ounce, and the real big move is yet to come.

Chambers is not the most aggressive player in the market; BNP Paribas ... Some analysts have even set a target price of $100 per ounce for silver next year, demonstrating the current market's optimistic expectations for silver prices.

Chambers also pointed out that while Monday's record high silver prices were related to a system glitch at the Chicago Mercantile Exchange, it was not the primary cause and did not indicate a market squeeze. The global silver market is undergoing a deeper structural shift.

According to a series of studies conducted by Wall Street this year, the future price of silver depends on five major factors: industrial demand, liquidity risk, hedging needs, investment (speculative) trends, and policy challenges.

This concerns lithography technology! The Trump administration is once again investing in a strategic industry: it will acquire a stake in xLight.

The Trump administration has agreed to fund a company that is trying to develop more advanced semiconductors in the United States. Manufacturing technology startups are receiving funding of up to $150 million, the latest move by the government to use incentives to support strategically important domestic industries.

In a press release issued Monday, the U.S. Department of Commerce stated that under this arrangement, the Department will provide incentives to xLight; in return, the U.S. government will acquire equity in xLight, potentially becoming its largest shareholder.

xLight is a startup that is trying to improve a key chip manufacturing process known as extreme ultraviolet lithography (EUV).

Dutch company ASML ASML is currently the world's only manufacturer of EUV lithography machines, each costing hundreds of millions of dollars. xLight is seeking to improve a component of the EUV process: the crucial laser that etches complex micropatterns onto silicon wafers. xLight hopes to integrate its light source products into ASML 's machines.

US Stocks Focus

Amazon cloud computing Grand Opening! CEO to Take the Stage Tonight to Introduce New AI Models and AI Chips Coming soon?

On December 1, Eastern Time, "AWS Re:Invent 2025," the annual cloud computing event hosted by Amazon Web Services (AWS), the world's largest cloud service company, opened in Las Vegas, USA.

Currently, AWS accounts for one-fifth of Amazon's sales, and in many quarters, its profits exceed half of the entire Amazon Group. Therefore, this event is of great significance to Amazon, both in the short and long term.

However, Amazon's biggest competitor right now is Microsoft. And Google are working on artificial intelligence With continued progress in cloud computing , Amazon must prove that its massive investments in artificial intelligence have yielded returns on both technology and capital.

Therefore, tonight's opening speech by AWS CEO Matt Garman, Beijing time, is likely to be the most anticipated highlight of the night.

At this event, AWS will host over 600 technical workshops to explore how AI agents can innovate applications, work environments, and business processes in AWS's own way, giving attendees the opportunity to learn about the latest developments in this rapidly evolving field.

A year after Amazon launched its internal Nova AI foundation model, Amazon's next-generation Nova AI model is set to be one of the most anticipated focuses in the market , and it is likely to be one of the core topics of AWS CEO Matt Garman's opening keynote address.

Warner's acquisition battle escalates to Netflix It is understood that a cash-based acquisition plan has been proposed.

According to industry insiders, Warner Bros. is exploring... The company received a second round of bids on Monday, including a primarily cash-based acquisition offer from streaming giant Netflix . The bidding process could conclude in the coming days or weeks.

Warner Bros. Discovery , the parent company of HBO, CNN, and Warner Bros. Studios, officially went public in October after receiving multiple offers for all or part of its assets.

Sources familiar with the matter revealed that during the Thanksgiving holiday, Paramount Skydance and Comcast... Both Netflix and other services have updated their pricing.

It is understood that while Paramount's offer was primarily supported by the family of Oracle co-founder Larry Ellison, it also included support from Apollo Global Management. Middle Eastern funds also participated in the company's debt financing.

These offers are all binding, meaning that Warner Bros. Exploration could quickly approve the deal if it meets the board's objectives. However, the company has not yet made a final decision and will consider new bids should more attractive terms emerge in the future.

The bullish logic of the "Google AI ecosystem" is further strengthened! Demand for cloud AI computing power surges, and MongoDB's performance far exceeds expectations.

MongoDB, a database software maker that provides database platform services on Google Cloud, reported that its total revenue for the third fiscal quarter increased by 19% year-over-year to $628 million, far exceeding market expectations of $592 million; adjusted earnings per share were $1.32, far exceeding market expectations of $0.80.

Revenue from the core cloud product, Atlas cloud database, grew by 30% year-over-year (higher than the average Wall Street expectation of 20%-25%), accounting for approximately 75% of the company’s total revenue in the third fiscal quarter, making it the absolute main driver of the overall high growth trend.

The company also raised its full-year earnings guidance, increasing its fiscal 2026 revenue forecast to between $2.434 billion and $2.439 billion, up from its previous forecast of $2.34 billion to $2.36 billion, and significantly higher than the market expectation of approximately $2.36 billion.

As of press time, MongoDB shares surged nearly 23% in pre-market trading on Tuesday.

"Big Short" Burry turns his attention to Tesla The article directly criticizes the "absurd overvaluation" and names Musk's exorbitant compensation as diluting his equity.

Renowned short seller Michael Burry has recently made another move on an overvalued stock – Tesla . He called the electric vehicle manufacturer “absurdly overvalued.”

He criticized the "pathetic way" of calculating stock-based compensation, citing Tesla as an example. He said Tesla... It dilutes its shares by 3.6% annually through the issuance of new shares and does not conduct share buybacks.

He added that CEO Elon Musk's $1 trillion compensation package would further dilute Tesla 's stock.

(Article source: Hafu Securities) )